A little more than six months ago, Vault took to the Disrupt Battlefield stage to introduce automated investment accounts small and medium-sized business owners could offer to their employees. Today the company is launching a set of mobile apps and expanding its investment offerings to allow any independent contractor to easily start saving for retirement.

The company was founded on the idea of allowing any business to be able to offer retirement benefits. Those plans cost $10 per employee per month, which was a small price to pay for businesses to offer a new perk to their employees.

But shortly after launch, Vault founder Randy Fernando realized the company could serve a lot more people by going directly to contract workers who might not have access to employee-offered plans. There are 54 million people in the U.S. who work independently in one form or another, and many of those people probably aren’t setting aside enough for retirement.

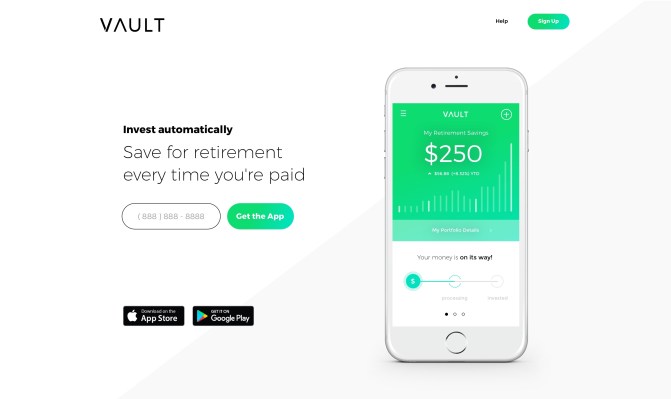

Designed for freelance contractors who might not have steady or reliable income flows, Vault’s new products help simplify the process of putting aside a percentage of each paycheck. Users simply connect their bank accounts to Vault, tell the service what percentage they’d like to put aside for retirement, and Vault does the hard work of saving for them.

Users can choose between SEP IRA, Roth IRA or traditional IRA accounts, and once set up, Vault recognizes when income comes in and moves the designated amount of money into a retirement account. Instead of just putting money into one or a series of investment funds, Vault auto-rebalances and optimizes portfolio construction for retirement based on a series of different factors.

Vault is designed to lower the cost of creating a retirement account for those who most need to save. It costs just $1 a month for customers just getting started, or a fee of 0.25 percent for customers who have more than $5,000 under management. It also ensures that all funds it invests in charge low fees, usually between 0.03 and 0.09 percent, according to Fernando.

While expanding its business to include anyone who has 1099 income, the company also is launching iOS and Android mobile apps to make it easier for customers to manage their accounts and keep track of their retirement savings progress. Releasing those apps should also have the side benefit of helping to find new customers through mobile distribution channels, as opposed to just online through its desktop site.