Angus Pacala has had a lifelong passion for autonomous cars going all the way back to high school. A little more than a decade ago, he followed the launch of the DARPA Grand Challenge, a Department of Defense competition that pitted research teams against each other over who could build the best autonomous car. Stanford won the challenge in 2005, which is “one of the reasons I went there,” Pacala said.

His freshman year, he met Mark Frichtl, who was similarly interested in autonomous cars. The two took classes and worked on problem sets together, eventually working with each other at Quanergy, which Pacala had co-founded. Now, they are putting their collective talents together in a new venture called Ouster to bring affordable LiDAR sensors to the world.

Ouster today announced a $27 million series A fundraise led by Cox Enterprises, whose Cox Automotive division owns and offers a variety of auto services including the well-known Kelley Blue Book and AutoTrader.com.

Few areas of research are as important to the viability of fully autonomous cars as sensors — the actual physical hardware which evaluates the space around a vehicle and provides the raw data for machine learning algorithms to control the car without a human driver.

While visible light cameras, radar, and infrared sensors have been used by various engineering teams to build a physical map around a vehicle, the key component for nearly all autonomous car platforms is LiDAR. As Devin described on TechCrunch in an overview earlier this year, the technology, which has been around for decades, has become one of the key linchpins to successfully building L4 and L5 fully-autonomous vehicles.

There is just one challenge: essentially only one company makes the technology for production scale — Velodyne, which is based in the Valley. The company announced just a few weeks ago that it is quadrupling production of its main LiDAR product due to demand from autonomous car manufacturers. However, the prices for many of its sensors remain out-of-reach for most consumer applications, with some of the company’s most advanced sensors costing tens of thousands of dollars.

For Pacala, that price barrier has been a major challenge and ultimately gets at the mission of Ouster. “Our long term vision is to push LiDAR from being a research product to being in every consumer automobile,“ he said.

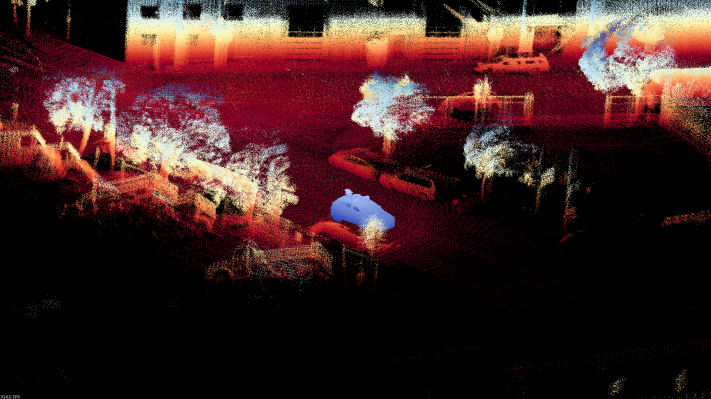

Ouster hopes that its first product, a 64-channel LiDAR sensor called OS1, which will be priced at $12,000, is that solution. The company says that the product is dramatically lighter, smaller, and uses less power than other competitors. It’s also shipping now.

Improving the performance of the sensor while also lowering its sticker price wasn’t a simple challenge. Pacala emphasized that technology wasn’t the entire solution. “While we can talk about the nitty-gritty of technology, the other side is not just the fundamental technology, but the design for manufacturability that really makes this lower cost while maintaining the performance” of the sensor.

That’s one of the reasons he chose the venture partners he did. “This isn’t just a typical list of Sand Hill investors. There is a time and place for those sort of investors, but we saw an opportunity to expand our reach by having investors who are much more attuned to the auto industry,” Pacala said. “VCs that are located in Detroit and who talk to OEMs day in and day out” had more to offer the company at this stage.

Ouster is setting an aggressive timeline to scale out its manufacturing. It intends to ramp up production heavily in the new year, targeting a thousand units a month in January and getting to ten thousand units a month by the end of June.

Certainly speed is of the essence. Venture capitalists around the world have been heavily funding automotive sensing technology over the past two years, including large rounds into Valley-based Luminar, Israel-based Oryx Vision, and China-based Hesai. But Pacala is sanguine about the company’s chances. “We have delivered first and then talked second, which is why you haven’t heard anything about us until now.” He hopes the heavy emphasis on getting manufacturing right early on will give him a lead in the race for your automobile.

In addition to Cox Enterprises, Fontinalis, Amity Ventures, Constellation Technology Ventures, Tao Capital Partners, and Carthona Capital also participated in the fundraise.