Atomico, the European venture capital firm founded by Skype’s Niklas Zennström, has released its latest annual The State of European Tech report, published in partnership with Slush and Orrick.

As part of the report, the authors surveyed 5,000 members of the ecosystem — including 1,000 founders — as well as pulling in robust data from other sources, such as Dealroom and the London Stock Exchange.

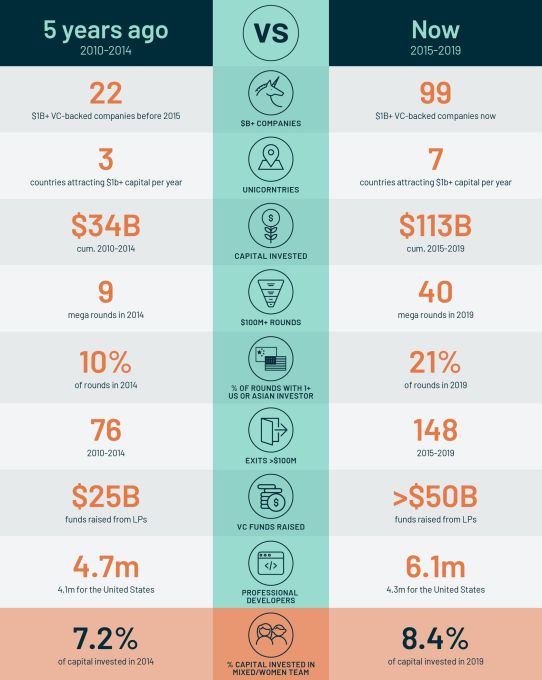

This year, the report reveals that the European tech ecosystem continues to mature and shows no sign of slowing — particularly highlighting the contrast from five years ago when the The State of European Tech report made its debut. Almost every key indicator is up and to the right, except, rather depressingly, diversity.

The data shows, for example, that competition for talent and access to the best founders has increased ferociously. And from a funding perspective, European founders have more choice than ever, especially with U.S. and Asian VC firms investing more and more in the region. Progress with gender diversity stalled, however, such as 92% of funding going to all-male teams.

I caught up with the report’s author Tom Wehmeier, Partner and Head of Insights at Atomico (also sometimes jokingly referred to as the “Mary Meeker of Europe”), where we discuss in more detail some of the key findings and why, it seems, that the rest of the world has finally woken up to Europe’s tech potential.

But first, a few headlines from the report:

- European technology companies are on track to raise a record 30$B+ in funding in 2019, up from $25B the year before. (Source: Dealroom)

- Despite failing to match the level of venture-backed exits of 2018, there was a record number of 40 $100M-plus deals as of September 2019, a size that many European tech sceptics did not believe was possible. (Source: Dealroom)

- A number of multi-billion-dollar non-venture backed companies like Nexi and Trainline made their debut on the public markets.

- European tech policymaking remains a mystery to many European founders.

- When asked to describe the top priority of the European Commission in terms of tech policy, 40% of founders and startup employees say they don’t feel informed enough to comment. (Source: survey)

- Despite this reported lack of awareness on policy issues, all respondents voted EU competition commissioner Margrethe Vestager as the person who had the most influence on European tech in 2019, good or bad. (Source: survey)

- European parliamentarians aren’t talking about fintech and digital health, two sectors which investors poured a combined $12.7bn into last year (Source: Politico and Dealroom)

- Europe’s diversity figures are still grim reading.

- In 2019, 92% of funding went to all-male teams, a similar level to 2018. (Source: Dealroom)

- There is still only one woman CTO in the 119 companies (<1%) based on a sample of executives in CxO positions at 251 European VC-backed tech companies that raised a Series A or B round between 1 October 2018 and 30 September 2019 with more than $10M funding, even though 7.5% of software engineers are women. (Source: Stack Overflow, Craft, Dealroom)

- Looking beyond gender diversity, ethnic minorities in tech experienced discrimination at a much high rate than white peers. (Source: survey)

- At least 80% of Black/African/Caribbean respondents who reported experiencing discrimination linked it to their ethnicity. (Source: survey)

- 63% of women VCs reported increased focus on attending events with stronger participation from diverse founders. The corresponding number for men VCs was only 33% of female respondents suggested that their male counterparts are leaving female VCs to fix Europe’s diversity problem. (Source: survey)

- European founders aren’t just aiming for commercial success — they are trying to solve some of the world’s largest problems.

