The whole on-demand space has faced a lot of scrutiny in the past few years as questions about whether they are viable businesses balloon and the periodic down round leaks out. Then Instacart raised a massive round at a $3.4 billion valuation, and while the terms aren’t exactly clear, the funding environment for that space may be softening a bit.

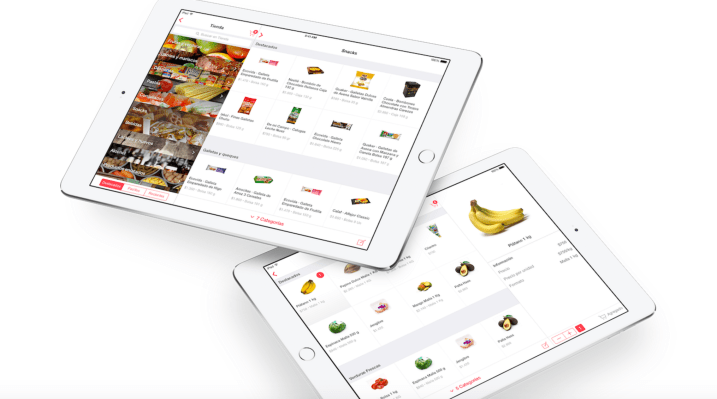

That’s offered an opportunity for new companies to start to attract attention like Cornershop, a grocery-delivery app that operates in Chile and Mexico. The company raised $21 million in a financing round led by Accel as it starts to expand in that market — and potentially get ahead of looming competitors like Instacart. To a certain extent, however, CEO Oskar Hjertonsson may have Instacart’s up round to thank for some enthusiasm in the space as the model starts to creep abroad.

“The longer answer is that I think Instacart can build a profitable business in the US, as can we down here,” Hjertonsson said. “I think the general notion that ‘this and that service can’t exist’ is the wrong way of looking at it. I think it’s more a question of how to model the service for each market, including the positioning in terms of price/value, to build a business that makes sense for each market.”

Like Instacart, Cornershop works with shoppers to track down products in stores and then deliver them in 90 minutes or less. So the whole business may not seem all that unfamiliar to observers in the U.S. and abroad. However, that model since Instacart raised its last round of financing has shown that it can be plenty challenging. Indian ride-sharing operator Ola shut down its grocery delivery service, while Amazon and Google Express have more robust coffers to continue expanding and experimenting on the model.

Still, there may be an opportunity abroad, and that’s part of what attracted Accel to the financing round, Accel partner Andrew Braccia said. “Instacart’s recent growth is another positive data point that we’re reaching an inflection point in the shift of consumer purchase dollars online not just here, but in large international markets as well,” Braccia said. “They’ve demonstrated the patience and domain expertise required to tackle the opportunity before them in Latin America.”

Hjertonsson said he announced the round internally with a temporary hiring freeze (which was more symbolic than anything) to explain to the team that the pieces were already in pace to grow, and that the company didn’t want to go crazy with the new funding.Of course, growth is still going to come in the next months as it expands to regions. And for a business like Cornershop, a lot of the growth is going to have to come from methodical expansion from region to region and with future partners.

“I think it’s a market where the early lead easily ends up in a position where it’s easy to stay on top, I don’t spend much time thinking about competitors,” Hjertonsson said. “Our primary competitors are curiously also some of the stores from where we source. Walmart owned Superama in Mexico and the leading grocer Jumbo in Chile are our largest competitors.”