Big problems require big war chests. Ribbon wants the biggest chest of them all.

The startup, which was founded just about a year ago by ex-LendingClub head of strategic development Shaival Shah and ex-Twitter/TellApart engineer Jian Wei Gan (who, full disclosure, is married to TechCrunch columnist Joyce Yang), wants to replace the incredible stress of securing a mortgage during the home buying process with a Ribbon Offer: If a buyer can’t secure a mortgage in time for close, Ribbon will pay for the house itself and give the buyer extra time to get financing.

It’s a simple premise, but potentially revolutionary in its effect on home buying in the United States, and Ribbon’s investors have taken notice. After raising a small seed earlier this year, the company announced today that it has raised $225 million in a combination of debt and Series A equity financing. (The company refused to go on the record about the breakdown of debt and equity.) The equity portion was led by its existing seed investors Bain Capital Ventures, Greylock, NFX and NYCA.

Understanding Ribbon requires understanding the immense difficulties of consumer home buying. Home ownership remains a dream for most Americans, but actually purchasing a home in the United States remains incredibly challenging. From finding a home to negotiating with a seller and handling hundreds of pages of paperwork — all of it together can create one of the most stressful periods of anyone’s life.

And it is getting even more intense. For consumers buying homes, their competitors are often not their fellow humans, but rather large investment firms that come with all-cash offers and guarantees to close. As The Wall Street Journal noted last year in a deep dive on the practice, “All told, big investors have spent some $40 billion buying about 200,000 houses, renovating them and building rental-management businesses, estimates real-estate research firm Green Street Advisors LLC.”

That has made mortgage financing — necessary for most buyers — an increasingly common no-go for home sellers. To solve for this, Ribbon wants to give every consumer the leverage of an all-cash offer while eliminating the mortgage contingency in home buying.

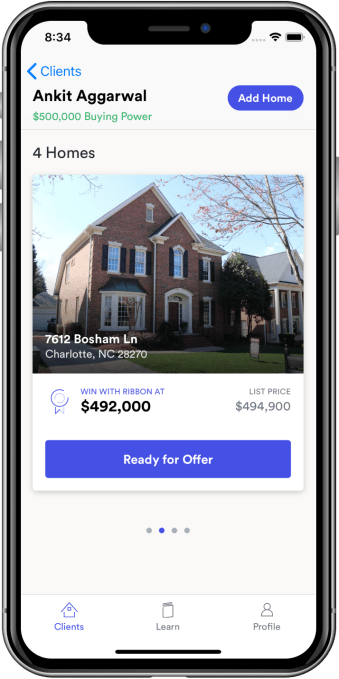

Ribbon’s app allows home buyers to find houses and determine Ribbon Offer prices (Photo from Ribbon)

When purchasing a home, buyers who need mortgage financing will include a clause in the home purchase contract stating that if they are unable to get a mortgage in time for closing, they are able to walk away from a deal, generally without financial penalty. This is known as a mortgage contingency.

That clause puts sellers in a bind: move forward with such a buyer, and their creditworthiness will determine whether a transaction is completed. Yet, sellers don’t really know their buyers, and they have very little visibility into a buyer’s ability to get a mortgage. Pre-approved mortgages help here, when they are available, but are a poor substitute for cash.

Ribbon takes on home buyers as clients and assesses their likelihood of securing a mortgage using data science. If convinced that a buyer will get a mortgage, it then offers a Ribbon guarantee to the seller that if financing falls through, it will offer the cash needed to close the transaction.

“We guarantee a close and we guarantee a move in,” explained Shah, who is CEO. He emphasized that “we are not just providing a cash offer, but a guarantee to close … which creates certainty in the real estate process.”

One of Ribbon’s early purchases was this home (Photo from Ribbon)

Ribbon is free for buyers, and the company charges a 1.95 percent fee at closing from sellers. It is not uncommon for home sellers to discount their home price for all-cash offers due to the greater certainty of close, and Ribbon believes the same pattern will hold true for its Ribbon Offer. “Our view is that if discounts are going to exist because of the cash guarantee … let that discount flow through to the consumer ecosystem,” Shah explained.

If a mortgage falls through at the last minute, Ribbon will buy the home and wait for the buyer to secure a different mortgage. That process can sometimes be just a few days, which means that Ribbon doesn’t need to hold substantial housing inventory or take on macroeconomic risk, and can turn over its debt quite rapidly.

The company launched in Charlotte, North Carolina and has been in the market for about six months. Shah said that the company “tripled” transaction volume from Q2 to Q3, although demurred on deeper details of the company’s revenues. Charlotte was chosen both because home prices are cheaper than in major global cities like New York City and San Francisco, and because the percentage of cash offers locally has hovered slightly above one-third in recent years, according to company data, due to a surge in corporate buying.

Ribbon wants to be “Switzerland” according to Shah, which means working with existing realtors and existing mortgage lenders in a neutral and non-competitive way. He doesn’t see a world in which the company would offer its own mortgage products (at least, not yet), and instead wants to focus on perfecting the data models that underwrite its guarantee.

Home buying startups have been heavily financed by venture capitalists, including Opendoor, which has raised $1 billion, and others like Perch and Knock. Shah says that his competitors primarily focus on sellers rather than buyers, and Ribbon wants to do the opposite.

The company intends to expand to 10 new markets in the coming year, and has already grown organically through realtor referrals to expand to Asheville and Cary, North Carolina.