One of the most-discussed plot twists in recent advertising has been the pivot of Direct-to-Consumer (DTC) brands to linear TV. These data-driven, digital-first players are expanding well beyond Facebook and Instagram—and becoming serious players on the largest traditional medium in advertising.

A January 2019 Video Advertising Bureau study found that in 2018, 120 DTC brands collectively spent over $2 billion in TV ads—up from $1.1 B in 2016. 70 of those 2018 advertisers ran TV ads for the first time.

But while we know that they’re advertising on TV, what may be less discussed is whether they’re succeeding on television—and what strategies they use to achieve their success.

At EDO, we have a unique and differentiated ability to measure how DTC advertisers perform on TV by tracking incremental online searches above baseline in the minutes immediately following individual TV ad airings as viewers translate their interest in advertised brands and products directly into online engagement with them.

By measuring incremental search activity across 60 million national TV ad airings since 2015, we are able to effectively isolate the effects of TV ad placement and creative decisions that are most likely to cause online engagement.

We ran the numbers on DTCs as well as advertisers in various other categories to better understand how DTCs specifically are succeeding in TV ads—and what DTCs who are considering TV advertising can do to achieve success on TV.

Table of Contents

- Does the David vs Goliath story play out on TV?

- Is there a newcomer advantage on TV?

- How does the DTC marketing playbook translate to TV? (A brief history and how-to, plus a Casper mini-case study)

- Conclusion: 3 keys to DTC TV success

Does the David vs. Goliath story play out on TV?

The DTC revolution is a quintessential David and Goliath story. In vertical after vertical, small, digital-native upstarts are changing the game and overtaking major brands. Does that story play out on TV as well—or is TV advertising one area where DTC marketers have finally met their match?

To answer that question, EDO looked at how effectively TV ads elicited viewer activity since September 2018 across eight major industry categories including DTC. Guided by historical ad performance across billions of ads, we rated ad performance based on how closely the DTC ads came to meeting the benchmark volume of brand-related online activity in the minutes following each TV ad airing.

We index each industry accordingly—giving an index value of 100 to an ad that meets benchmark standards, and below-par ads getting a score under 100 while higher-scoring ads receive a score over 100. We chose to set our index baseline of 100 to the average Consumer Packaged Good (CPG) ad since it is such a large and broad ad category. Our results are as follows:

What emerges is a picture of DTC brands giving traditional advertisers a very strong fight. In the minutes following ad airings:

- The typical DTC brand garnered an average 6.7 times more search engagement than the CPG category.

- DTC appears to be a serious competitor to traditional retail—the latter with just 11% more search from the average TV ad than DTC advertisers.

- DTC also outperformed the benchmark itself by 6.7 times.

Because DTCs are typically competing with entrenched players across the various categories above, it’s particularly illuminating to look at specific comparisons. DTC’s lead was significant as we drilled into specific advertisers’ performance.

In the men’s grooming category, consumers who viewed a Dollar Shave Club ad were 6.5 times as likely to engage online than were people who viewed a typical ad for traditional brands Gillette and Schick. Within bedding, TV viewers who saw mattress ads were 3.4 times as likely to engage online if that ad was for DTC brands Casper, Leesa, or Purple Mattress than for traditional mattress companies Mattress Firm, Sleepy’s, and Tempur-Pedic.

To understand what an accomplishment DTC’s TV ad performance really is, keep in mind that even the “giant” DTC companies—valued between $1 and $2 billion at the most—are still tiny compared to the massive traditional incumbents (P&G, for instance, has a market cap over $230 billion). Simply put, when it comes to TV ad impact, DTCs are punching way above their weight—and giving traditional brands a run for their money.

Is there a newcomer advantage on TV?

DTCs are overwhelmingly challenger brands—and thus “the new kids on the block” within their respective categories. Does being a fresh face help or hinder the way TV audiences receive them?

One hint may come from the way viewers respond to DTC advertisers over time. Looking at the search engagements that brands garner as they first arrive on air versus the months following, it’s clear that TV newcomers receive a “pop” in the first three TV months. After that, ad-related online search levels out in the nine months that follow.

