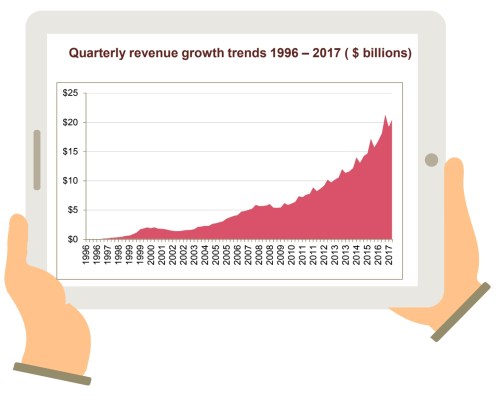

Digital ad spending continued to grow during the first six months of 2017, according to the latest Internet Advertising Revenue Report.

The report was prepared by PricewaterhouseCoopers for the Interactive Advertising Bureau, a trade group of online advertisers and publishers. It shows that digital ad revenue in the United States reached $40.1 billion in the first half of this year. That’s both a 23 percent year-over-year increase and an all-time high.

The previous report highlighted the fact that in 2016, mobile accounted for the majority of ad spending for the first time. That trend continued into 2017, with mobile ad revenue growing to $21.7 billion, accounting for 54 percent of the total.

And in a year where publishers seemed eager to “pivot to video,” it does seem that they were following advertiser dollars, with video ad revenue growing 36 percent to $5.2 billion. Mobile video advertising accounted for $2.6 billion of that total.

Meanwhile, social media advertising grew 37 percent to $9.5 billion, while digital audio advertising grew 42 percent to $603 million.

One of the ongoing industry questions is the extent to which Facebook and Google dominate the landscape. The IAB report doesn’t break out revenue for individual businesses, but it does look at “revenue concentration,” namely the percentage of revenue that went to the top 10 companies.

In the first six months of 2017, that concentration stood at 75 percent — the IAB says that over the past decade, the number fluctuates between 69 and 75 percent, so this is on the high end, but still within the historical range.

Outside the main report, the IAB has also been doing research into small and medium businesses, finding that of the 9 million SMBs in the U.S., 75 percent or more have spent money on advertising, with 80 percent using self-service platforms and 15 percent using programmatic advertising.

How does that fit into the bigger picture? IAB’s senior vice president of research and impact Chris Kuist said that while the team still needs to “dimensionalize” the data and find a systematic way to incorporate it into the report, the initial analysis suggests that much of the growth in digital ad spending is coming from small and local businesses, rather than the big Fortune 500 companies.

He also argued that this means that the growth isn’t just a “reshuffling” of ad spending, where money moves from offline ads to online ads. Instead, small businesses are serving as a “novel” source of ad revenue, taking advantage of the fact that the “barriers to entry have dropped’ with digital advertising.

This may also point to why many digital media businesses have been consolidating and cutting staff in the past year, despite the increased ad spending — if much of the growth is coming from small businesses using self-service tools from big platforms like Facebook and Google, it’s going to be tough for individual publishers to benefit.

Kuist said he can’t comment on the dynamics of any specific business, but he tried to paint the situation as one of opportunity.

“There is an engine of growth for the industry as a whole,” he said. “I think any individual company’s trajectory will help shape how successful they are at tapping into that. This is not me saying that every company needs to run out and become a self-service platform for SMBs. But as the broader economy evolves, there are opportunities for marketing to evolve and still play a very, very important role.”