COVID-19 has transformed the way Americans use their phones and the way they spend their time and money online. These shifts present both a number of challenges and a raft of opportunities for savvy growth marketers.

We’ve seen COVID-19 affect a number of verticals. A number of industries have taken a hit (like music streaming and sports), while some are expanding due to the pandemic (groceries, media, video gaming). Others have found distinctive ways to adjust the way they position and sell their product, allowing them to take advantage of changes in buyer behavior.

The key to being able to read and react to changes in this still-tumultuous time and tailoring your growth marketing accordingly is to understand how public sentiment is reflected in new purchasing behaviors. Here’s an overview of the most important trends we’re seeing that will allow you to adjust your growth marketing effectively.

By the numbers: A sheltering-in-place economy

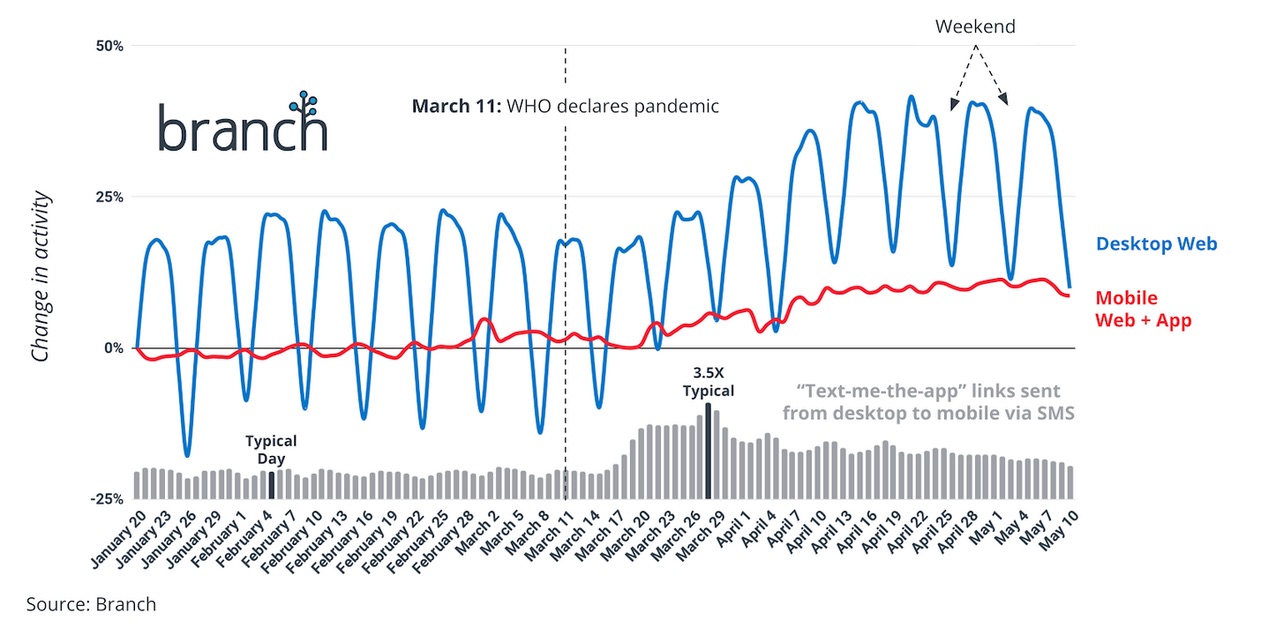

Virtually all of the data we’ve seen shows a marked difference in buyer behavior following the WHO’s declaration of a pandemic on March 11, 2020. With consumers encouraged to stay home to deter the spread of COVID-19, it’s no surprise that the biggest change is the spike in online activity.

Image Credits: Branch (opens in a new window)

Based on the graph above provided by Branch, the mobile growth platform, average desktop usage rose almost 20% in the weeks following the pandemic declaration. Mobile web and app use also increased, although less sharply.

