Due to a challenging regulatory environment and high switching costs associated with getting consumers to change banks, few startups try to compete with the big incumbent financial institutions head-on.

But Varo Money, which provides a mobile-first banking product to consumers, is up to that challenge. In an effort to offer similar — but better — checking, savings and lending products to consumers, the company has applied for a national bank charter with the Office of the Comptroller of the Currency.

Varo Money was founded in 2015 by Colin Walsh, who spent 25 years working for incumbent financial institutions like American Express and Wells Fargo before deciding to launch a banking product for a new generation of consumers.

To get the company off the ground, Walsh raised $27 million from Warburg Pincus and spent the last two years creating a mobile-first competitor to existing checking accounts. Released last month, Varo’s mobile app provides a new way of thinking about how consumers should manage their money.

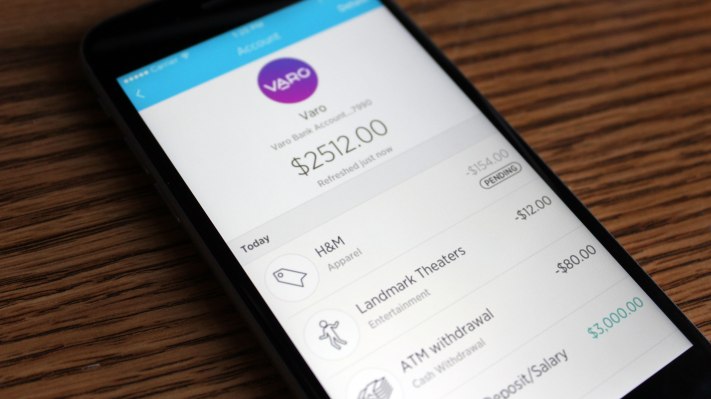

Varo provides everything you’d want from a traditional checking account, including direct deposit, online bill pay and a debit card. But unlike traditional banks, Varo is built to be consumer-friendly, doing away overdraft fees, minimum balance fees and ATM fees that most financial institutions rely on.

That is not an entirely new idea — after all, banking products like Simple have launched with similar features. What sets Varo apart is how it connects with consumers’ other bank and credit card accounts to provide a fuller picture of their financial lives.

Through its app, users can manage their cash flow and track their spending across all their savings and credit card accounts, not just their Varo account. The company has also launched a lending product to enable users to take out personal loans that can help them get out of high-interest credit card debt.

Varo Money launched their app and banking product last month through a partnership with The Bancorp Bank, which is the same banking partner that Simple used when it launched. By doing so, it is able to come to market with an FDIC-insured product to compete against the incumbent banks.

But the company has bigger ambitions, and hopes to become a bank itself. As a result, it has applied for a national bank charter through the OCC. In doing so, Varo is joining online lender SoFi in the vanguard of Silicon Valley startups hoping to get licensed so they can offer many of the same products as big financial institutions like Wells Fargo or Chase.

Last month, SoFi filed an application for an industrial bank charter in Utah that would enable it to move beyond student loan financing, mortgages and personal loans to offer online banking services. The application came a few months after the company bought online banking startup Zenbanx, which SoFi plans to use as the underlying tech stack of the new suite of products.

Both SoFi and Varo Money will face an uphill battle, as there haven’t really been any new bank charters issued in the last decade. In Varo’s case, it has to prove not only that it has the right financial and technical team in place but also that it is financed well enough to meet regulators’ requirements. (SoFi, by contrast, has raised $1.9 billion in financing and claims to be profitable.)

“It’s not a fait accompli,” Walsh admitted. He noted that conversations with regulators began last year and that they’ve shown interest in what the company is doing. “They were much more receptive than I had anticipated,” he said.

With the vision of becoming a national, mobile-first bank, it’s a step the company knew it had to take. A lot has to happen in the meantime, however: Varo has to attract users to its existing product, it has to raise a bunch more money, and it has to hope (fingers crossed) that regulators are open to once again allowing new banks to be formed.