Coinbase has had a pretty crazy six months.

It may be hard to remember, but at the beginning of 2017 the cryptocurrency world was a different place. Bitcoin was below $1000 per coin and the entire market cap for all cryptocurrencies was about 7x less than it is today. Since then, the market has surged. And as arguably the most established wallet and exchange service that exists today, Coinbase has been in the right place at the right time to capitalize on the excitement in the industry.

So to support this growth Coinbase has raised $100M in Series D funding led by IVP, with participation from Spark Capital, Greylock Partners, Battery Ventures, Section 32 and Draper Associates. The funding gives the digital currency startup a post-money valuation of $1.6B.

While Coinbase had previously raised a total of $106M, it’s been two and a half years since their last raise – which was their $75M Series C round in early 2015. But it seems that the wait paid off, as the recent growth allowed the startup to nearly triple their valuation to $1.6B, from a rumored $500M in 2015.

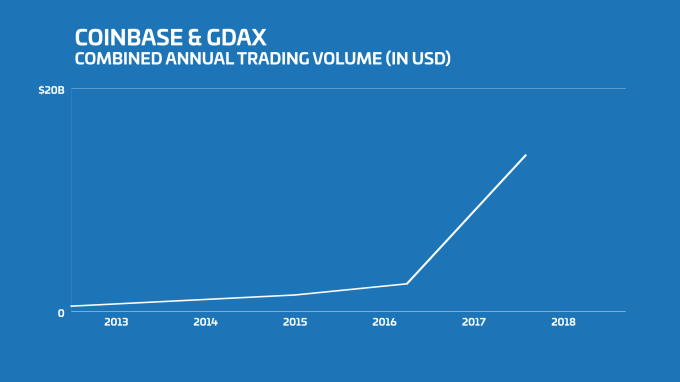

So just how explosive has this growth been?

Coinbase has facilitated almost $15B in digital currency exchange in just the first half of 2017, which is 5x more that was exchanged in the entirety of 2016. At this pace the startup may see a 10x increase in transaction volume from full-year 2016 to full-year 2017. The chart below helps put this growth in perspective.

And during this same six-month period the startup has also had a 4x increase in new customers signing up for the platform.

But of course with insane growth comes growing pains.

The exchange has experienced some downtime over the last few months, which they attributed to degraded performance related to “unprecedented volume”. Customer service response times have also been a big issue, but the company has acknowledged this and is working getting response times to below 6 hours by Q3 2017, and phone support for at least some percentage of the customer base by Q4. They also said that some of this new funding will support scaling customer support and engineering teams.

Of course there’s also been a lot of good. The exchanged added support for Ethereum in 2016 and Litecoin in 2017, and have been open about the fact they want to add many more cryptocurrencies in the future. And on the product front, GDAX recently added margin trading to appeal to professional traders, and Coinbase is planning on opening a GDAX office in New York City to continue building relationships with institutions and professional traders.

So what’s next for Coinbase? Besides the expected goals – like improving customer support and adding new cryptocurrencies when the market supports them, Brian Armstrong, cofounder and CEO of Coinbase, hinted that he sees the company beginning to transition into phase three of its “master plan” – which is described as building a consumer interface for digital currency apps that can potentially reach 100M people.

And he’s right – the next year or so will determine whether cryptocurrency breaks into the mainstream, aided by technology that helps make it accessible to the average consumer, or remains a relative niche within the technology and finance community.