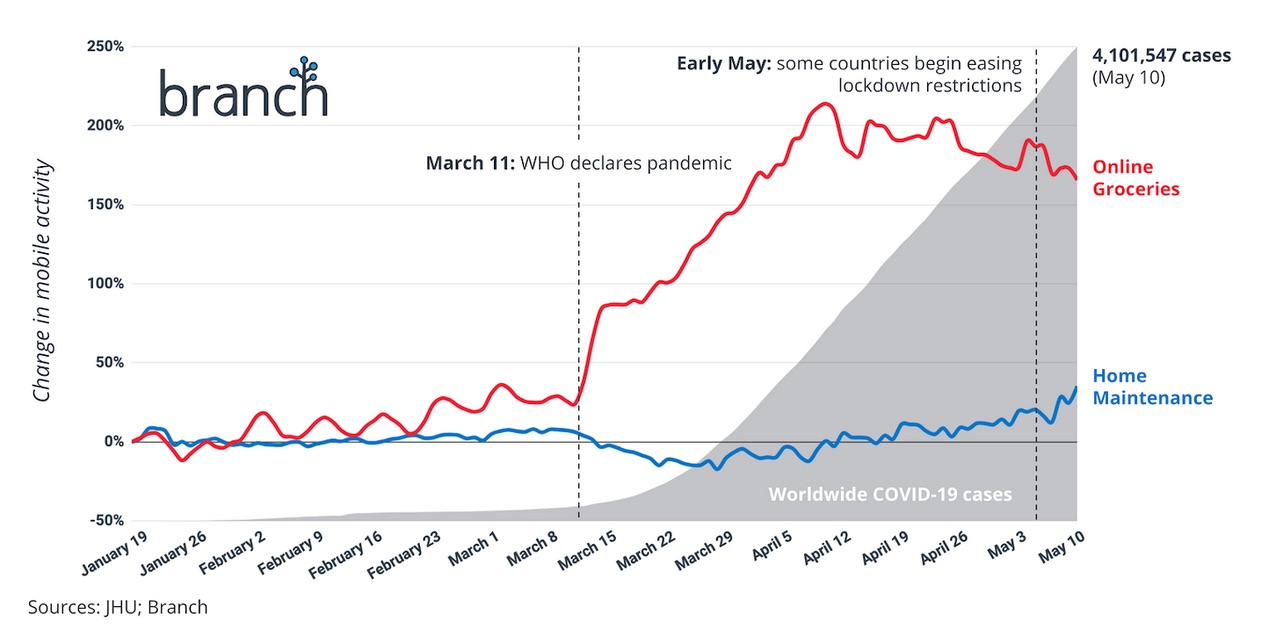

Sheltering in place also changed how shoppers bought life essentials. Home maintenance and groceries are two industries affected positively. As you can see in the graph below, online grocery orders skyrocketed, seeing a 200% increase in from-mobile purchases in the first 30 days of the pandemic. Meanwhile, home maintenance, after an initial decline following declaration, saw steady increases building up to the first easing of lockdown restrictions.

Image Credits: Branch (opens in a new window)

