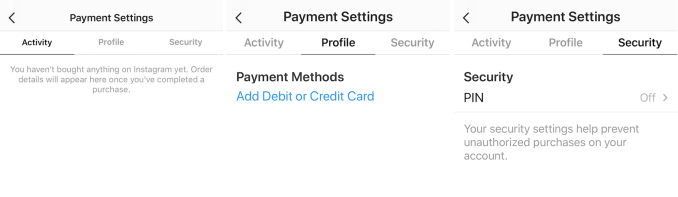

Get ready to shop the ‘Gram. Instagram just stealthily added a native payments feature to its app for some users. It lets you register a debit or credit card as part of a profile, set up a security pin, then start buying things without ever leaving Instagram. Not having to leave for a separate website and enter payment information any time you want to purchase something could make Instagram a much bigger player in commerce.

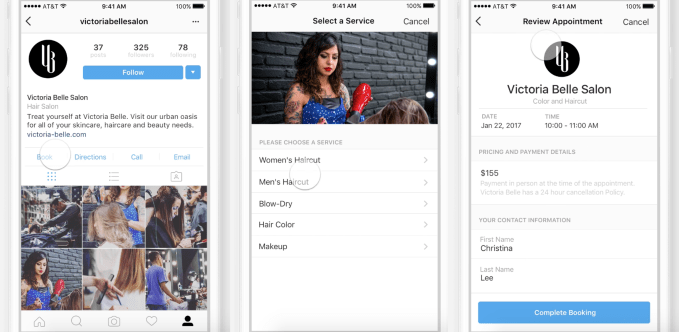

TechCrunch reader Genady Okrain first tipped us off to the payment feature. When we asked Instagram, a spokesperson confirmed that native payments for booking appointments like at restaurants or salons is now live for a limited set of partners.

One of the first equipped is dinner reservation app Resy. Some of its clients’ Instagram Pages now offer this native payment for booking. And in the future, Instagram says you can expect direct payments for things like movie tickets through the app. Instagram initially announced in March 2017 that “we’ll roll out the ability to book a service with a business directly from their profile later this year,” but never mentioned native payments.

Instagram’s native appointment booking

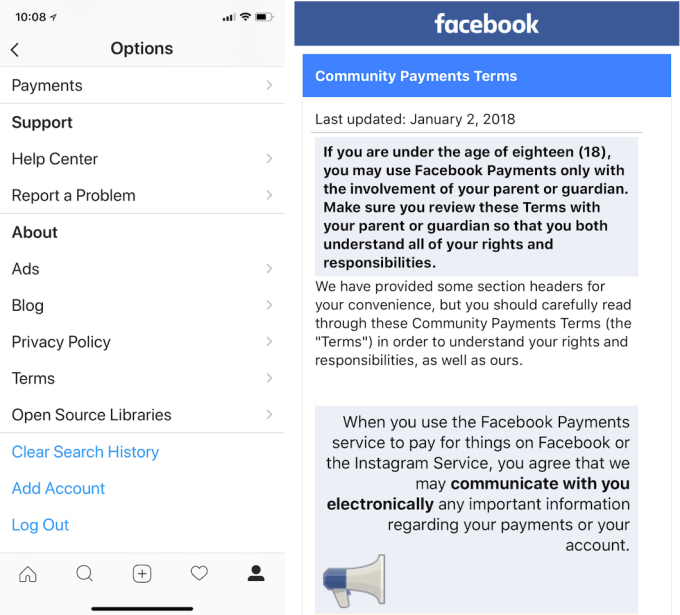

We’ve confirmed that the payment settings are now visible; some, but not all, users in the U.S. have it while at least some in the U.K. don’t. A tap through to the terms of service reveals that Instagram Payments are backed by Facebook’s Payments rules.

With its polished pictures and plethora of brands, shopping through Instagram could prove popular and give businesses a big new reason to advertise on the app. If they can get higher conversion rates because people don’t quit in the middle of checkout as the fill in their payment info, brands might prefer to push people to buy via Instagram.

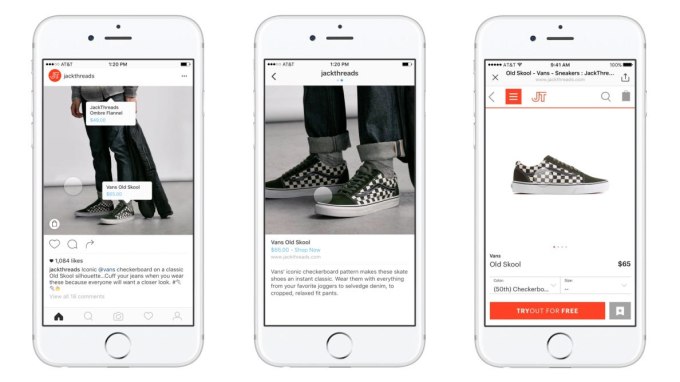

Instagram’s existing Shoppable Tags feature forces you out to a business’ website to make a purchase, unlike the new payments feature

Facebook started dabbling in native commerce around 2013, and eventually started rolling out peer-to-peer payments through Messenger. But native payment for shopping is still in closed beta in the chat app. It’s unclear if peer-to-peer payments might come to Instagram, but having a way to add a credit or debit card on file is a critical building block to that feature.

It’s possible that the payments option will work with Instagram’s “Shoppable Tags,” which first started testing in 2016 to let you see which products were in a post and tap through to buy them on the brand’s site. Since then, Instagram has partnered with storefront platforms BigCommerce and Shopify to get their clients hooked up, and expanded the feature to more countries in March. For now, though, none of Instagram’s previous shopping feature partners like Warby Parker or Kate Spade let you checkout within Instagram, and still send you to their site.

But the whole point of Instagram not allowing links in captions is to keep you in a smooth, uninterrupted browsing flow. Getting booted out to the web to buy something broke that. Instagram Payments could make impulse buys much quicker, enticing more businesses to get on board. Even if Instagram takes no cut of the revenue, brands are likely to boost ad spend to get their shoppable posts seen by more people if the native payments mean more of them actually complete a purchase.

Instagram isn’t the only one who sees this potential. Snapchat started testing its own native payments and checkout feature in February.