- One in five European founders states that their company is already measuring its societal and/or environmental impact. (Source: survey)

- Only 14% of founders don’t believe it’s relevant for their company. Founders that are women are much more likely to be advanced in their approach to measuring impact. (Source: survey)

- Employees are placing a greater emphasis on corporate social responsibility, with 57% citing its importance in the State of European Tech survey. (Source: survey)

Extra Crunch: It is 5 years since Atomico published the first The State of European Tech report, which really attempted to capture a data-driven snapshot of the entire ecosystem. What are some of the biggest changes you’ve seen within European tech in the intertwining years or in this year in particular?

Tom Wehmeier: If I think back to when we did the first report, people who believe that Europe could actually be an interesting player in global technology, were largely limited to people who were in the tech industry in Europe itself. If you then fast forward to today, what has clearly happened — and I think 2019 was the year where this really materialized and became part of the narrative — was that belief translating from people on the inside to a bunch of people that were on the outside.

Most obviously has been the strength of interest from from the U.S. and the number of top-tier U.S. funds that are not just increasing their level of investment activity but committing to spending more and more time here on the ground, hiring people, building teams, building a network, and getting to know companies. I think it probably surprises people to know that 19% of all rounds this year will involve at least one U.S. investor in Europe, which is more than double since since the first year we did the report.

I think the other thing, where I come back to this idea that now we have finally convinced a certain group of people about the role that Europe can play, is mainstream institutional investors. I know it is not going to be lost on you, [but] this is going to be another record year for VC fund raising from Europe. And whilst the headline numbers might not be a surprise, I think what should catch people’s attention is that the composition of the LP base here in Europe is now shifting. And finally, there’s an unlocking of institutional investors, [by which] I mean pension funds, funds of funds, insurance companies, sovereign wealth funds, who are committing to European VC at levels that are significantly increased and elevated from where they had been in the past. So, if you just take pension funds, we’re going to see close to a billion dollars invested which is up nearly three fold.

It’s a validation of what’s happening around European tech to see that now coming through and I think is ultimately something that helps to build a foundation for the next five years of success. As much as this is a report that’s looking back, it’s also about trying to understand where things go from here.

With regards to the pension funds, do you think that is driven by the general bullishness towards European tech, or do you think it’s more the macro economic reality that maybe other places where they could put their money aren’t very attractive at the moment?

I think it’s really a reflection that there’s a strong level of belief that European venture as an asset class is an attractive investment opportunity. And that is reflected by the numbers. One of the charts that we’ve got in the report is from Cambridge Associates who do the benchmarking for the VC indices… And when you look back over a 1, 3, 5, or even a 10 year horizon, the performance from European VC is demonstrating that this is a place where for anyone building a diversified portfolio, they should have some allocation. I think it’s fundamentally the strength of the investment opportunity. That is the single biggest driver for why you’re seeing this happen.

I think the biggest thing that Europe has been able to prove is that it can take a great idea and turn it into a great company and that company can scale to not just a billion dollar outcome but to a multi-billion dollar outcome and go all the way through into an IPO or into a large scale acquisition. What you’ve seen happen in 2019 is in part A reflection of what happened last year where it was obviously this record year with Spotify, Adyen, Farfetch, Elastic and others that really showed you can go full cycle from start all the way to finish. And that the magnitude of those outcomes can be at a scale that makes them globally relevant.

Are the pension funds shifting their allocation of VC away from other geographies or are they just doing more VC as a whole?

This is one of the slices that I can’t give you, and I’ve sliced this in every which way. But I can speak anecdotally. I don’t think it is necessarily happening at the expense of deployment elsewhere. I think what you are genuinely seeing is an overall increasing allocation into into alternative investments, within alternative investments into private, and within private into private equity, and then within private equity into VC. So that is definitely an overall rebalancing of allocations that’s happening.