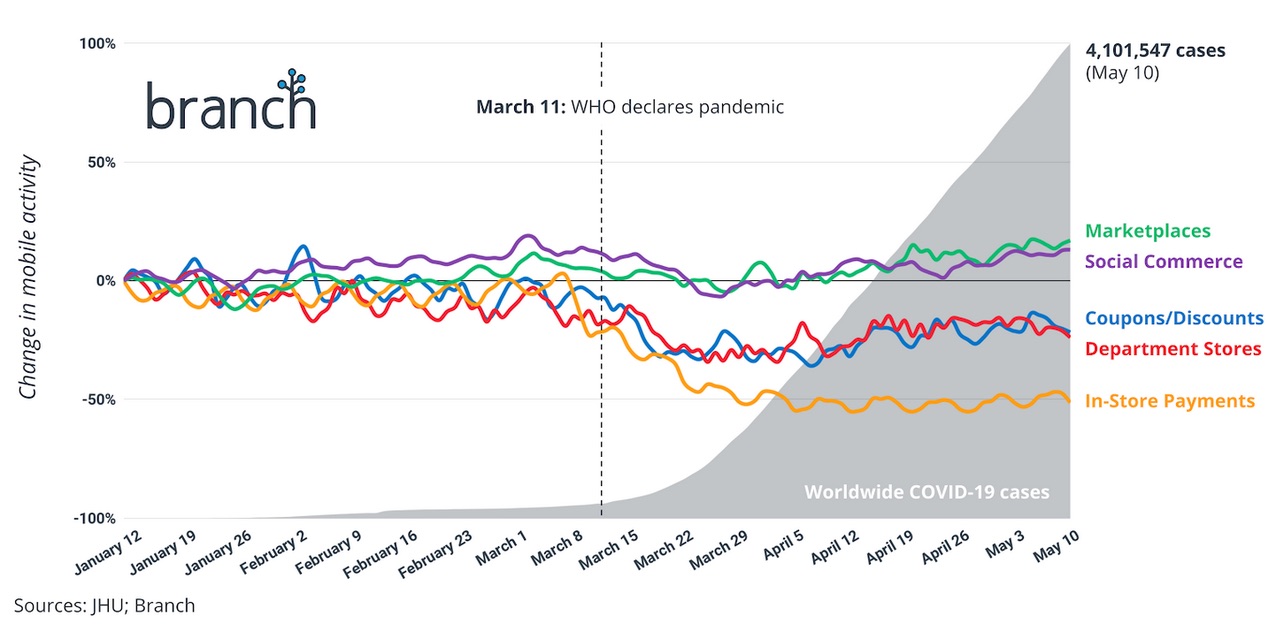

E-commerce has, unsurprisingly, seen the lowest impact among all available buying channels.

Image Credits: Branch (opens in a new window)

Both marketplace (Amazon/eBay) and social commerce channels have seen steady activity, with increased user volume offsetting higher price sensitivity. Meanwhile, the lack of foot traffic has caused in-store and department store sales to suffer. As consumers avoid in-store shopping whenever possible, physical retail continues to bear the brunt of lower engagement.

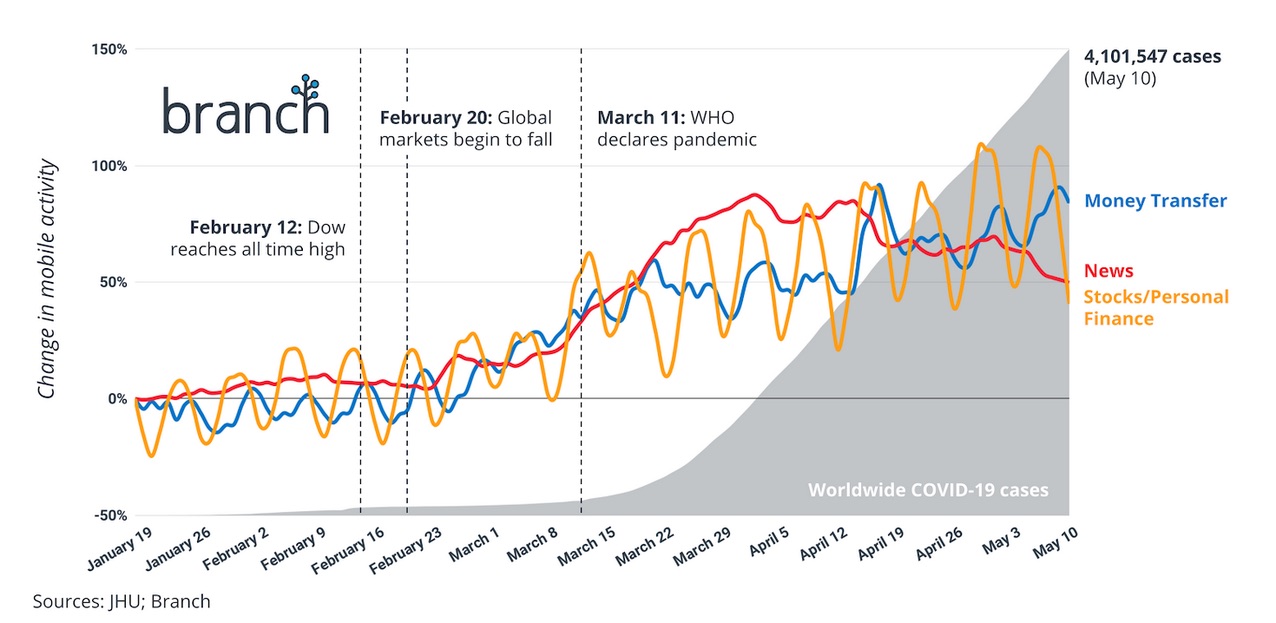

How media and finance are winning

Locked-down consumers have found themselves with more time on their hands, and a volatile market has forced them to be careful with their hard-earned cash. As a result, media (online news outlets, Netflix, etc.) and finance companies have seen pronounced spikes in engagement and conversion since the pandemic began.

