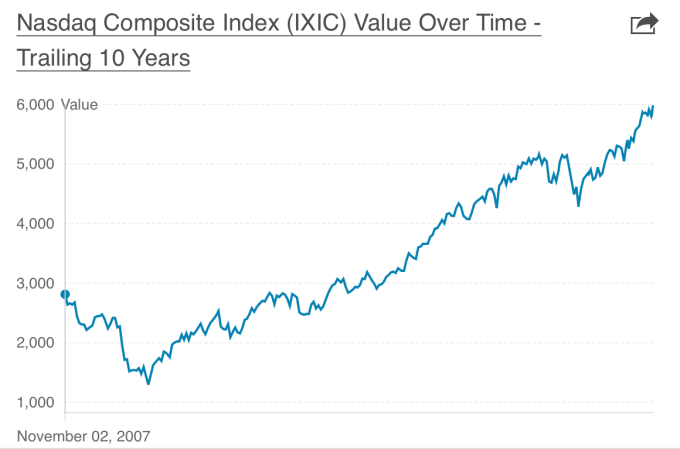

The Nasdaq composite just passed 6000 for the first time, hitting an all-time intraday high in the process. Over the past 12 months the composite is up nearly 32%.

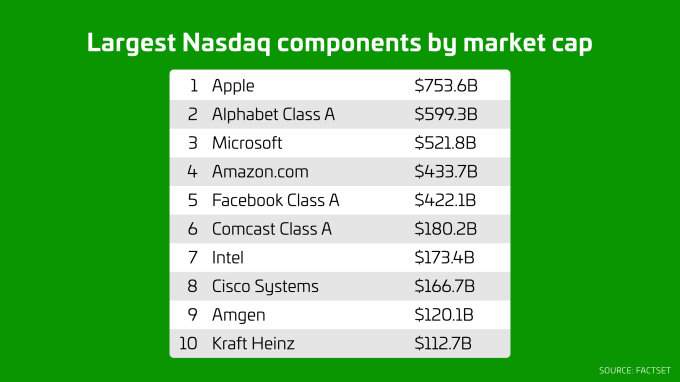

The majority of this strong performance can be attributed to five technology stocks that have also been surging – Apple, Facebook, Amazon, Microsoft and Alphabet account for about 40% of the composite’s gains in 2017.

All of these stocks have hit all-time highs at some point in the last 6 months, and most of them have again reached new highs over the last few weeks.

Of course the stock market in general has also been on a tear recently – the S&P 500 is up 20% over the last year, and the Russell 200 is up 30% over the past year. While its hard to pinpoint exactly what is causing this bull rally, many attribute it towards positive sentiment regarding future corporate tax reform from the White House, as well as generally strong earnings from tech companies over the past few quarters.

Not surprisingly, these five tech companies are also the top five largest components of the NASDAQ by market cap, with the 6th largest being worth almost $250 billion less than Facebook, which is currently the 5th largest.

As a refresher, the Nasdaq composite is an index of all the stocks that currently trade on the NASDAQ. The index is weighted by market cap, meaning bigger companies have a bigger impact on the overall index.

All five above mentioned companies report earnings over the next week or so, meaning this strong growth may continue if they can meet or beat analyst expectations for the last quarter.