It’s great that all the charts are moving in the right direction, apart from diversity, which we can talk about in a minute, but does that mean that European tech is overheated? Is there any indication that this is unsustainable and they’ll be a correction?

Good question.

It’s also a question completely against your [Atomico’s] own interest!

Actually, I don’t think it necessarily is because I think great investors will invest through the cycle and that will be absolutely part of their planning. If you look back in history at the years in which important companies have been built, it’s at the high points in the cycle and the low points in the cycle.

I don’t think that we see anything in the numbers today to suggest that there’s a bubble around the corner. And I think, throughout the whole of the five years that we’ve been doing this report, that same question has been asked, and I think through that time we’ve learned that you don’t want to predict what might be around the corner. I think it comes back to fundamentals. And if I look at the underlying drivers of what’s happening in European tech and why we’re seeing this continued trajectory, it’s simply because what you see being unleashed is this virtuous cycle of success breeds more success.

You have all of the fundamental ingredients. From an incredibly strong talent base that is now becoming increasingly experienced, people that either founded companies before going on to found new companies, or have helped and been part of the journey of scaling companies, now going on to help build a new generation of companies. And then, alongside people – and I think this is the sort of under appreciated aspect of one of the pillars of what is underpinning European tech – the build out of the European investor base has been a really significant piece of this story. Not just in the U.K., but in Germany and France, and in the Nordics, you have this generation of funds approaching things with very much a Silicon Valley mindset in terms of scale of ambition, and the types of founders that they back and the long term approach to their investment, and their ability to fund companies through the various stages of scaling their business. And combined with the last and most intangible of all the elements, which is a fundamental belief that Europe is a place where you can build incredibly valuable and important and impactful tech companies, those three things, they’re not going to change in a macro environment.

You might see a narrative come full circle, because back when we did the first report, I seem to remember some of the questions that we got asked then were: Aren’t European founders too conservative? Don’t they lack ambition? Do they have the risk appetite to build valuable businesses? And where once, you know, a European approach to building a company was something that was seen as a stick with which to beat those founders, I think now you see that perhaps that’s something that’s an inherent strength.