Image Credits: Branch (opens in a new window)

Since March 11, we’ve seen money-transfer applications rise as more users divert funds from savings accounts to supplement reduced or suspended wages. Media app usage rose significantly in the first 30 days of the pandemic before beginning to drop. This is likely due to a saturation of subject matter and a relative lack of new events to sustain that higher level of interest.

Other trends in buying behavior

Changes in the public’s purchase intent have been responsible for industries’ shifts in fortune during COVID-19. For instance, more people are postponing big-ticket purchases. As a result, we’ve seen pointed initial drops in real estate and automobiles, with some recent recovery as the extent of the financial impact of COVID-19 becomes clearer. A lack of ability to congregate in large numbers has also resulted in a pointed drop in wedding spending, for example, and that has yet to recover.

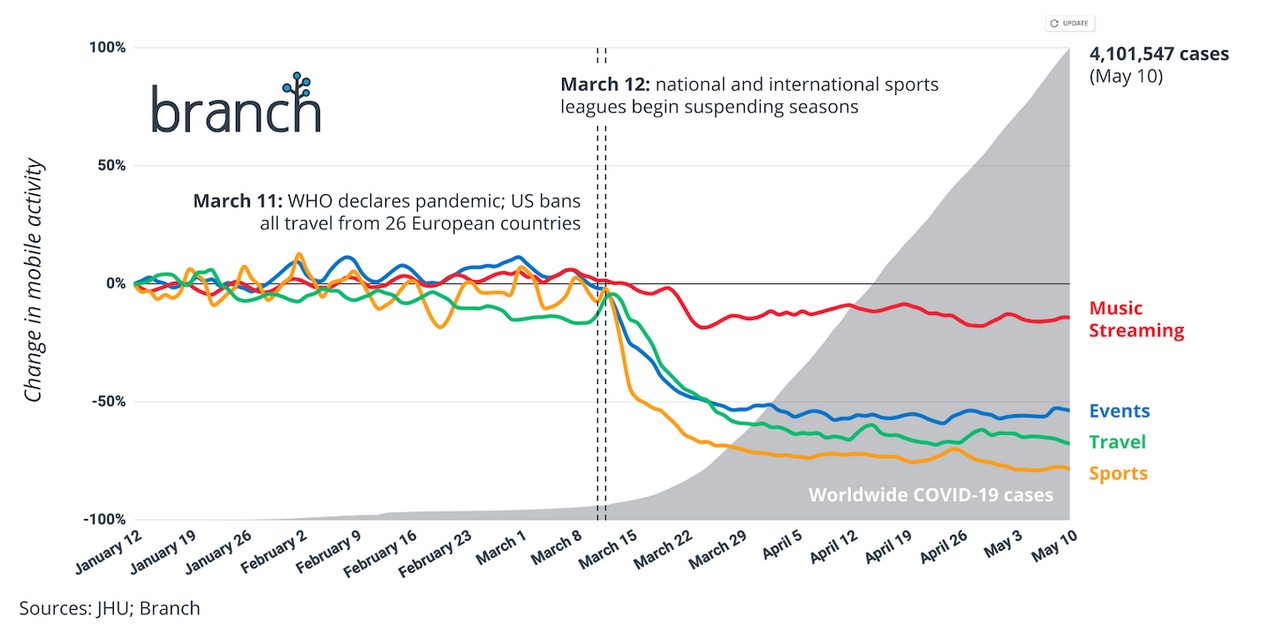

This suspension of gathering and commuting has affected other associated industries as well. Music streaming has fallen sharply since the suspension of travel on public transport. Sports, travel and other event-based markets have also suffered from suspensions of competitive seasons, as well as general bans on transit and large gatherings.

