Freightos, a marketplace for logistics providers, announced today that it has raised a $44.4 million Series C led by Singapore Exchange. Returning investors including General Electric Ventures (the lead investor of Freightos’ Series B extension last year), ICV and Aleph also participated in the round, which brings Freightos’ total funding so far to $94.4 million.

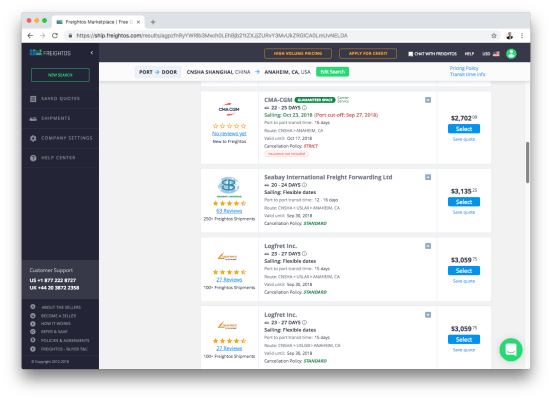

Launched in 2016 as a price comparison service for freight forwarders—the agents that organize shipments from a supplier or manufacturer to their final destination—Freightos now also lets users book, manage and track shipments with more than 1,200 logistics providers.

In an email, founder and CEO Zvi Schreiber said its online freight marketplace will continue to be Freightos’ flagship product, but the company also wants to find ways to make the industry more efficient by building a global digital infrastructure.

The company claims to process more than one million instant freight quote requests each month using its patent-pending routing and pricing engines. Its database of global shipping rates also underpins the Freightos Baltic Index (FBX), an industry-specific index created to provide more pricing transparency.

Developed in partnership with the Baltic Exchange, a market information provider for the maritime transportation industry, the FBX tracks freight pricing from 12 major routes around the world and also combines them into one index to serve as the freight industry’s equivalent of the S&P 500.

“Nearly every major global industry, from jet fuel to livestock, leverages dynamic pricing based on real-time metrics to make smarter, automated decisions. We’re excited to explore how our global freight index, the Freightos Baltic Index, can reduce pricing risks and improve stability, and are already exploring implementation with major multinational corporations,” Schreiber said.

He added that Freightos is also looking at more ways to connect airlines with logistics providers to sell cargo space on passenger flights.

Freightos will partner with the Singapore Exchange, which owns the Baltic Exchange, to develop new financial instruments. It will start by launching daily reporting on the FBX, which is currently updated weekly.

In a press statement, SGX head of derivatives Michael Syn said, “Freightos is at the forefront of a new wave of solutions for price discovery and digital marketplaces in global freight – an industry at the heart of the global economy. SGX is excited by the potential to develop risk management tools and services and build on Singapore’s unique position in the trade ecosystem, to bridge the physical and financial markets.”