The SaaS market in Brazil is booming. It mirrors the rapid adoption of SaaS as the dominant cloud computing type in a global public cloud services market that’s forecast to reach more than $122 billion in 2017, per research firm IDC. Earlier this year, we embarked on an inaugural survey of more than 400 executives of Brazil-based SaaS companies, the largest research project of its kind in the region.

Here is just one founding story of a Brazilian SaaS startup called RD Station that’s indicative of the growth and fast-changing landscape of the SaaS market in Latin America’s largest country as new VC and corporate venture investment in Brazil continues to rise:

Eric Santos launched his first SaaS startup in 2011 alongside co-founders André Siqueira, Bruno Ghisi, Pedro Bachiega and Guilherme Lopes. They set up a small office in Florianópolis, the capital of southern Brazil’s Santa Catarina state. The team entered a crowded space of marketing automation with a nimble, but strikingly simple SaaS platform. It featured a landing-page creator, a metrics dashboard and an email marketing platform. But they understood the challenges of the Brazilian marketer and gained initial traction through a blog and community meetups.

Business growth was slow in the beginning, but steady. It took the small team about two and a half years to reach the R$1 million (about US$300,000) in annual recurring revenues (ARR). To help accelerate its growth, the early-stage startup raised a Series A round in 2013.

Fast-forward to 2017: RD Station has expanded exponentially. It now offers a full-featured marketing automation platform. Its annual conference attracts 10,000 marketers to Florianópolis. Today, they’ve grown from a small, bootstrapped startup with just five founders to 450 employees and more than 9,000 customers in just six years. With this kind of growth, it attracted local investors such as DGF, Astella and Redpoint eventures. More recently, international VCs TPG Growth and Endeavor Catalyst have invested. The company’s total funding today is north of US$30 million and RD Station is growing more than 150 percent year-over-year, an impressive number as only one-third of Brazilian SaaS startups achieve this kind of growth at this stage, per our research study.

A familiar tale for SaaS founders in Brazil

Many Brazilian SaaS entrepreneurs share a similar story. The local market is growing at an accelerated pace. Every other week, we’re seeing new local and foreign VCs investing. Brazil is the fifth-largest internet and mobile economy in the world, and one of the primary international markets for juggernauts such as Google and Facebook. Like the evolution of the internet in the U.S., businesses in Brazil are increasingly online and seeking SaaS solutions.

Brazil is the fifth-largest internet and mobile economy in the world.

According to Manoel Lemos, a managing director of VC firm Redpoint eventures, SaaS is now a sizable opportunity for Brazilian startups. Lemos is seeing a trend of more experienced, high-quality entrepreneurs, leaving companies such as Salesforce and LinkedIn in Brazil to start their first businesses. While Brazil is still only scratching the surface to breed global SaaS players of the likes of Salesforce or Zendesk, companies like RD Station are scaling quickly across Brazil and starting to set their sights on global markets.

Enter Brazil’s first robust SaaS market landscape

In May 2017, with support from Signal Hill and Redpoint eventures, we surveyed 597 Brazil-based SaaS founders (49 percent CEOs) to launch the inaugural version of our survey, called “The Brazil SaaS Landscape 2017.” It is important to note that the Brazil SaaS market is relatively new. Out of the companies polled in the survey, 71 percent were founded after 2010. In this research, we analyzed data about funding, employee strength, revenues, retention rates and growth rates of SaaS startups in Brazil. Here are some of the most interesting things we learned.

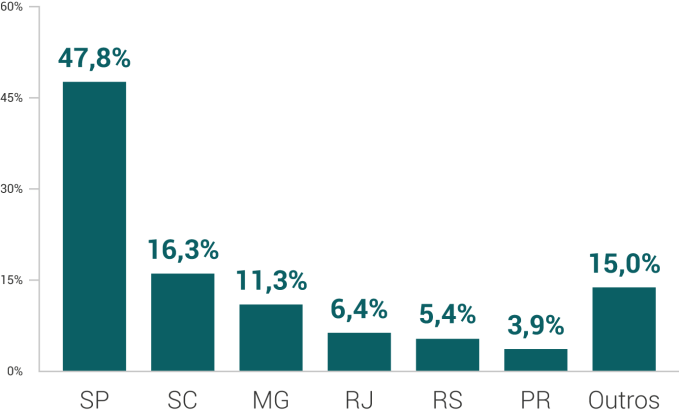

São Paulo is the SaaS capital of Brazil, followed by Santa Catarina and Minas Gerais

