Traders who have an idea for a money-making algorithm have two choices: learn to code themselves, or hire a great engineer. But neither of these two options are realistic, especially for part-time traders who don’t have a large bankroll behind them.

Meet Algoriz, a startup participating in Y Combinator’s Winter 2017 batch. Soraya Taghavi, founder and CEO of Algoriz, previously worked in trading at Goldman Sachs, where she noticed a disconnect between traders with ideas and people actually able to code technical trading algorithms. So she created a platform that lets any trader write algorithms in plain English.

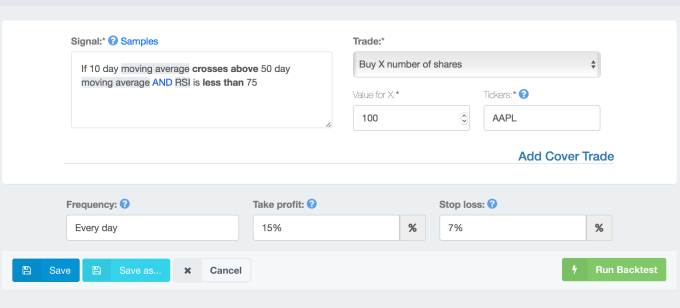

Here’s how it works: To create an algorithm you could write “If SNAP is up 3% from yesterday, and the S&P is down, sell 100 shares of SNAP.” The platform also supports more complicated technical indicators, like Bollinger Bands, exponential moving averages and moving average convergence divergence.

You also can specify things like when to take a profit or the maximum percent loss you’re willing to take. Algoriz takes these inputs and coverts them behind the scenes into a working algorithm that runs 24/7 on the startup’s platform.

You can then back-test the algorithm using historical data to see how it would have performed, or push it live.

Algoriz plans to build in brokerage functionality to let your algorithms actually initiate trades whenever your specified parameters are met — but for now, it sends you an email notification, meaning you’ll have to actually make the trade yourself. Once this functionality is built in, they’ll charge users who choose to use other brokerage firms, but the platform will remain free for users who use Algoriz as their broker.

Algoriz wants to expand into a marketplace that can connect people with capital with successful traders who have created profitable algorithms on the platform. Algoriz also plans to broaden the type of supported securities beyond equities, so users can create algorithms to trade things like currency and futures.