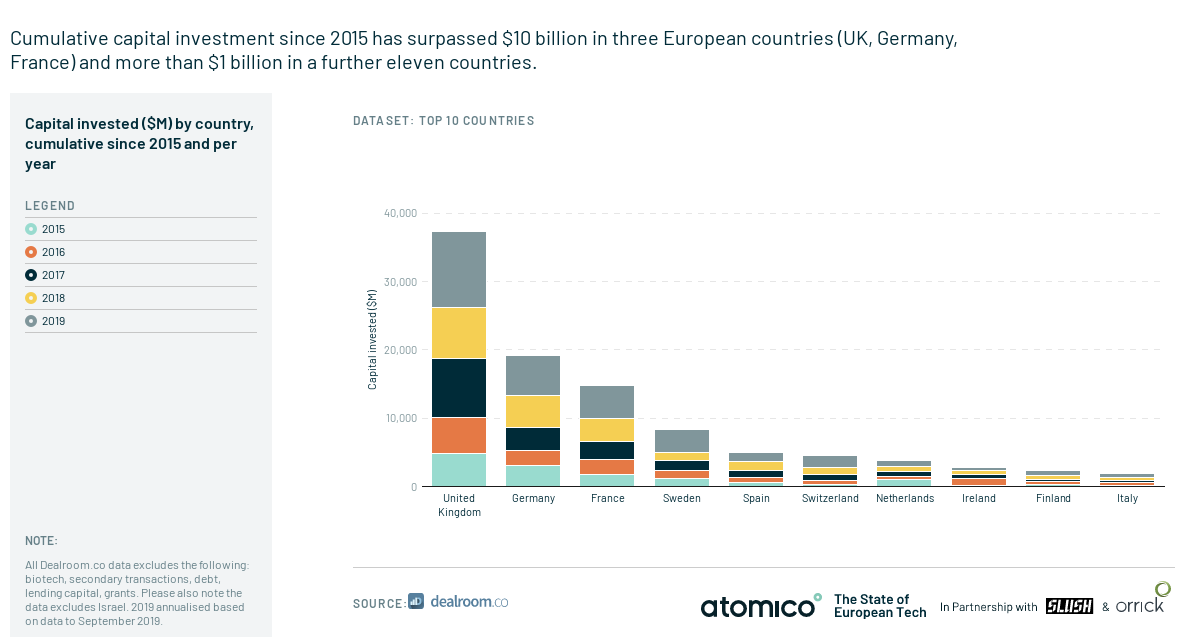

The report says that London is still the number-one hub. And so I wondered wherever you think that is latency. In other words, London is still benefiting from some of the things it did three or four years ago, or five years ago, and whether it’s going to continue to be the leading hub and who is second, and what are the hubs that are underreported and might jump up next year?

I think London is the number-one hub in terms of capital invested. You can call it latency, I think is is obviously a reflection of the fact that, over multiple generations of companies London’s been able to build Europe’s densest talent base; the largest number of people that have either built or helped to build companies that have real scale. It’s home to the largest number of investors and ultimately has a number of advantages that I think, looking forward, will mean that London continues to be one of, if not the most, attractive places to start and build a European tech company.

I think you’re right to make a distinction, though, between indicators that perhaps lag a little and those that are leading indicators. This is all in the context of a change in terms of the number of options that talented individuals have in terms of why they might choose to start and build their company from Europe.

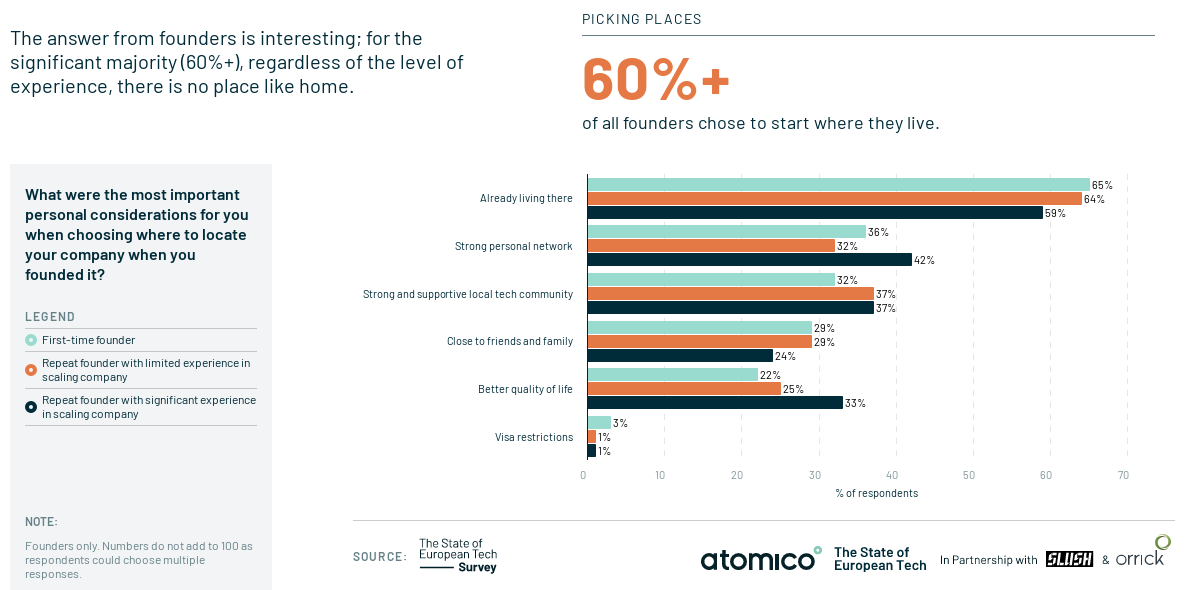

Obviously, what has happened, not just over five years but over a longer period of time, is that London has been joined by Berlin, which, by measure of total capital invested, is the second-largest hub, and Paris and Stockholm and Amsterdam, as places where it’s now proven that it’s viable to build an enormously valuable businesses. And actually there are billion-dollar venture backed companies from 20 different countries across Europe. As you’ve seen communities being built at scale, that are engaged, supported by an increasing number of local investors, it means that there’s never been greater optionality for those individuals. And so I think it drives a long-term structural trend in Europe, where perhaps once there was a huge amount of founder mobility, and it was 10 times higher than the average for a European citizen within the tech industry, that’s probably going to contract over time.

