Starbucks plans to double its store count in China to 5,000 in 2021 and Luckin, a one-year-old coffee startup, is matching up by aiming to reach 4,500 by the end of this year. Luckin’s upsized $651 million flotation has brought American investors’ attention to this potential Starbucks rival in China, where the Seattle giant controlled over half of the coffee market as late as 2017. But as soon as you make your first purchase with Luckin, you realize its ultimate goal may not be to topple Starbucks.

To get your caffeine intake from Luckin, the ordering process happens entirely on its app. First, you will decide how you want to fetch the drink: have it delivered within 30 minutes, pick it up at a nearby Luckin kiosk, or sit back and sip at one of its full-on cafes, or what it calls ‘relax stores.’

Say you’re tied up at the desk, you can input your location to check if you’re within Luckin’s delivery radius. Luckin has essentially built a vast coffee delivery network through its partnership with one of China’s biggest courier services SF Express, which dispatch staff to ferry the drinks on scoot fleets. You then place the order, choosing from a range of drinks and customizing it — hot or cold, the amount of sugar and portions of creamer, the type of syrup flavor and the likes. When you get to the end, Luckin will ask you to pay via its app. If you’re a first-time user, you get a ‘first order free’ voucher, a common strategy for many Chinese consumer-facing apps to lure new users.

You then place the order, choosing from a range of drinks and customizing it — hot or cold, the amount of sugar and portions of creamer, the type of syrup flavor and the likes. When you get to the end, Luckin will ask you to pay via its app. If you’re a first-time user, you get a ‘first order free’ voucher, a common strategy for many Chinese consumer-facing apps to lure new users.

How to order with Luckin

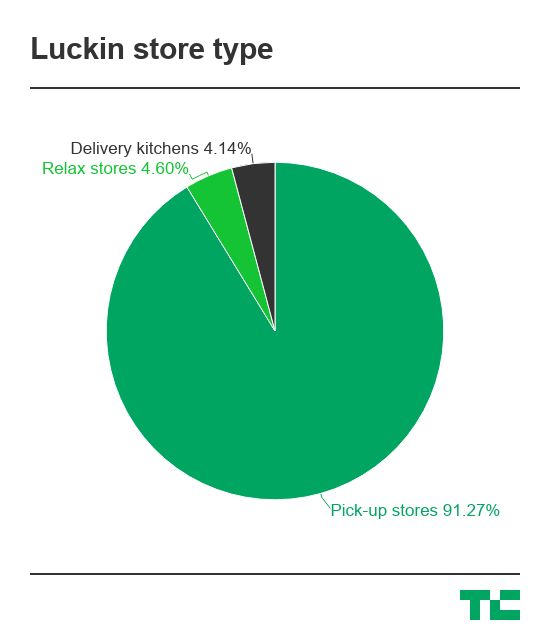

Alternatively, you can pick up the order from any of Luckin’s coffee bars or cafes. Only 4.6 percent of Luckins’s 2,370 locations are set up for the sit-down scenario. In contrast, 91.3 percent are pick-up bars that it “strategically focus[es] on,” reads a note from its IPO prospectus. That makes Luckin more akin to McDonald’s or 7-Eleven, which also sell coffee aimed for grab-and-go customers, than Starbucks offering the ‘third place’ between homes and workplaces.

White-collar drinkers

Access to Starbucks as a temporary office doesn’t come without a price. On average, Starbucks drinks are 5-10 yuan ($0.72-$1.45) more expensive than Luckin’s. A large Americano, for example, costs 28 yuan at the American chain and only 21 yuan at Luckin, even excluding the discounts for returning customers. Similarly, a large latte goes for 32 yuan at Starbucks while it costs 24 yuan at Luckin.

“When Starbucks customers buy a cup of coffee, they are paying for two types of services. There’s the coffee, and there’s the right they are buying to use the space, whether they are using it to meet friends or discuss work,” Huang Hai, principal at Chinese venture investment firm FreesFund, said to TechCrunch.

Nonetheless, there are a lot of regular coffee drinkers out there who “just want the caffeine without the space,” added Huang. “They are Luckin’s real target.”

Liu Lingyu is one. An accountant working in Shenzhen’s bustling high-tech hub, She rarely visits Starbucks because she drinks her cup at her desk, so it makes more economic sense to get the 10 yuan Americano from 7-Eleven downstairs.

Indeed, most of Luckin’s pick-up stores are “typically located in areas with high demand for coffee, such as office buildings, commercial areas and university campuses,” states the company’s F1 filing. That means Luckin has its eyes on China’s white-collar professionals and college students. According to data provider Jiguang, 68 percent of Luckin users were under the age of 29 a few months after the app launched. There were slightly more female users, who represented 54 percent of the customer base.

