Amid the ever-present specter of Amazon, Blue Apron reported its second-quarter earnings today — where it showed a mixed performance for Wall Street, but also some small much-needed improvements in certain metrics.

The biggest drag on the company was that it said it was paring back its marketing expenses between the first and second quarter, resulting in a 9% decrease in total customers when comparing the second and first quarter this year. Blue Apron saw its burn rise dramatically in the periods before its IPO as it sought to acquire as much of the market as it could in an increasingly competitive industry, and now it’s had to try to show that it can be something that’s wholly sustainable now that it appears very possible that Amazon will try to go after it.

“In the second quarter, we saw an 18 percent year-over-year increase in net revenue, and a $20.6 million improvement in our net loss between the first and second quarters. We recently strengthened our balance sheet as a result of our initial public offering, convertible note issuance and the expansion of our revolving credit facility,” CEO Matt Salzberg said in the earnings release. “We are beginning a new chapter as a public company, and remain focused on our long-term strategy to build an iconic consumer brand, develop a more diverse product portfolio, and further build out an end-to-end supply chain platform.”

But because of that decrease in its costs, the average amount of revenue that it brought in for each customer — of which there are around 943,000 — rose significantly. Each customer generated $251 in revenue for the company, which was still well below the performance the company was seeing in the second quarter last year. It is still a high in terms of customer value for the year thus far. The average order per customer, too, grew to 4.3 from 4.2 in the first quarter this year. The jump seems very incremental, but every bit of margin is critical for the company. The drop in net customers was due to a planned reduction of marketing of $26.1 million between the first and second quarter, the company said.

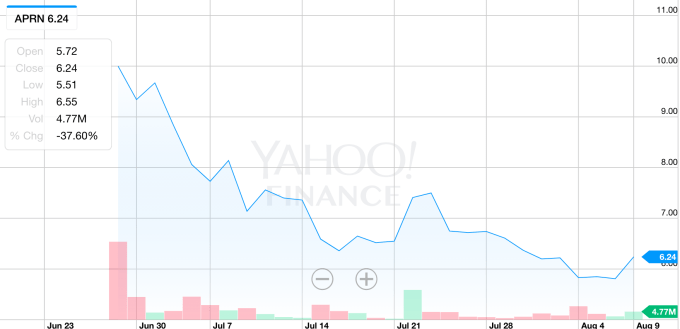

Following the report, shares of Blue Apron briefly jumped, though it looks like things have once again leveled out as Wall Street continues to temper its expectations for the company. The company brought in $238.1 million in revenue with a loss of 47 cents per share. It was a mixed result for Wall Street, which was looking for a loss of 30 cents per share on revenue of $235.8 million.

All of this is, once again, with respect to Amazon’s looming threat to its existence. Since the company filed to go public, evidence of Amazon’s plan to go after the meal-kit delivery space has trickled out slowly and has put significant pressure on Blue Apron. Its stock price has cratered from where it was when it first started the IPO process — during the middle of which Amazon announced that it would purchase Whole Foods for $13.7 billion. Since then, it’s been a drip-drip-drip of bad signals for Blue Apron, from registered trademarks to test launches.

And for good reason: Blue Apron, over the span of just a few years, exposed a market that’s worth at least $800 million, and Amazon is known to simply bulldoze its way into new markets that Jeff Bezos thinks are interesting and have potential. Since then, Blue Apron’s shares have done very poorly — down more than 30% since going public (and even worse when you consider where it originally priced).