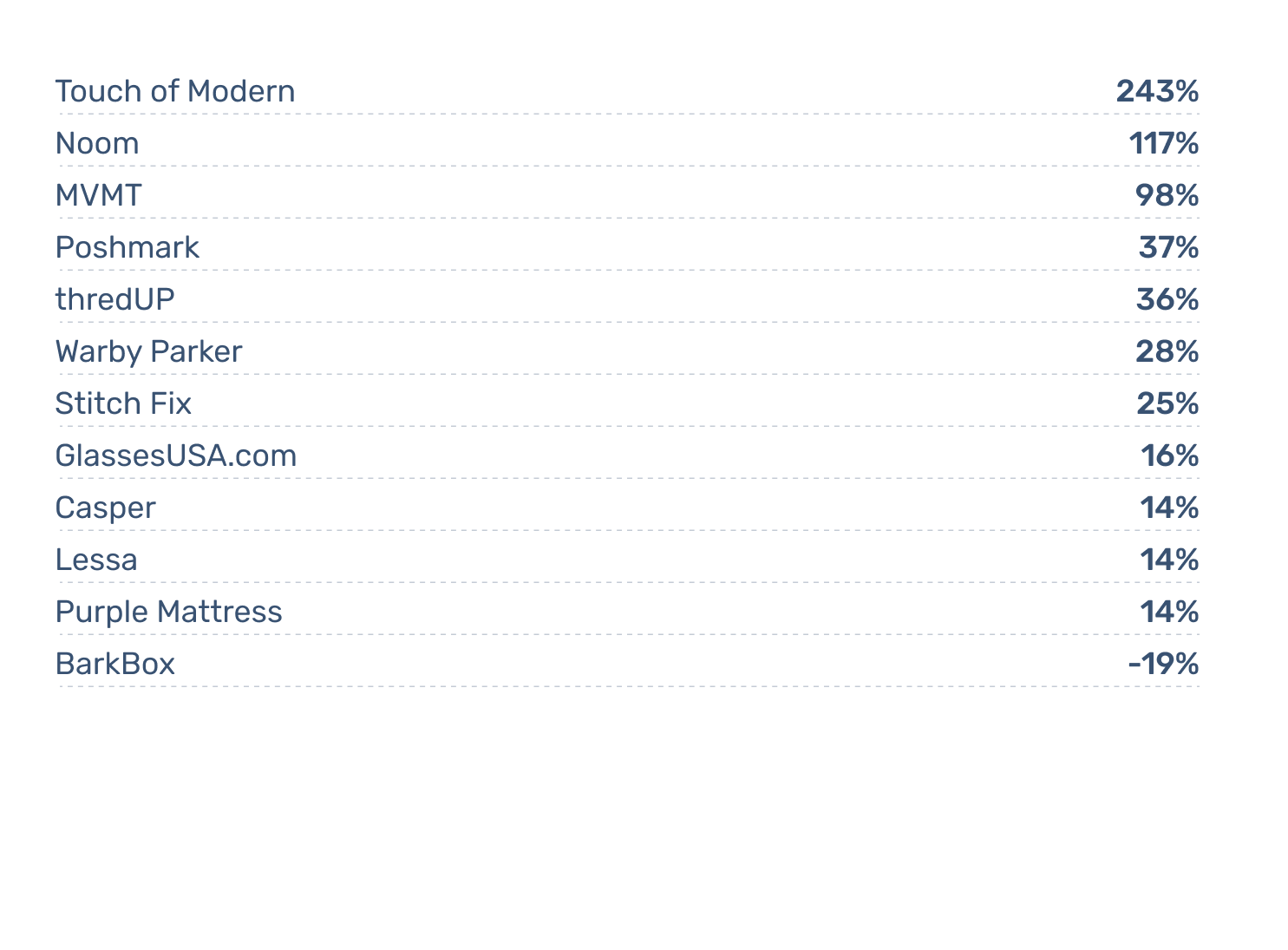

Below is a sample of that newcomer’s welcome amongst a select few DTC TV advertisers:

How much more engaged were audiences in the first three months of a brand’s TV ads vs. the subsequent nine months?

Overall, amongst the brands we studied, audiences were 75% more responsive to DTC TV ads in those first three months. When it comes to TV ads, being a newcomer can help. That’s good news for many DTC advertisers looking to enter the TV game.

How does the DTC marketing playbook translate to TV? (A brief history and how-to, plus a Casper mini-case study)

DTC brands are built on driving efficiencies by rethinking the marketing status quo – simplistically, by cutting out the middleman. Can DTCs translate that philosophy to TV?

First, it’s important to recognize the historical context here. It’s not actually a new phenomenon to use TV to drive direct sales to consumers. For many decades, TV has had a category of advertisers called “Direct Response” (DR) marketers – you probably know them as those memorable, if sometimes annoying, spots loudly pitching you the latest kitchen or workout gadgets with a toll-free phone number and/or, for the past couple decades, a URL.

We know the longer-duration versions of these ads fondly as “infomercials.” DR marketers are the predecessors of today’s generation of DTC marketers. TV networks generally relegate DR ads to non-guaranteed placements (i.e., “we will run your ads in whatever programming we have open slots”), almost always outside of the higher-profile dayparts, in exchange for a much lower price per ad than that paid by advertisers who commit to guaranteed placements in the Upfront.

