Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today, we’re digging into a host of data concerning the East Coast venture capital scene, specifically looking into the performance of its two key startup markets.

It’s 12 degrees Fahrenheit as I write this in my office situated between Boston and New York City — a perfect vantage point for studying these vibrant tech ecosystems. Let’s see what the data tells us.

The information we’re examining today comes from White Star Capital (often via CBInsights), a venture capital firm that describes itself as “transatlantic” and takes part in seed, Series A and Series B rounds around the globe. The group last raised a $180 million fund that TechCrunch covered here, noting at the time that capital pool was “oversubscribed from an initial target of $140 million” and would be invested into “around 20 new companies from the new fund, writing opening cheques of between $1 million and $6 million.”

With boots on the ground in New York, White Star cares about the East Coast, so the fund’s put dossier on the region isn’t unexpected. What it includes, however, is.

We’ll start with NYC and its surprising 2019 before turning to Boston, digging into its super-giant venture totals and hearing from Founder Collective’s Eric Paley on the state of things in urban Massachusetts.

New York City

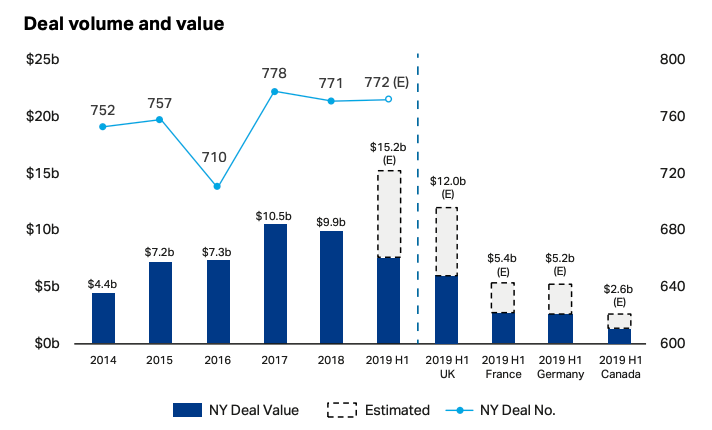

White Star’s report details record-breaking figures for NYC’s current year. Off of effectively flat deal volume (New York City sees around 775 venture deals per year at the moment, or a little more than two per day), the overgrown town should set record venture dollar volume in 2019.

Observe the following, astounding chart detailing the abnormality of 2019 from a comparative venture dollar perspective:

By smashing 2017’s local maximum, 2019 appears set to crush the city’s record — and rich — venture investment totals. The graphic also manages to point out (somewhat embarrassingly) that Gotham will manage to best a number of European countries’ aggregate venture dollar investments by itself this year.

That’s is a useful bit of context as in the United States, New York City is always Number Two to Silicon Valley. But, this chart argues, being number two in the number-one market is still a hell of a lot of capital.

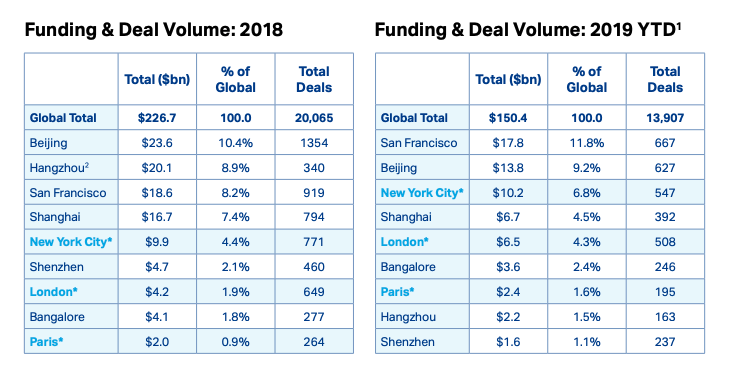

Putting New York City’s venture into even sharper comparative perspective, observe the following table:

The YTD data in the right table ends September 21, 2019. So, before Q4 2019 even began, New York City had surpassed its full-year 2018 venture capital dollar volume. That’s a huge increase. (Which shows up in the percentage tables, of course, though I’d argue that it’s more important to note the decline in China’s venture capital results from 2018 to 2019 than it is to note that New York City’s jump up the chart.)

