Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re digging into SoftBank’s latest earnings slides. Not only do they contain a wealth of updates and other useful information, but some of them are gosh-darn-freaking hilarious. We all deserve a bit of levity after the last few months.

The visual elements we quote below come from SoftBank’s reporting of its own results from its fiscal year ending March 31, 2020. Much of the deck is made up of financial reporting tables and other bits of stuff you don’t want to read. We’ve cut all that out and left the fun parts.

Before we dive in, please note that we are largely giggling at some slide design choices and only somewhat at the results themselves. We are certainly not making fun of people who’ve been impacted by layoffs and other such things that these slides’ results encompass.

But we are going to have some fun with how SoftBank describes how it views the world, because how can we not? Let’s begin.

Data, slides

TechCrunch has a number of folks parsing SoftBank’s deck this morning, looking to do serious work. That’s not our goal. Sure, this post will tell you things like the fact that there are 88 companies in the Vision Fund portfolio, and that when it comes to unrealized gains and losses, the portfolio has seen $13.4 billion in gains and $14.2 billion in losses. $4.9 billion of gains have been realized, mind you, while just $200 million of losses have had the same honor.

And this post will tell you that the “net blended [internal rate of return] for SoftBank Vision Fund investors is -1%.”

Hell, you probably also want to know that Uber was detailed as Vision Fund’s worst-performing public company, generating a $1.46 billion loss for the group. In contrast, Guardant Health is good for a $1.67 billion gain, while 2019 IPO Slack has been good for $605 million in profits. Those were the two best companies in the Vision Fund’s public portfolio.

But what you really want is the good stuff. So, shared by slide number, here you go:

Slide 11:

This is the undergirding issue that the deck deals with. What drove it?

Slide 44:

What does that have to do with SoftBank? Well, as you can imagine, the economic impacts are hitting some of the portfolio of SoftBank Vision Fund. Slide 46 has a good take on what that might mean.

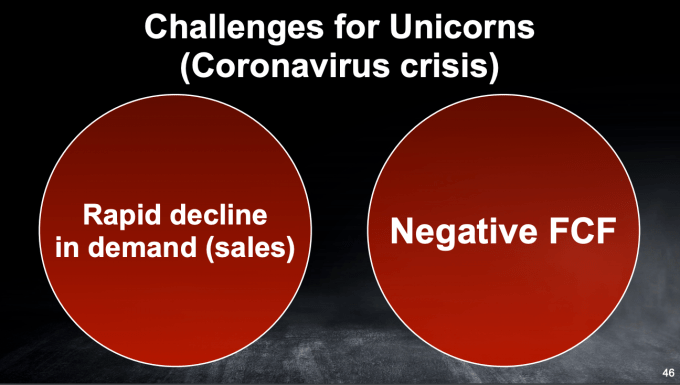

Slide 46:

Falling sales and negative free cash flow are a tough combination, as the former reduces the ability of a company to attract new capital, while the latter makes the need for new funding acute.

But while that’s bad news, there’s also some good stuff to expect. Let’s observe a trio of slides:

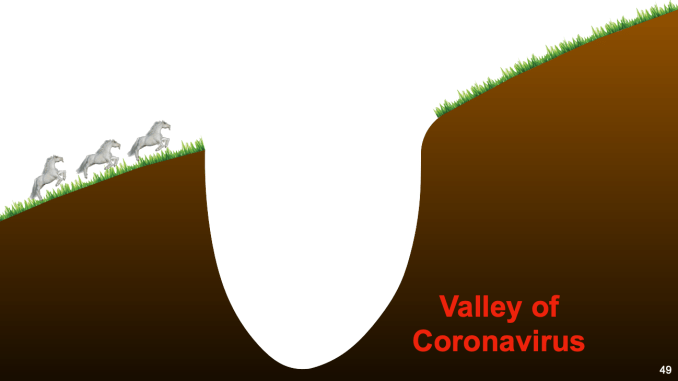

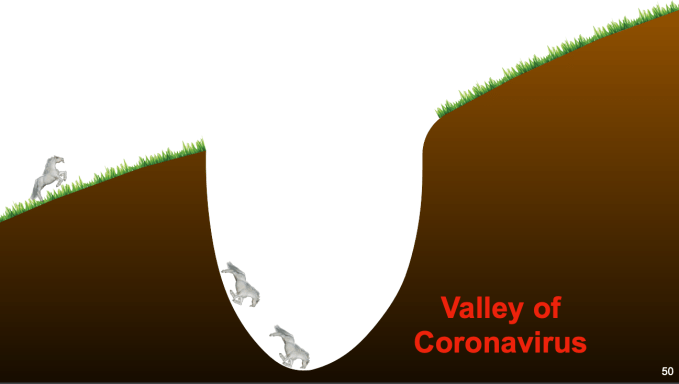

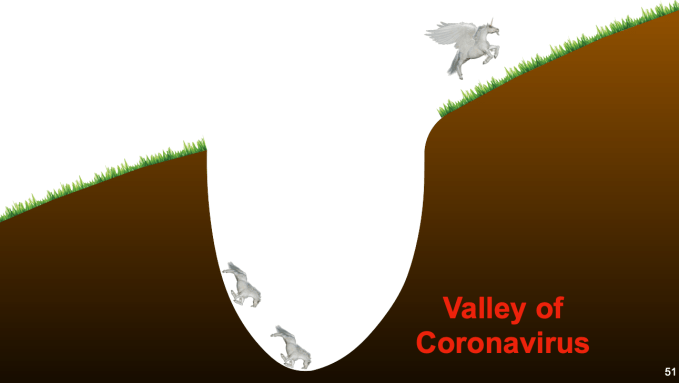

Slides 49, 50 and 51:

I suppose what we see here are most horses (startups worth less than $1 billion?) falling prey to the Valley of Coronavirus (see Slide 46). But the real unicorns will fly over the top and make it through?

I suppose what we see here are most horses (startups worth less than $1 billion?) falling prey to the Valley of Coronavirus (see Slide 46). But the real unicorns will fly over the top and make it through?

SoftBank then makes a historical note that the 1929 Great Depression led to new industries on its exit, saying that we’ll see something else this time around. Let’s turn to Slide 53.

Slide 53:

Two things come to mind here. First, SoftBank is content to compare today’s economic environment to the Great Depression. That’s terrifying. The company is either trying to explain the world to its investors, or trying to tell investors that external factors are to blame for some of its stumbles.

Either way, not great. But don’t worry. SoftBank has some good news, namely that the technologies in Slide 53 might add up to something pretty amazing. Let’s check out the last real slide from the deck for more.

Slide 54:

Let’s hope. I’ve been pretty down lately. I could use a bit more happy. And with that, back to more serious work.