How do the DR marketers know it’s a good trade? Quite simply, they watch the data very carefully – they keep track at a very precise level the exact time an airing runs on TV and then they look for the spike of people of entering their sales funnel. The special thing about live, linear TV is that there’s almost always a spike.

There are hundreds of thousands or millions of people watching the ad live and some portion of them react by looking for more information and perhaps buying. So the DR marketers count how many site visitors (or in the past, how many phone calls) above the norm arrive in the minutes following the TV ad, tag them as a cohort with metadata about the specific airing that got them there and then see how many convert into buyers.

They do the ROI math on value relative to cost, and then they buy more of what’s working for them and less of what’s not.

If they realize there’s a very specific chunk of TV programming that’s really performing well for them, they might pay more to get guaranteed placement, but more typically they’ll identify a certain creative (the 15-second or 30-second piece of video that is the ad) is doing particularly well in certain types of programming and they will ask the networks to rotate that one in more often, or they’ll shift money into better-performing dayparts or networks, staying in the DR-tier of inexpensive inventory.

Why doesn’t every marketer do this? The short answer is it’s hard for most brands because they do not have the visibility that DR marketers have.

Whether it’s an old-school DR marketer selling a countertop rotisserie chicken roaster or a next-gen DTC marketer selling a networked stationary bike, there’s only one way the interested consumer can shop and buy. DTC brands own their funnels.

Most other brand marketers, from automakers to CPG to movie studios, can’t see the data about their customers’ paths to purchase because it is scattered around a tangled web of online and offline sources and outlets. What we do at EDO gives these brands a sophisticated proxy of the real-time, granular visibility that previously only DTC (and DR) marketers had.