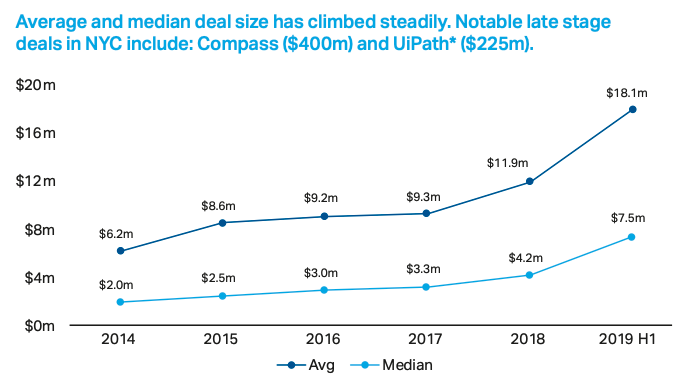

If deal volume is flat and dollar volume is up, surely deals are getting larger in the Large Pineapple Oversized Peach Grandiose Mandarin Big Apple? They are:

These are The Good Days in New York venture. If you are a founder in NYC and aren’t considering adding capital to your accounts while it’s raining down from the sky, I’m curious why. Unless you’re profitable, of course. (If you are, please email me and tell me how much money your startup makes.)

Boston

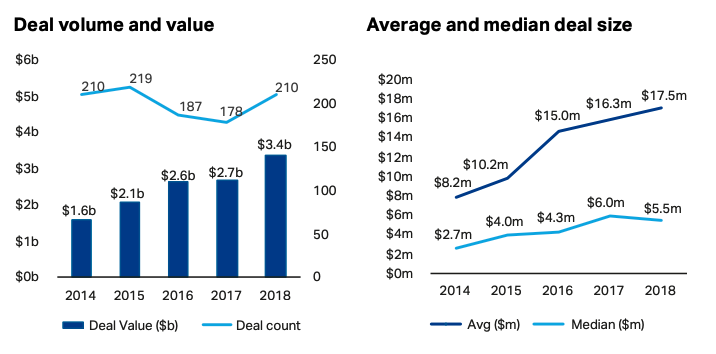

The White Star report does lots of work exploring NYC’s 2019 while leaning more on full-year 2018 information when looking at Boston. That said, a coda on the city seems reasonable. Quickly, here’s the key brace of charts from the report:

Things look good, which shouldn’t be a surprise; most venture markets are seeing more dollar and deal volume over time in the Unicorn Era. To supplement the information, however, I did some digging. Let’s talk about recent Boston-area super-giant funding events.

Using Crunchbase data, here are the number of $100 million or larger investments in Boston over the past few years (inclusive of all funding types):

This is less clear than the above charts. While the number of Boston venture deals looks healthy (and similar to NYC in terms of having reached a historically high plateau), and venture dollars invested look great, super-giant activity is cooling. Don’t read that as necessarily the end of the world, however; as we reported yesterday, there is a general softening in the super-giant investment market in general and given Boston’s somewhat modest sample size, we can’t take too much from the numbers other than to say that they aren’t going up anymore.

That’s about enough from me, I think. To get a bit more context on Boston’s performance I hit up seed fund Founder Collective and got well-known investor Eric Paley to weigh in. Paley has put money into companies you’ve seen go public (Uber), sell for billions (Cruise) and use (Airtable).

On why Boston’s venture scene has seen its investment totals rise over the past half decade:

Paley: I think the rise in dollars invested in Boston is largely a reflection of the quality of startup that’s been emerging over the last half-decade. Companies like Toast, Indigo Ag, Draft Kings, Drift, Desktop Metal, Formlabs, EZ Cater, Starry, and Gingko Bioworks (among many others) have made significant progress in their businesses and earned very large rounds as a result.

On the impact of exits on Boston venture capital activity

Paley: The last decade of exits also plays a part with category-defining startups like Wayfair, Cargurus, HubSpot, TripAdvisor, LogMeIn, and PillPack continuing to demonstrate the long history that large transformative companies are built in Massachusetts.

Boston is often thought of as a biotech hub, but the reality is that it has minted more $1B tech exits than any startup geography in the US or Europe aside from the Bay Area over the last ten years. This is particularly notable given the very impressive rise of the NYC, LA, Seattle, and even Utah markets.

On building companies in Boston over the Bay Area:

Paley: Boston is the “Goldilocks Zone” for startups. There’s enough VC to get companies started, but not so much easy capital that allows founders to develop inauthentic companies. The employee base is large and tremendously skilled, but more loyal and less likely to vest a couple of years before jumping ship to the next bright and shiny startup.

There are a bunch of reasons for this — An unrivaled collection of colleges and universities concentrating an invaluable endowment of human capital being the most obvious.