With its regulatory woes behind it — and the acqui-hire of fintech startup Pariti — Tandem‘s product roadmap appears to be picking up pace.

The challenger bank founded by Ricky Knox has launched its second credit card today, this time targeting people in the U.K. who have yet to build up a credit history at all. Credit cards are already one of the most effective ways of improving your credit score (presuming you are approved for one and always repay on time, of course) and it seems that Tandem wants a piece of that action.

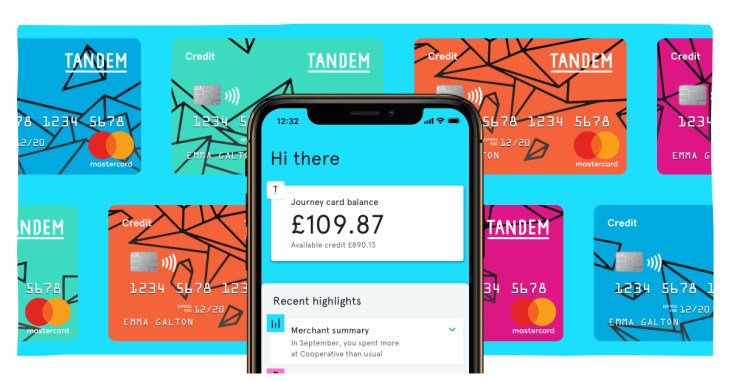

Dubbed the “Journey Card,” Tandem says the new credit card is “a way for those who haven’t had credit before to build up a strong credit profile”. The upstart bank says it is tapping into a climate where people are realising the importance of credit scores for building a better future and how essential a decent credit score is when taking out further credit such as a car loan, mortgage and other longer-term financial products.

However, although the new Journey Card shares the same low FX fees when spending abroad, there are some key differences compared to the original Tandem Cashback Card. These include no cash back, for starters, and what appears to be a higher APR in recognition of the higher risk Tandem is taking on.

With that said, both cards integrate with the Tandem mobile banking app, which acts as a Personal Finance Manager (PFM), including letting you aggregate your non-Tandem bank account data from other bank accounts or credit cards you might have. Very recently the app has released a plethora of updates (including digital statements, at last!), and these include some useful budgeting tools, which sits well alongside a credit card designed to help you build your credit score.

Meanwhile, it is becoming clearer that Tandem sees consumer credit as its “attack vector” in the consumer banking space, as opposed to offering a current account or pre-paid/debit card, although I wouldn’t be surprised to see the challenger bank go there eventually. It already offers a fixed-saver account, after all.

Says Ricky Knox, CEO of Tandem: “The integration of credit products into our app is a game-changer for the industry. Our competitors have launched some great pre-loaded and debit cards, but we will own credit in this space”.