Amazon Prime has driven growth for the e-commerce company for years now. But Amazon has traditionally been cagey about disclosing too many details regarding the popular service. In a 10-K filing summarizing performance throughout 2016, the business did something that drew the attention of Wall Street analysts. It designated a category entitled “retail subscription services” that refers, in part, to Prime.

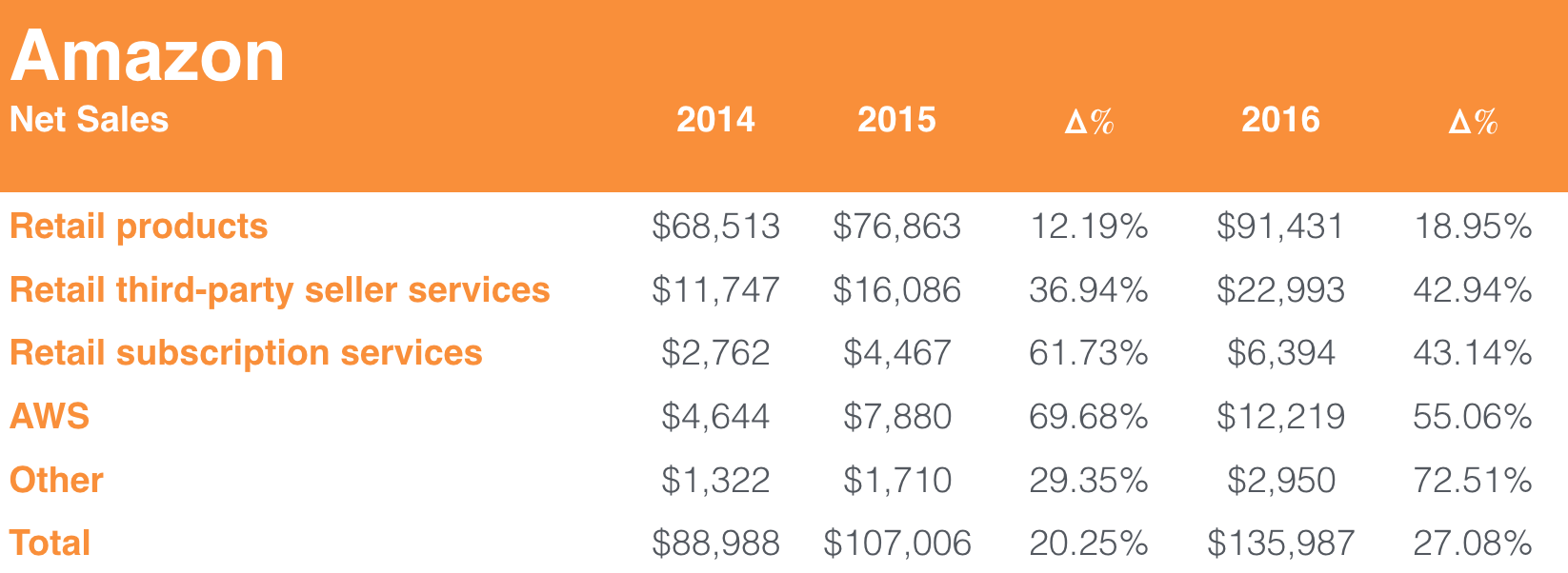

For 2016, Amazon reported almost $6.4 billion in sales from retail subscription services. To put that in perspective, Prime sales alone surpass the entire e-commerce sales of Macy’s, The Home Depot and Best Buy. That figure represents 43 percent growth over last year’s ~$4.5 billion. Prime’s enthusiastic growth gives AWS, Amazon’s favorite child and source of Wall Street optimism, a run for its money — that’s no small feat.

The number that everyone wants to pull from the sales reported is total Prime customers. Amazon notes in its filing that its retail subscription services category broadly includes, “annual and monthly fees associated with Amazon Prime membership, as well as audiobook, e-book, digital video, digital music, and other subscription services.” So step one is separating Prime sales from other retail subscription sales.

Business Insider cites a report by Morgan Stanley’s analyst Brian Nowak that roughly pegs there to be 65 million Prime members worldwide. Nowak’s estimate assumes both that $88 is the average price paid for Prime, per user, across all markets and that 90 percent of sales for the respective category result from Prime.

I roughly sketched my own model on an office whiteboard and ended up with a subscription number just over 70 million, likely the result of weighting Amazon penetration in Asia more heavily. I also think it might not be generous enough to assume that 90 percent of retail subscription revenue comes from Prime.

Somewhat outdated estimates of Amazon music subscriptions indicate that only a few million users have subscribed to the service, which, ranging from $48 to $180 per year, doesn’t quite account for 10 percent of sales — though things get more complicated when you add in other subscription services, so it’s hard to say for sure.

Aside from all the Prime drama, Amazon also noted that it poured $103 million into acquisitions in 2016. That number is relatively small with respect to its activity last year that totaled $690 million. Small acquisitions like Harvest.ai don’t quite run up numbers like Twitch or Zappos.