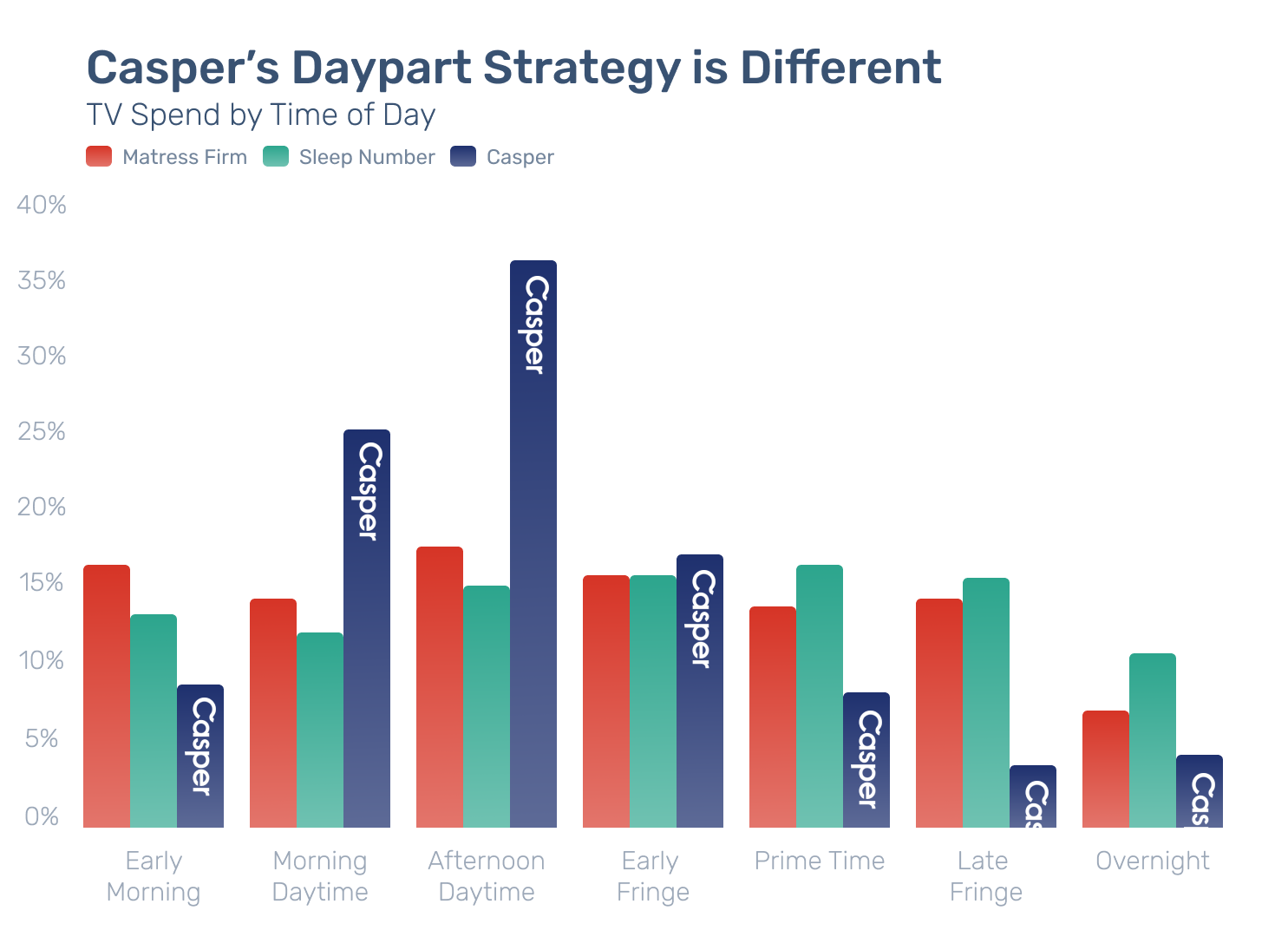

Casper Sleep, one of the best-known DTC players, seems to have leveraged the DTC player’s data-driven approach with its innovative approach to dayparting (apportioning ad buys across time of day).

Dayparts are a classic media balancing act, involving investing ad budgets across a spectrum of time slots that represent the biggest audiences for the highest prices (prime time) to lower-cost, lower-viewership times like overnight. Striking the right mix along that spectrum lies at the heart of an efficient TV plan.

We looked at the dayparting strategies of three of the leading mattress brands—DTC leader Casper, alongside traditional brands Sleep Number and Mattress firm—over a six-month period to get an up-close view of how these traditional and DTC brands might approach dayparting differently. The differences were striking.

Mattress Firm and Sleep Number take a conservative portfolio approach to dayparting, spreading their ad buys roughly evenly across time segments.

Casper takes a very different approach. It focuses the bulk of its advertising from morning into mid-afternoon—particularly in the early afternoon (“afternoon daytime”)—and spends little in all other times, including premium-priced prime time TV.

This enabled Casper to spend an estimated $2.5 million versus Sleep Number’s of $22 million in the same time period. Focusing on the daytime dayparts was clearly driven by Casper’s data-driven view of what was working for them. EDO’s data validates that Casper’s TV ads were 4.7 times and 6.6 times more effective in generating engagement than those of Mattress Firm and Sleep Number respectively.

The core of the DTC playbook is to take a critical eye—and a lot of data—to every aspect of marketing. In the case of Casper’s TV buys, the brand shows that the approach works on TV as well.

Conclusion: 3 keys to DTC TV success

DTC brands are leveraging their test-and-learn, audience-driven and data-informed marketing approach—coupled with their sheen as exciting new players—to win in the old-is-new world of TV ads.

How can an aspiring DTC brand (or one who wants to perform like one) follow in their successful footsteps? Our conclusions above point to the three keys to TV ad success:

- Timing is critical. Given the initial excitement that TV ads drive, deciding when to enter the TV medium is nearly as crucial as is deciding whether to advertise on TV. The strategic fundamentals of your strategy must align with what TV can do for you. It’s a mass medium and if your offering is super-niche, then TV may not be right for you. If you have a local or regional offering, then national TV is obviously overkill when local or regional TV buys would make more sense. Are you ready for scale? Enter too soon in your company’s growth, and you may not have the capacity or capital to carry the momentum past that initial pop. Start advertising on TV early enough to benefit from the growth that TV ads offer—but not so soon that you can’t sustain TV advertising as part of your ongoing marketing strategy.

- Treat TV like direct response. To ROI-driven DTCs, every medium is a DR medium. DTC marketers regularly use their data to help them ignore tradition and focus instead on getting maximum impact with maximum efficiency. As Casper’s dayparting strategy indicates, that’s an approach that works on TV as well. DTCs should use their innate direct response tendencies to their advantage—and carry that approach to TV too.

- Commit to an investment. This point follows from the two points above. TV success takes a significant amount of advertising, and a significant amount of data. Both of these require a critical mass of ad volume. TV is a scale game: if you’re looking to dabble, it’s not for you. With a serious approach and budget, the TV networks will open up their innovative, audience data platforms, like WarnerMedia’s Ignite and Viacom’s Vantage, to you and help you build a sophisticated TV campaign plan that can include benefits like performance guarantees and automated optimization.

Ignore the headlines about the declines in TV ratings. Watch what the smart money is doing. The smart money knows that the days of spray-and-pray are in the past.

In this era, every brand marketer has the opportunity to act like a DTC and buy the TV that works for them and run the creatives that are performing best. Follow their lead and you’ll be able to reap the benefits of the most under-appreciated channel in the DTC marketer’s media plan.

Kevin Krim is EDO’s President & CEO. His 21-year career has spanned search, social and TV advertising across start-ups and major companies like Yahoo and NBCUniversal.

Sebastian Chiu is EDO’s Chief Data Scientist. He earned his undergraduate and post-graduate degrees from Harvard, working previously as a data scientist at Dropbox.