A Luckin pick-up stand inside a high-rise in Shenzhen / Photo source: Luckin

Liu is now getting coffee from the Luckin kiosk perched at her office’s lobby about three times a week. On the other hand, Liu said she’s still happy to pay for marked-up lattes at Starbucks where her son meets with his tutor once a week. “This way I feel that I’m getting value for my money,” she said.

Luckin’s eat-in stores could easily serve the same purpose that puts it in competition with Starbucks, though this is clearly not its only focus. The startup says it’s currently widening its menu to add juices, pastries, sandwiches, snacks and lunch sets as it braces for a future where it not only faces off traditional coffee chains but also “convenience stores as well as food and beverages operators with convenient locations.”

A coffee popularizer

Starbucks has ridden China’s economic boom over the past 20 years and became a household name, but for the most part, the American brand is still seen as an indulgence rather than a daily necessity.

That leaves much room for new players in a tea-drinking nation whose coffee market is far from mature. China consumed a mere 6.2 cups of coffee per capita last year, far fewer than 279 in its neighboring Japan and 388 in the U.S., according to Frost & Sullivan findings cited by Luckin’s prospectus. New opportunities could include hipster cafes that provide a more Instagrammable interior than Starbucks, or cheaper coffee without the premium incurred by store rentals, as Luckin promises.

Couriers from SF Express pick up orders from a Luckin booth in Shenzhen / Photo source: Luckin

“Starbucks is everywhere, so why are so many people still not drinking coffee?” Asked Luckin’s chief marketing officer in a speech last October. “That’s because Starbucks is too expensive. [Our products] are only half their price.”

Only 26 percent of Chinese respondents of a recent survey by Frost & Sullivan were willing to pay for a cup of freshly brewed coffee priced over 30 yuan, or $4.34. But the average for the top five coffee chains in China was around 30 yuan, according to the consulting firm.

By the measure of price, Luckin is not a Starbucks challenger but rather a coffee popularizer. To lure non-drinkers, Luckin has adopted the standard playbook of Chinese startups — raising large sums of cash to splurge on marketing and discounts for new and existing users. Liu Mingzai, a doctoral student at Peking University in Beijing, told TechCrunch that she’s not a coffee drinker at all but “tried out Luckin anyway because of the vouchers.”

“One of Luckin’s strength is its scale, which it can utilize to shape how China’s young generations perceive coffee,” said Eason Lin, a Shenzhen-based coffee shop owner.

The time seems ripe for a domestic player to enter the coffee field. A report from Credit Suisse found Chinese consumers are warming up to local brands as preferences for imported goods, which were regarded better-made and a symbol of social status, is waning.

Who’s drinking Luckin, really?

People hold different standards for coffee. Some look for taste and aroma, some need a caffeine kick, while others buy the service attached to the cup. A lot of coffee enthusiasts are skeptical about Luckin’s taste because “most of its drinks are made automatically by machines,” as Liang Jie, a coffee shop owner told TechCrunch.

“Luckin is for people with a low expectation for coffee quality. They may give Luckin a try because of the discounts, but whether they will stick around after the discounts go away depends on their habit,” he added.

One of Luckin’s few full-on stores / Photo source: Luckin

He further argued that as Chinese coffee drinkers become more sophisticated and care less about price, services that treat coffee as a fast-moving consumer product, such as Luckin, will struggle to catch up. Lin, the other cafe owner, is more optimistic, saying Luckin has a leg up in cost control.

“As Luckin scales, it could improve its margins significantly while exploring cost-saving measures such as automation,” he said.

This is all too early to know, but Luckin has gained some early momentum. Monthly customer retention rates have mostly hovered between 20 percent to 35 percent, and although they tend to dip in the second month when discounts drop, the percentages have bounced back over time. The startup attributes the early headway to “expansion of [its] store network, growing brand awareness, more diversified product offerings and enhanced customer experience.”

Luckin’s customer retention rates over time / Chart: Luckin F1 filing

On the other side, Luckins’s losses are appalling, as many observers including my colleague Danny Crichton and Arman Tabatabai have pointed out. Its net loss amounted to $82.2 billion for the three months ended March 31, compared to just $19.2 billion a year before, and the company does not plan to scale back cash burning anytime soon.

“We… expect to continue to invest heavily in offering discounts and deals and other aspects of our business, especially sales and marketing expenses, in the foreseeable future as we continue to expand our store network and our product offerings,” notes Luckin in its F1.

“The challenge for Luckin is whether investors will continue to buy into in its story and keep giving it money,” Frees’ Huang warned.