Starboard Value, LP revealed in an SEC Form 13D filing last week that it owns a 7.5% stake in Box, the cloud content management company.

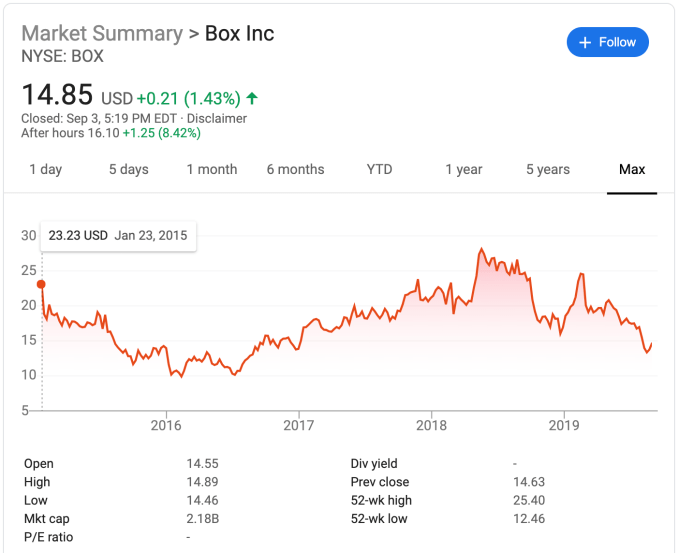

It is probably not a coincidence that Starboard Value invests in companies whose stock has taken a bad turn. Box’s share price has been on a roller coaster ride in the years since 2015, when its stock was priced initially at $14.00/share but then surged to $23.23 on its opening day. In recent years, its share price has gone as high as $28.12, but the declines have been steep: its 52-week low is $12.46 per share.

“While we do not comment on interactions with our investors, Box is committed to maintaining an active and engaged dialogue with stockholders. The Board of Directors and management team are focused on delivering growth and profitability to drive long-term stockholder value as we continue to pioneer the Cloud Content Management market,” a Box spokesperson told TechCrunch.

Indeed, it is too early to tell what Starboard’s investment will mean longer term. But more generally, it has been known to take a very active role in its portfolio companies, sometimes increasing its stake to secure places on the board and using that position to advocate management changes, restructuring, sales and more.

And Box is now, in a sense, on notice. From Starboard’s filing:

“Depending on various factors including, without limitation, the Issuer’s financial position and investment strategy, the price levels of the Shares, conditions in the securities markets and general economic and industry conditions, the Reporting Persons may in the future take such actions with respect to their investment in the Issuer as they deem appropriate including, without limitation, engaging in communications with management and the Board of Directors of the Issuer, engaging in discussions with stockholders of the Issuer or other third parties about the Issuer and the [Starboard’s] investment, including potential business combinations or dispositions involving the Issuer or certain of its businesses, making recommendations or proposals to the Issuer concerning changes to the capitalization, ownership structure, board structure (including board composition), potential business combinations or dispositions involving the Issuer or certain of its businesses, or suggestions for improving the Issuer’s financial and/or operational performance, purchasing additional Shares, selling some or all of their Shares, engaging in short selling of or any hedging or similar transaction with respect to the Shares…”

Box began life as a consumer storage company but made the transition to enterprise software several years after it launched in 2005. It raised more than $500 million along the way, and it was a Silicon Valley SaaS darling until it filed its S-1 in 2014.

That S-1 revealed massive sales and marketing spending, and critics came down hard on the company. That led to one of the longest IPO delays in memory, taking nine months from the time the company filed until it finally had its IPO in January 2015.

While losses more recently appear to be getting smaller, they are still a very prominent aspect of the company’s financials. In its Q2 earnings report last week, Box announced $172.5 million in revenue for for the quarter, putting it on a run rate close to $700 million, but it also said its GAAP operating loss was $36.3 million, or 21% of revenue (year-ago GAAP operating loss was $37.2 million, or 25% of revenue).

Non-GAAP operating income meanwhile was $0.5 million, or 0% of revenue (year-ago non-GAAP operating loss was $6.5 million, or 4% of revenue). Negative free cash flow was also up to -$19 million versus -$10 million a year ago. In other words, these are precisely the kind of metrics that attract activist investors to high-profile public companies.

Levie will be appearing at TechCrunch Sessions: Enterprise on Thursday.

We emailed Starboard Value for comment on this article. Should it respond, we will update the article.