Image Credits: Branch (opens in a new window)

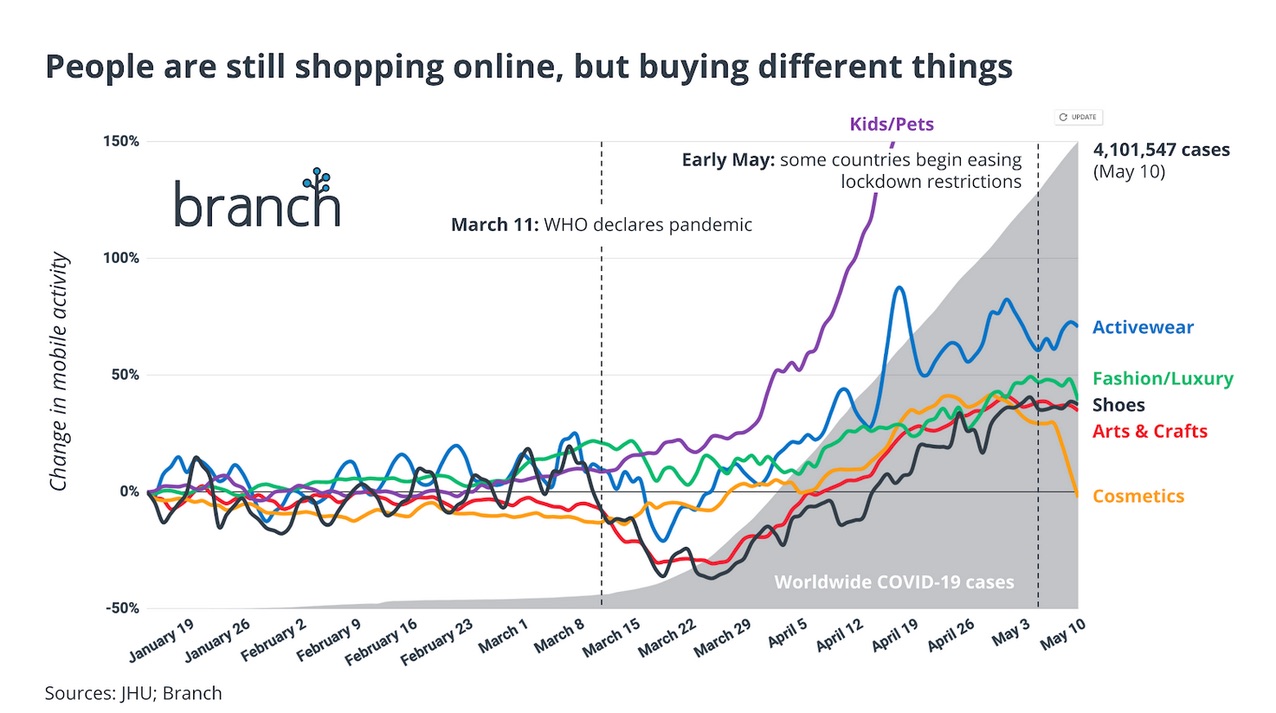

The good news for vendors overall is that people are still shopping online, but they’re buying different things and in different volumes than they used to. Kid/pet-oriented mobile activity and associated purchases have skyrocketed. We’ve also seen spikes in the purchase of activewear, fashion items, shoes and arts and crafts items, as people wait out the lockdown and prepare for what they hope will be a summer of freedom.

Image Credits: Branch

Universal changes

The numbers don’t lie: COVID-19 has not only affected online behavior but has also changed our spending habits. People are putting off big purchases and delaying large investments. Some e-commerce channels are being hit harder than others. Online shopping hasn’t abated, but what people are shopping for has certainly shifted. From our media usage to the way we feed ourselves, COVID-19 has influenced it all.

Perhaps the best news to emerge from the data is that there are still plenty of gains to be had — willingness to buy has not suffered any kind of terminal decline. Smart growth marketers will find that they have a great deal of pivot room, and that continued growth is just a question of going where customers have gone.