After WeWork exploded there was — at least supposedly — a change in sentiment among investors and founders alike. Gone were the days of easy nine-figure rounds, expensive growth, negative unit economics and the rest of the excess that Startupland has enjoyed over the past half-decade.

Inside this purported sentiment shift, I presumed, was a decrease in optimism; surely venture capitalists and entrepreneurs would change their behavior inside this new paradigm?

But by some measures, they haven’t. I expected that startups would achieve more conservative proximate valuations in the post-WeWork world, as their leaders would aim to raise a bit less, and a bit more conservatively, and investors would be less starry-eyed in the prices they were willing to pay for startup equity.

That was all wrong, it turns out. A recent report from Fenwick and West, a legal firm that works with technology companies, paints a picture that is the complete opposite of what we might have anticipated.

Perhaps we shouldn’t be surprised; our recent reporting hardly describes a market in slowdown. Boston is having a good start to the year, for example. SaaS is also looking healthy from a venture capital perspective. Cloud stocks are at all-time highs and One Medical is still defying gravity as a public stock. Whatever lesson WeWork was supposed to teach, it doesn’t appear to have made much impact.

Let’s explore the Fenwick data and then ask if we can spot anywhere where the markets are behaving like the chastened children that we were told had taken over.

Up and to the right

The Fenwick report has a number of data points that underscore a sharply optimistic fourth quarter. Which is fine, mind, I don’t have a dog in this race.

But a sharply warm and welcoming Q4 2019 indicates that dealmaking after WeWork either featured companies that had magically improved their financial makeup (unlikely), or that deals crafted in Q4 were similar in ilk to those struck in preceding quarters. And, as you’ll see in a second, it’s possible to argue that the same sorts of companies that had raised before did better in Q4 2019 than in preceding periods.

So much for pessimism, then.

Data

One caveat before we start. There is temporal lag in venture data. We only hear about deals long after they are done. So, it takes some time for news to make its way into funding rounds. Bad news, good news, any news, will take some time to make an appearance.

That said, WeWork filed to go public in August and pulled its IPO in late September. Surely some of that market signal was available for Q4 (October and later) venture rounds? So it’s hard to argue that the Q4 data we’re observing is untouched by WeWork’s collapse and isn’t indicative of a more conservative market. That argument implies that Q1 2020 would include the real retrenchment. We’ll see.

To work: Here are the raw data points that stuck out the most, starting with two concerning the portion of venture rounds that repriced startups higher and lower:

- Up rounds (venture rounds at higher valuations than their preceding price) were 84% of total deals. Flat investments were 11% of Q4 rounds, while down rounds were a mere 1 in 20 at 5% for the period. Each result was better than what was recorded in Q3 2019.

- The Q4 2019 up round percentage result was higher than its year-ago figure.

How much more were those companies worth? Turning to median data (not average, mind), more from Fenwick:

- The median price change for startup rounds in Q4 was +76%, up from +53% in the sequentially preceding quarter.

- The Q4 2019 up round media percentage gain was sharply higher than its year-ago result.

So, more companies than in Q3 2019 or Q4 2018 saw up rounds as a percentage of the total, and the amount that those companies repriced higher also rose. It’s hard to find any real negative signal in that mix. Or, perhaps we should say, it’s hard to find any mark of declined optimism in the data so far.

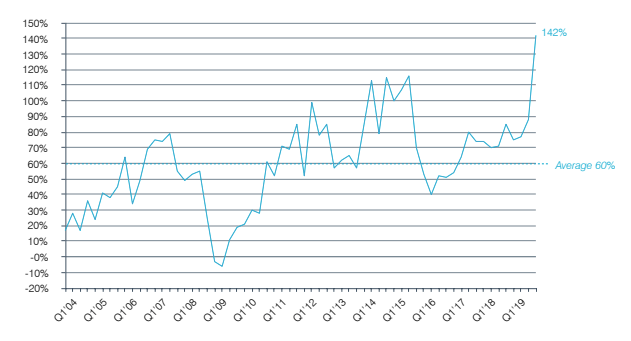

That trend continues when we turn to average price gains for startups in Q4, which not only beat the hell out of the rest of 2019 and 2018, but took a baseball bat to all historical records that Fenwick has tallied since 2004. Per the legal group, the following chart details “the average percentage change between the price per share at which companies raised funds in a quarter” and is inclusive of “all rounds (up, down and flat).” Observe (chart used with permission):

Holy shit.

You could actually have argued, given the data for 2016 through Q3 2019, that we were living through a period of reduced optimism. And, in Q4 2019, when we were supposed to actually move into that sphere of influence, the data did the precise opposite of what we might have expected, showing a market that was more champagne than embarrassed apologies.

Instead of seeing a venture market on its heels, scrambling in the dark for profits, things look, well, pretty damn good.

Huh.