Done betting, Alibaba is getting down to work in Southeast Asia as it bids to lead the region’s promising e-commerce space and maximize its early mover advantage over Amazon.

Alibaba became the first major international player to enter Southeast Asia, a region with more than 600 million cumulative consumers, when it bought a majority stake in Lazada, the Rocket Internet-backed venture, nearly one year ago. Amazon, Alibaba’s key foe in India, is still to make its move, having pushed back a planned Q1 2017 entry to later this year.

If the Lazada deal was a test of the water, then Alibaba is now ready to get soaked. Two smaller (but notable) developments this week show it is executing on a plan to build out a strong presence in Southeast Asia, where e-commerce is forecast to reach $88 billion by 2025, according to a 2016 report co-authored by Google.

Removing barriers, opening doors to China

Alibaba Executive Chairman Jack Ma has spent the past year hobnobbing with a range of heads of state across the region’s key countries, including Singapore, Thailand and Indonesia. This week, Ma’s dabbling in politics bore its first fruit as Malaysia’s government partnered with his e-commerce firm — and its affiliates Cainiao (logistics), Ant Financial (fintech) and Lazada — to launch a series of initiatives aimed at easing red tape and barriers around cross-border e-commerce in the country. (Malaysia’s government appointed Ma as an economic advisor last November.)

Alibaba stressed that the planned e-fulfillment hub, a physical location to handle inbound and outbound deliveries, and other aspects of the initiative — which it calls eWTP or Electronic World Trade Platform — will benefit anyone who sells online in Malaysia, not just Alibaba. Malaysia’s zone will be linked to an existing zone in Hangzhou, Alibaba’s homestead, to enable freer exchange of goods between Malaysia and China and open up economic and social opportunities, Alibaba said.

But the firm’s central involvement — it may also invest in a financial capacity — is proof that the project is very much strategic to Alibaba’s aim of connecting Southeast Asia with China.

Malaysian Prime Minister Najib Razak, Alibaba CEO Ma and Lazada CEO Max Bittner were among the many attendees at the free trade zone event in Kuala Lumpur, Malaysia

On home-turf it has hundreds of thousands of sellers operating across its Taobao marketplace and other services. Taobao is already embedded in many parts of the country — more than 1,000 so-called “Taobao Villages” have relied on the service to stimulate financial regeneration — and it could increase its audience further still through more direct links in Southeast Asia.

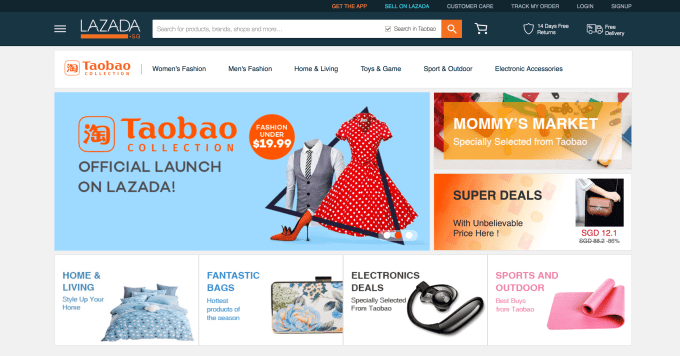

But Alibaba isn’t waiting around for initiatives like that in Malaysia to get off the ground, it is already forging opportunities for Taobao in Southeast Asia. This week, it bridged Taobao with Lazada through a new feature that debuted in Singapore. Lazada Singapore is boosting its existing catalog of five million products with the addition of 400,000 listings that have been selected from Taobao.

Alibaba offers a selection of Chinese products through Aliexpress, an internationally focused e-commerce site, but “Taobao Collection” is focused on a single market — in this case Singapore — and dedicated to solving some of the recurring problems of selling overseas from China.

“We want to solve those difficulties, enabling an effortless way for them to shop. Now it’s all translated into English and you don’t have to worry about shipping options, payment method, returning. You are going to be able to track your order end-to-end,” Lazada Singapore head Alexis Lanternier told Bloomberg.

Viewed separately, the Malaysia project and Taobao Selection are interesting developments, but, occurring in the same week, they reveal much of the blueprint that Alibaba has for fully optimizing its presence in key countries in Southeast Asia:

- Smooth the inefficiencies of cross-bordering trading — ideally hand-in-hand with the local government

- Open the doors to link local Lazada country businesses with Taobao sellers in China

The new Taobao Collection on Lazada Singapore

Completing the Lazada acquisition

These moves also come at an interesting time for Lazada-Alibaba.

Under the terms of the deal announced last April, Alibaba has until May this year to consummate the acquisition by purchasing the remaining shares in Lazada, TechCrunch has come to understand.

The initial acquisition gave Lazada a valuation of $1.5 billion, fairly generous given loses were spiralling and the business had run out of cash, but it remains to be seen what value the final purchase of shares will be made at.

One well-placed insider told TechCrunch that he expects the $1.5 billion valuation to hold and remain the price at which Alibaba completes the full acquisition. But anything could happen.

Alibaba’s announcements this week come at the same time that we reported that Amazon had postponed its much-anticipated entry into Southeast Asia. Last year, we revealed that the U.S. giant was working to launch in Singapore, its first market in the region, during Q1 2017. With that window almost up, we learned that the time frame had shifted to “later this year.”

Some elements of the required groundwork have taken longer than first expected, but the delay may also be related to other strategies Amazon is pursuing across the world. This week, it agreed to buy Middle East-based Souq.com for $650 million, ending months of ongoing negotiations, while media in Australia have reported that it has hired more than 100 people ahead of an imminent local launch in the country.

Amazon is already battling with Alibaba in India, where the Chinese firm invested in Paytm as its chosen proxy, and Alibaba is steeling itself for further brawl, this time in Southeast Asia.