And that does mean over the long time that if you’re a city or a country that has historically been incredibly dependent on international talent to grow, that sort of works against you in the long term. London together with Berlin are the two cities in Europe where, at least according to the proxy that we get from our survey, have the highest density of international migrant founders.

If you look at 100 founders, something like between 40 and 45% of U.K. tech founders are actually from outside of the U.K. and I think it does mean that it’s never been more important for U.K. tech as a whole to position itself as a place that continues to be the most attractive place to build a European tech startup because there are just underlying structural trends that that will challenge it over the longer term.

That’s really interesting. And emerging hubs?

From an emerging hubs perspective, I think what’s really interesting this year is to look across Central and Eastern Europe, how much activity there. Whether it’s the obvious one, like Bucharest, where of course the emergence of UI path has put that in everybody’s focused, or whether it’s Prague, or even somewhere like Belarus. You see those early indications of hubs really starting to get to a meaningful point on the journey of a tech hub, where they’ve started to have their first exits in the hundreds of millions, there successfully keeping the people involved in those first-generation companies as active members of the ecosystem, sometimes turning into founding partners of a new generation of VCs. So things are spreading east.

If the U.K.’s immigration policy goes from being free movement to regulated movement, they are completely differently from an ecosystem point of view. I feel like when you start a company, you don’t necessarily sort of wake up one morning and go, ‘where am I going to start a company?’ It’s more like, you may have already come to London, or you are visiting London regularly, and you say, ‘I’m going to stay here and see what happens’. It is much more serendipitous than other aspects of a startup, right? So if you take that away, there’s there’s not going to be those 45% founders.

You’re spot on. One of the questions that we asked in the survey is what are the personal and business considerations that were important to you when you chose where to base your company. And the number one answer, ‘I was already living there’.

Let’s talk diversity. I think I was quoted in this year’s report after I was asked what kind of progress has the European tech industry made on diversity in the past year? And I flipantly replied, ‘the slow kind’ and it turns out I was on the money, right?

You hit it on the head. I think there are two things. One is the headline numbers show no material progress. Last year’s numbers were shocking to people and this year’s numbers are no different. 92% of all funding, in terms of capital invested in 2019 will go to the founding teams that are all men. I think what is clear is that the industry is effectively trying to move a mountain and you’re trying to unwind was has effectively been decades of prejudice, false assumption, stereotypes that have created an industry that has been perceived as not being welcoming to people from all backgrounds or experiences or demographics. And so that’s not going to be an easy thing to change. And I think the numbers reflect that. What we do see, which I think show early signs that things might start to change, is that it is clear from the survey that for meaningful numbers of people, awareness has increased and people are feeling better educated, and people feel more empowered to actually go and take some positive action.

What we also see, which I thought was interesting but not surprising, is that the burden to make this change happen is falling upon women and people from underrepresented backgrounds to lead the charge themselves. We found in a survey that, for example, women VCs are disproportionately more likely to be the ones that are going out and attending events where there’s a more diverse set of founders, they’re more likely to be the ones that are spending time on sectors where there’s a greater level of diversity, they’re more likely to be running open an office hours, they’re more likely to be setting up events themselves to reach into more diverse groups of founders. It’s clear that if European tech wants to accelerate change on this, it has to be something that becomes a priority not just for some but for all.

We also looked at it in terms of socioeconomic backgrounds. It’s clear that European founders not only come from a disproportionately more educated background, they also come from a disproportionately more well-off background. Almost 80% of founders are university educated versus 35% of the European population. More than 90% of founders were living comfortably before they founded their company, compared to just 39% of Europeans who say they were living fairly easily, easily or very easily. So I think it’s clear that there are barriers to creating a more diverse founder base in Europe. And on a relative basis, we’re not seeing founders emerge from these types of backgrounds, as you might expect if you look at the composition of the overall population as a whole.