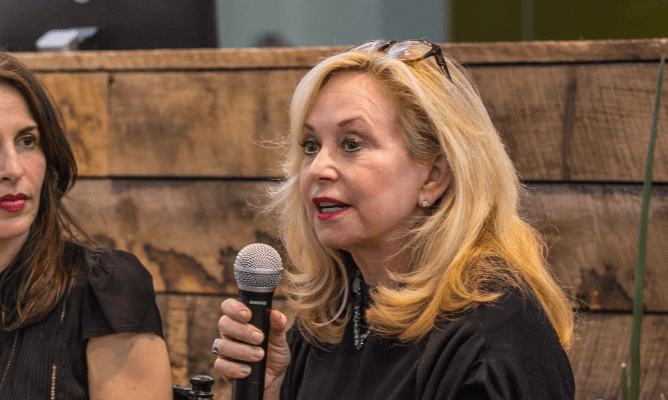

At an event in San Francisco last night I sat down with The RealReal founder and CEO Julie Wainwright, who is renowned in startup circles for a variety of things, including her role in winding down the e-commerce company Pets.com during the dot.com era; being one of the bigger personalities in the industry; and launching what’s become one of the fastest-growing consignment startups among a handful that received funding roughly six years ago.

Some no longer exist. The RealReal has meanwhile garnered $123 million in venture funding and says it’s on track to see $500 million in gross merchandise value this year — nearly half of it through the company’s mobile app.

She attributed that success so far to zeroing in on the luxury market, taking possession of consigners’ products and focusing on trust above all else, by ensuring that every item that The RealReal sells to a customer has been inspected and authenticated before it gets shipped out the door. She also said the company is weighing a strategy of opening a series of brick-and-mortar stores, starting first with one New York location that’s currently in the works.

Excerpts from our sit-down, edited for length and clarity, follow:

TC: You’ve raised a lot of money, including a $40 million Series E round last year, but you’re also very much in growth mode. For the VCs in the audience: might you raise another round anytime soon?

JW: No. We’re good for a while.

TC: You started with apparel, but you sold $100 million in watches and fine jewelry last year. Is that now your best-selling category?

JW: The reason we went into jewelry was we were trying to cater to our consigner base, who was saying, “Can you sell this for me? Can you sell that?” And we said, “You can bring in your jewelry and watches; we have a gemology and a watch expert on site.” And it just exploded our business.

TC: You’re talking about valuation offices, which you’ve been launching across the U.S. over the last 18 months. You and I talked about these recently, but they seem to be underreported.

JW: It’s true. We did a little test in Midtown [in New York] around 18 months ago. We now have six offices across the U.S. and soon to be seven. We wanted people to comparison shop because we know you make two-and-a-half to three times more money if you sell your fine jewelry to us. We also wanted to remove any friction. [Jewelry consignment] is sort of weird space. If you’ve ever tried to sell jewelry to anyone else, it’s a pawn shop environment; it’s a little gross. So we wanted to bring the whole process up front, have a discussion with people, and have it be transparent and respectful.

TC: Back to your best-selling items . . .

JW: For men, it’s Rolex. For women, there are three across all age groups: Chanel, Hermes and Louis Vuitton.

TC: Meaning clothing or jewelry or both?

JW: Apparel is our number-one product in unit and dollars.

TC: Are men buying or selling on The RealReal? What’s the gender breakdown?

JW: We actually don’t get enough men’s consignment, so it sells through faster. Twenty percent of our shoppers are men who are shopping for themselves. They’re buying watches, primarily, and leather goods, but also apparel. Their average order size is smaller, but you men [in the audience] don’t like to return things, despite that we have a return policy. So that’s good; it all evens out. [Laughs.]

TC: What percentage of shoppers are also consigning items?

JW: We have about four buyers for every consigner, and half of our consigners buy.

TC: How do you ensure then that you have a constant flow of goods? We sat down a few years ago and you mentioned that summer is particularly tricky because your consigners are on vacation.

