Pinterest, the nearly decade-old visual search engine, has unveiled its S-1 as it prepares for an initial public offering expected in April.

Valued at $12.3 billion in 2017, Pinterest took its first official step toward a 2019 IPO two months ago, hiring Goldman Sachs and JPMorgan Chase as lead underwriters for its NYSE offering. Now it’s giving us a closer look at its financials.

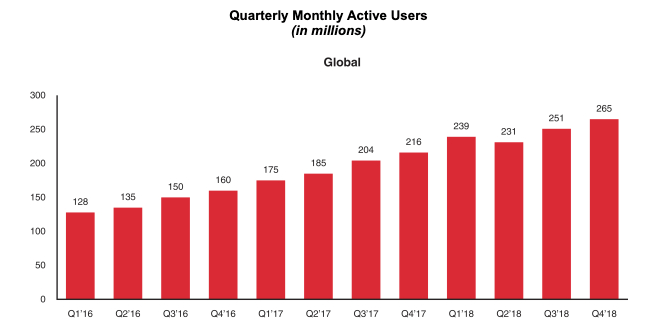

The San Francisco-based company, which will trade under the ticker symbol “PINS,” posted revenue of $755.9 million in the year ending December 31, 2018, up from $472.8 million in 2017. It has roughly doubled its monthly active user count since early 2016, hitting 265 million late last year. The company’s net loss, meanwhile, shrank to $62.9 million last year from $130 million in 2017.

In total, Pinterest has posted $1.525 billion in revenue since 2016.

Pinterest has similarly raised around $1.5 billion from VCs, listing both early and late-stage investors on its cap table. The company’s key stakeholders include Bessemer Venture Partners, FirstMark Capital, Andreessen Horowitz, Fidelity and Valiant Capital Partners, though the filing doesn’t state the percent ownership of each of these entities.

Pinterest counts more than 250 million monthly active users, bringing in some $700 million in ad revenue in 2018, per reports, a 50 percent increase year-over-year. The business employs 1,600 people across 13 cities, including Chicago, London, Paris, São Paulo, Berlin and Tokyo. Per the filing, Pinterest has signed a lease for a brand new San Francisco headquarters, which will be constructed near its current HQ.

The company’s global average revenue per user (ARPU) in the year ended December 31, 2018 was $3.14, up 25 percent YoY. Its U.S. ARPU, meanwhile, sat at $9.04, a 47 percent increase from the prior year.

Pinterest emerged in 2010 as a buzzy social media startup and mobile app meant for sharing inspirational images and quotes. Under the leadership of co-founder and chief executive officer Ben Silbermann, it has expanded over the years as it has attempted to monetize the platform, which relies on ad revenue to stay afloat. Last fall, in a bid to turn more of its users into shoppers (and compete with Instagram), the company rebuilt the infrastructure behind its product pins. The update brought to the app up-to-date pricing and stock information on all product pins, links directly to retailers, a new “Products like this” category under each fashion and home decor pin and other user-friendly tweaks.

Pinterest’s IPO paperwork emerged just hours after another tech unicorn, Zoom, filed to go public. Several billion-dollar tech companies have made the choice to IPO in 2019, even after a weeks-long government shutdown caused a significant delay in offerings. Pinterest follows Lyft, which unveiled its S-1 and nearly $1 billion in 2018 losses just three weeks ago. Uber and Slack are both expected to make their IPO paperwork available to the public soon.

Pinterest may be looking to benefit off the 2019 IPO hype spearheaded by Uber and Lyft, though The Information has previously reported Pinterest’s offering could suffer because it’s a social media business, which means it’s often compared to the likes of Facebook and Twitter, a pair of companies that have repeatedly raised concerns about user privacy.

We’ll have to wait a few more weeks to get a better understanding of Wall Street’s demand for Pinterest. If it’s anything like Lyft’s IPO, which is already over-subscribed, the company will fare just fine.

This story is updating.