There are a lot of headlines today about tech getting a slap in the face on Wall Street — particularly Apple which is down more than 3%. These guys are actually down only a few percentage points but for the largest companies in the world, that translates to billions of dollars.

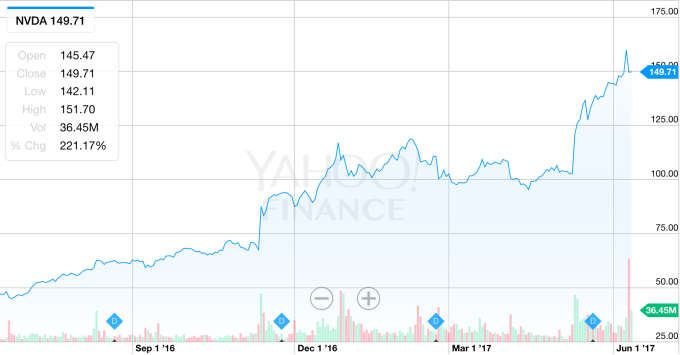

But while we wring our hands around a bit of a sell-off today in some of the largest companies in the world, here’s a not-so-subtle reminder that there’s at least another company that’s decided to go on a rapid rise in the past two years:

That’s Nvidia, a stock that might as well be in the FANG acronym at this point as a major growth stock (that’s Facebook, Amazon, Netflix and Google). Nvidia’s been on a complete tear in the past couple months (and the past few years) thanks to its major presence of the market for GPU technology, which stumbled into a critical component of machine learning technology. Instead of normal CPUs, Nvidia’s windfall has been the wild demand for technology that can support emerging products like self-driving cars, image recognition and natural language processing.

Not surprisingly, Nvidia’s income more than doubled year-over-year when the company last reported its financial guts in May. Major car companies looking to power their self-driving efforts are going to need this kind of hardware. The larger companies like Google are working on their own kinds of hardware to power machine learning, but Nvidia for now can at least enjoy a head start and power the rest of the world for now.

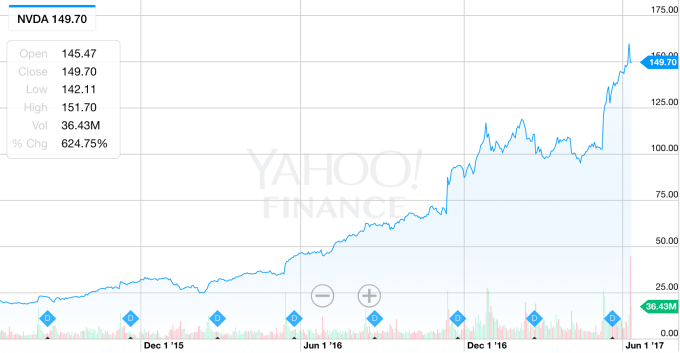

Let’s also wind the clock back just a little further to two years:

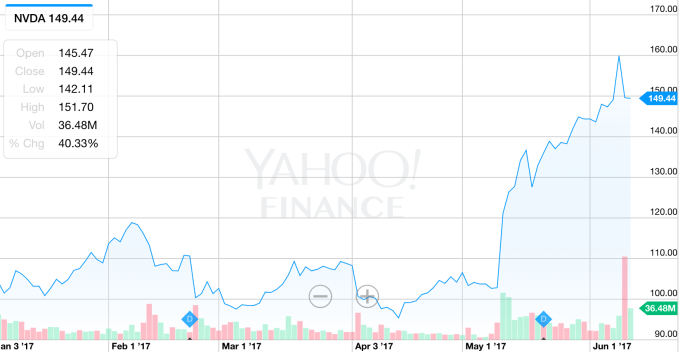

Nvidia’s not down today, either — it’s flat. And here’s what it looks like since CES, which it held a massive keynote that included everything from self-driving cars to a demo of the wildly mediocrely-received Mass Effect: Andromeda. The Nintendo Switch also came out during this period, which you still probably can’t find a place to purchase right now:

Nvidia was more or less the star of CES amid a flurry of pressure on companies to start deploying increasingly complex machine learning algorithms. While there will still be plenty of demand for better gaming technology, nearly every major company in the world will be in a race against the other to show they have some kind of competitive edge — either in a voice assistant or a startup looking to power some new kind of technology with a massive pile of data.

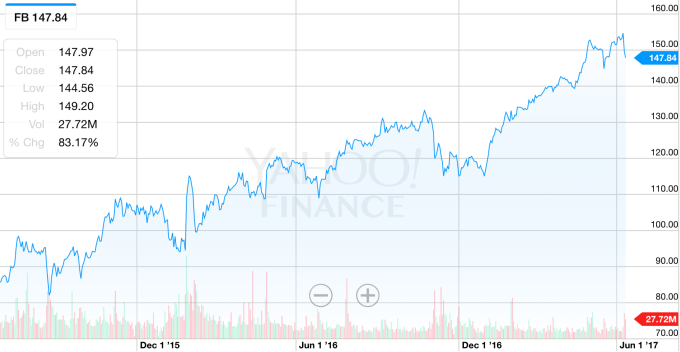

For the sake of the rest of things, here’s Facebook in the last two years:

Anyway, happy lame stock day folks. Not everything is awful. Onwards and upwards.

(Charts via Yahoo Finance)