JW: We do a lot of lead generation that drives people to the site. We have sales people in the field who will go and clean out closets, including in the Hamptons. Also, demand isn’t that great in the summer, so it balances out. Things slow down around the third week of June. In the middle of August, it goes crazy again.

TC: Shipping takes a week. Is there a way to speed that up?

JW: At some point we’ll designate that certain items will arrive faster or we’ll say, if you want items today, here’s your selection [of things to choose from]. Hopefully, by the fall, if you’re in New York and you order from our New Jersey warehouse, you can get your item the same day.

TC: What about the company’s demographics? Is it all over the map?

JW: A third of our buyer base is millennials. And they still buy Hermes, Chanel, Louis Vuitton, but after that [as they age] it’s a lot of Gucci, Saint Laurent, Céline. We’ve been able to track brands by age and I’ve met with all the top brands and I tell them that I’m the gateway drug for their brands, and some are in trouble.

TC: Such as?

JW: Dolce is in trouble. We pick it up from people over 40 [years of age] and sell it to people over 50. There’s a whole disconnect with its advertising and they know it. They aren’t reaching millennials at all.

We can also predict trends. If we get a lot of [a particular kind of inventory], it isn’t good for the brand and we have to drop the prices. We don’t give out raw numbers, but women in the audience, I can tell you right now, if you have Valentino Rockstuds, hand ’em over, because the party is over.

TC: How much do items sell for on average?

JW: We don’t give that out, but Net-a-Porter just announced that its average basket is $430, and ours is bigger. The highest sale we’ve had is $100,000, and we’ve done it a couple of times.

TC: What sold for $100,000?

JW: This is good. From one of our valuation offices, a Saudi princess consigned a Van Cleef & Arpels diamond cuff that retails for $250,000. Four days later, we sold it to another Saudi princess on the other side of the U.S for $100,000. That flew, but we do sell $30,000, $40,000 and $50,000 items on a regular basis.

TC: Are most people buying one item at a time? And what percentage are recurrent shoppers?

JW: They’ve buying almost two items on average, and they’re buying often. We don’t give out the number of recurrent buyers, but it’s a high number.

TC: How much of your business is coming through mobile versus the desktop?

JW: Three years ago, on every panel I sat on, the refrain was, “Apps are dead.” Well, our app generated about $100 million in GMV this year and it accounts for the majority of visits to the site. It’s still not half our sales, but it’s getting there.

TC: What’s on the roadmap?

JW: We now have about 75 people who are gemologists, watch experts, art curators or brand authenticators and in December, we decided to put a handful of them into a pop-up store in [New York’s] Soho for two weeks to showcase merchandise leading in to the holidays. We did more than $2 million in revenue. Half the shoppers were new to The RealReal. Some had heard of us but they hadn’t shopped because they didn’t understand the quality. So now we’re opening our first real store in Soho. It’ll have a valuation office, but it will really be selling.

When you have 100 Birkins on the wall and people have never seen that — even at Hermes — they tend to call their friends.

TC: Will you open another in San Francisco?

JW: If that works, we’ll do a few of them. But we’ll start with one.

TC: A lot of high-end boutiques like Louis Vuitton never discount their items; is there room for partnerships? [Editor’s note: this was actually an attendee’s smart question.]

JW: We’re in conversations with them. A key tenet of what we do is sustainability; we’re a circular economy company and brands are starting to understand that if something has a resell value, someone will pay more for new (knowing they can sell later), so we’re a value add.

LMVH group, too is taking sustainability seriously. While they destroy product, they’re conscious that it’s not a cool thing to do and there might be a partnership in the future because they like the circulation [economy]. I tell them: My consigners are your buyers. I’m paying them out hundreds of millions of dollars, and they’re taking that money, and they’re buying new products that they know have a high resell value. So at some point [these brands] will come around.

Photo: Dani Padgett