Peloton has seen great success with its exercise bikes for home use. Today, the company is doubling its product range (to two), with a bike aimed at commercial users. It’s more rugged to stand up to the “don’t be gentle, it’s a rental” hotel and gym crowd, and comes with software that’s more suitable for gym use.

The commercial bike comes with a 22-inch “sweat-proof” touch-screen and upgraded mechanics to withstand the abuse from being shared among many riders.

The new bike weighs in at about $3,000, which is about on par with what industrial-grade exercise bikes cost. The original bike for home use is $2,000. That sounds like an awful lot of money for a bike, but the company reports that people are more than happy to pay the price.

“We have sold around 75,000 bikes so far,” John Foley explains. “Officially, we are only selling in the US, but customers in 23 countries are using our bikes. They’ve bought them here and imported them to their own respective countries. I’m told that Richard Branson, has six of them on Necker Island. He’s obsessed with our bikes.”

Now, if the thought of a $2,000 exercise bike get your heckles up, you wouldn’t be alone. A beefy price point is an argument that Foley is used to fielding, not least from its early investors.

“I have been completely convinced from the beginning that this is a product that people want and need,” Foley says, but he admits that it took a while for the investors to cotton on to what the company was up to.

Which, let’s be honest, makes sense. If anybody were to pitch a company to you that suggests making its own computers (the touch-screen displays at the front of the bikes are custom-designed tablets), exercise equipment, apps, distribution network, content, and software, you’d tell them to bugger off. And yet, that’s exactly what Peloton have been able to pull off. 75,000 customers pay $39 per month for more than 4,000 different workouts. The company live-streams SoulCycle-style classes in parallel with a huge library of sessions ranging from the leisurely to the “oh my god I can’t feel my legs do I still have legs what happened to my legs am I dead now”.

“We own the entire process,” Foley explains, suggesting that Peloton has a tighter vertical integration than Apple. “We make our own content, we create the bikes, we deliver the bikes, we only sell from our own shops and online, and we sell the subscriptions so people can continue using the content.”

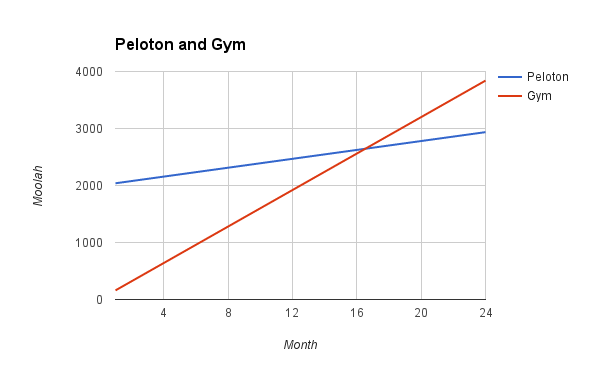

The $39 per month subscription price is undoubtedly steep, but considering what the company is up against, the price point does makes sense. If the choice is between two people in your household paying $80 per month for gym memberships, or one $39 Peloton content subscription, perhaps the choice is simple. Yes, paying $2,000 for a bike is more than the loose change that accumulates at the back of your sofa over a few months, but you’d recoup the cost for two people in under a year and a half, so perhaps it’s a better deal than it looks.

After about 17 months, the $2,000 + $39 subscription works out cheaper for two people than each of them paying for a $80 per month gym membership.

Of course, cost isn’t the only consideration here — gyms have more activities than just exercise bikes, after all, and for some people, there’s the social aspect of going to the gym to consider. Peloton has a few arguments in its favor, however. By gamifying the exercise experience and having the bike easily available at your home, Peloton claims its engagement level is way higher than a gym.

Low churn, high engagement

From a business point of view, this makes sense: If you’ve paid $2,000 for a bike that loses much of its magic if you stop paying your subscription, you’re probably not going to stop paying for your subscription. This is reflected in the customers’ behaviors: Foley claims that the company only has a 0.3% churn rate (the number of people cancelling their subscriptions each month), which is almost unheard of in any industry. Gyms, for example, would murder to only churn 0.3% of its customers every month. Assuming that Peloton makes a profit on its bikes (which effectively cancels that out of the equation), Peloton’s business model makes it look like a rather lucrative SaaS business.

The new bike launched today has two goals.

“People get addicted to the Peloton,” Foley says, “but our members travel, and they miss being able to participate in the exercises when they are on the road. Being able to train in your hotel and continue tracking your progress is great.”

Of course, the number of Peloton users in any given hotel is going to be vanishingly small — 75,000 bikes sold is impressive, but it pales in comparison to the number of people using hotel gyms, which brings us to the bike’s second objective.

“We are doing marketing on the commercial bikes,” Foley explains with a wry grin. He suggests that part of the commercial strategy for the company is driven by customer acquisition. “You’ll be able to buy your own Peleton bike with a few taps of the display on the bike you would be riding in a hotel.”

Expanding beyond bikes

The company isn’t just about bikes, however; it’s easy to see how a similar model could work for weights machines, rowing machines, and treadmills. When queried on whether one of those products are next, Foley shrugs, winks, and says that the company is taking a broad view of home fitness equipment, and that it is actively evaluating what products to build next. Which, if I were a betting man, means that the company probably has one or more of those products up its proverbial sleeve.

The company is gunning for aggressive expansion. This year, Peloton is starting operations in Mexico and Canada, but that seems like mostly a warmup session ahead of 2018’s planned Asia and Europe launch.

“We have raised $120m over five rounds, and we have strong demand from the rest of the world to start shipping Peloton bikes,” Foley says.

The commercial version of Peloton’s bikes will be available to buy in spring.

In additional to the new bike, Peloton also announced a partnership with Fitbit at CES. Starting now, Peloton ride metrics can now sync directly to the Fitbit app, making it easier for riders to see the impact a ride has on their stats. Nifty.

“We are proud of growing rapidly,” Foley says, explaining that the company’s 400-strong team still have a long road ahead of them. “Our research indicates that there are 4m people out there who are willing and able to pay $2,000 plus a monthly subscription fee for a service like ours. We’ve made some good progress, but the journey is just getting started.”