Almost 50 percent of SaaS startups are based in São Paulo, and 41 percent of total startups that surpassed R$1 million in ARR are based there. Santa Catarina takes second place for fast-paced growth. According to Diego Wagner, founder of Meetime, an inside-sales platform, Santa Catarina’s SaaS community is growing fast thanks to startup founders and employees giving back to the community with workshops, angel investments and mentoring.

Minas Gerais, a large inland state in southeastern Brazil, clocked in at third-fastest for SaaS company growth. According to Drew Beaurline, founder of Construct, an issue-tracking and communications app for construction companies, the local SaaS community there is fueled by government-funded programs such as the SEED startup accelerator.

“As a budding entrepreneur with zero capital, I was amazed I could contract a senior developer for a fraction of the cost it would take in San Francisco,” says Beaurline. “Plus, there were many more equity-free accelerator programs funded by the government.” Drew, who moved from California to Belo Horizonte, noted that Google’s first acquisition outside of the U.S. was in Akwan, a company based in Belo Horizonte.

Brazilian SaaS startups by state

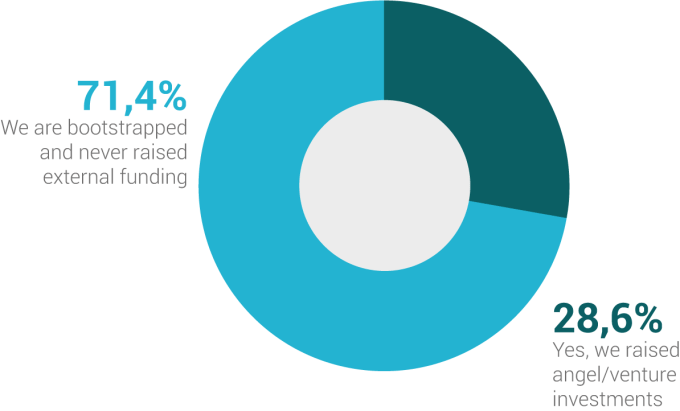

Brazilian SaaS startups are mostly bootstrapped, but VC investment is growing

We were surprised to find that more than 71 percent of Brazilian SaaS businesses of those surveyed are self-funded with no outside investors. Take Superlógica as an example: The company provides recurring billing software and the founders bootstrapped it, growing it to 5,000 customers and more than 130 employees. Superlógica grew more than 100 percent in 2016, and plans triple its revenue with the launch of its own payment service, according to its chief growth officer, Carlos Moura.

Of those who raised capital, only 10 percent of SaaS founders raised more than R$10 million (about US$3 million). Most investment in SaaS has come from VC firms based in Brazil. Funds such as Ebricks (Contabilizei, ERPFlex), Monashees+ (Conta Azul, RunRun.it) and Redpoint eventures (Gympass, Olist, Pismo), are making investment bets in the SaaS space. Regarding valuations, the median multiple for SaaS rounds to date is roughly six times ARR.

Brazilian SaaS startups funding

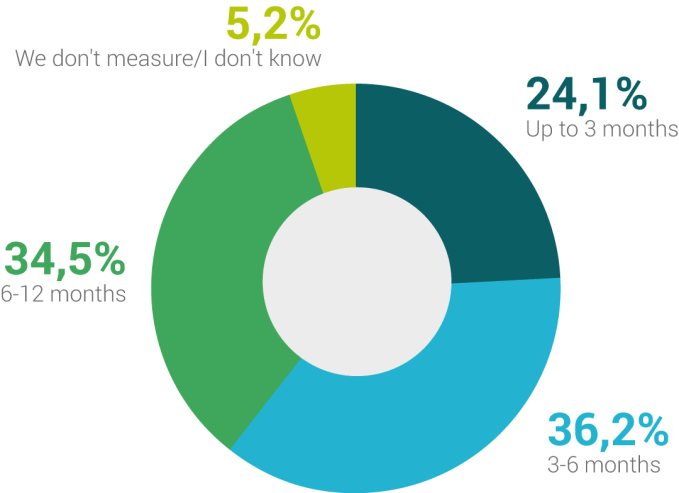

Brazilian SaaS startups are incredibly capital-efficient

If you look at public, mature SaaS businesses in the U.S., many of them take more than 12 months to recover customer-acquisition costs. In Brazil, this is not true. Taking a deep look into the survey data, we can see that Brazilian startups are more like mountain goats (or cockroaches) than unicorns: they are not magical, but they are reliable and resilient. More than 60 percent of startups surveyed recover their customer-acquisition costs (CAC) in less than six months. They have healthy unit economics: 67 percent of them have a LTV/CAC ratio superior to three, a feat that would make David Skok proud.

This enables them to survive and thrive in case of even tighter funding markets. We wonder if a change in the funding market, making more capital available to those companies, wouldn’t transform our goats into magical beings.

Time to recover CAC for Brazilian SaaS companies

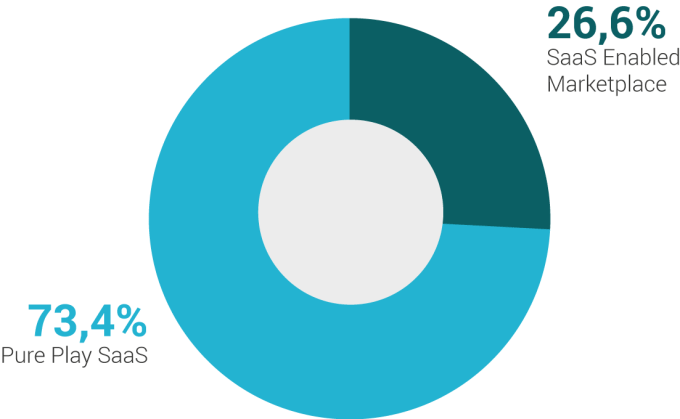

The SaaS-enabled marketplace is happening in Brazil, too

More than a quarter (26 percent) of the companies surveyed have a marketplace component baked into their offerings. Companies like Gympass have attached marketplace components to SaaS products and seem to be succeeding. According to Manoel Lemos, having a marketplace component helps companies create barriers to entry from foreign competition and produces a network advantage.

On the other hand, in our extensive research, we did not find any correlation with a marketplace component driving growth rates or business success across the 597 startups surveyed.

Brazilian SaaS-enabled marketplaces

Big Brazil SaaS market with its own distinctive twist

With a population of more than 211 million people, there are many potential customers to sell to, and SaaS startups are highly focused on Brazil first. SaaS products from Brazil are not clones of ones from the U.S. They mostly adapt to the local tastes and address the many government bureaucracies. Contabilizei, for example, focuses on helping small businesses manage accounting. Because all Brazilian companies are obliged by law to have an accountant, Contabilizei replaces the external accountant. When SaaS companies do expand outside Brazil, they tend to focus on other regions in Latin America first, due to proximity and lower competition.

Inspiring a new wave of SaaS entrepreneurs

“One of our key learnings is that hiring the right people is the most important thing to succeed as a SaaS company,” says Guilherme Lopes, one RD Station’s co-founders. “We were lucky to assemble such a talented and committed team that’s willing to learn the best practices and overcome the challenges that a SaaS startup faces in an emerging market like Brazil. When we started, there weren’t a lot of local benchmarks or data about the Brazilian market. We were always crazy about metrics and quite meticulous about digging into U.S.-based data and research to help guide us. But, we never knew how we compared to peers. I guess we did fine without it, but I’m glad about having in-depth data on other Brazilian SaaS companies to better understand our market dynamics.”

If you want to learn more about other founders’ stories like these and how the Brazilian SaaS landscape is evolving, check out the full research report here.