Yahoo made slightly more money than Wall Street expected — and no one cares at this point.

The company reported its third-quarter earnings, basically falling a hair above what everyone was looking for on its earnings and in line with revenue. But at this point the company is in the process of getting acquired by Verizon. As such, stock prices and whatnot like that don’t really matter right now.

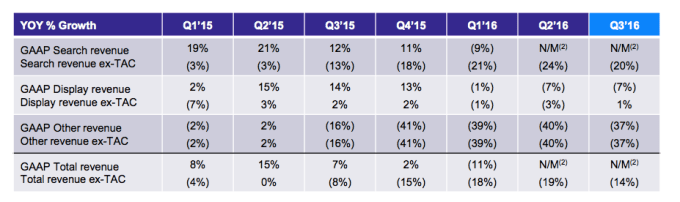

So, instead, let’s take this time to do a short review. Here’s Yahoo’s revenue performance for the past couple quarters:

[graphiq id=”73y9ryLa8mh” title=”Yahoo Inc. (YHOO) Revenue Breakdown” width=”600″ height=”494″ url=”https://sw.graphiq.com/w/73y9ryLa8mh” link=”http://listings.findthecompany.com/l/19200951/Yahoo-Inc-in-Sunnyvale-CA” link_text=”FindTheCompany | Graphiq” frozen=”true”]

Yahoo brought in earnings of 20 cents per share on revenue of $1.31 billion. Analysts were expecting earnings of 14 cents per share on revenue of $1.31 billion. But if you check out how much revenue the company has been bringing in for the past few years, it really hasn’t gone anywhere. It’s an established business, and one that makes money, but it simply hasn’t ended up going anywhere.

Verizon is still in the midst of acquiring Yahoo in a deal that’s supposed to be around $4.8 billion. However, there are reports that Verizon (which, in full disclosure owns AOL which owns TechCrunch) is looking for a $1 billion discount on the deal following revelations of a massive data breach and allegations that it scanned user emails. What the final result of all those discussions will be still remains unclear.

“In addition to our continued efforts to strengthen our business, we are busy preparing for integration with Verizon,” CEO Marissa Mayer said in a statement. “We remain very confident, not only in the value of our business, but also in the value Yahoo products bring to our users’ lives. To that end, we take deep responsibility in protecting our users and the security of their information. We’re working hard to retain their trust and are heartened by their continued loyalty as seen in our user engagement trends.”

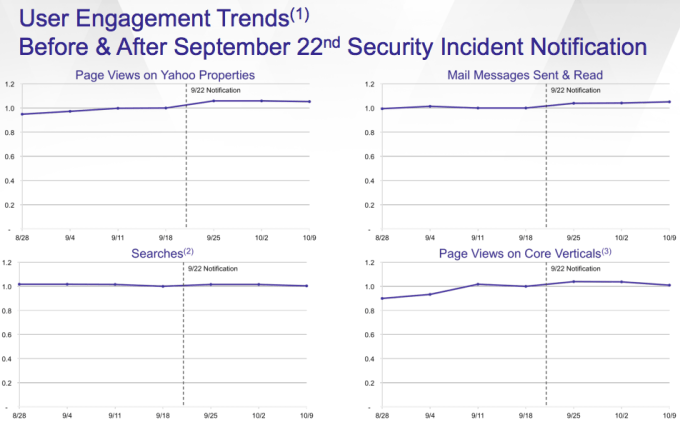

Yahoo even seems to be trying to get ahead of the issue by literally publishing engagement charts following the reports (each with a wildly ambiguous y-axis, natch). It seems like the company is trying to show that people still continued to use its services without a hitch after the stories hit:

For Wall Street, the value of Yahoo for the past years has instead been locked up in its stake in Alibaba. Jerry Yang made one of the most ambitions — and wildly successful — bets in the technology world when he invested $1 billion in the budding e-commerce company in China. That resulted in a massive windfall that would be worth orders of magnitude more than Yahoo’s own core business. To that extend, a lot of the executive leadership’s team’s role has been managing the ultimate fate of that cash pile.

Much of the blame for the lack of a turnaround has fallen on Mayer. Looked upon as the Googler who would find a way to bring the company back to growth and profitability, Mayer was named CEO of the company in July 2012. Since then, the company has rapidly whiplashed to multiple different strategies such as focusing on building mobile apps and large content plays, but didn’t find anything that would really stick and attract new users.

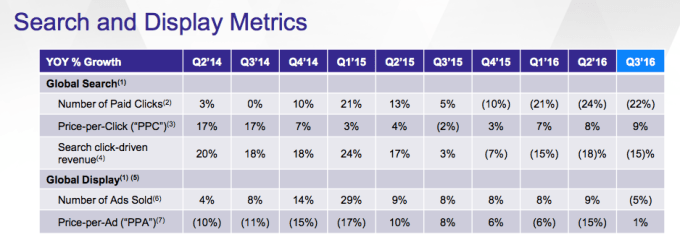

This table from Yahoo’s results kind of sums up the whole thing:

As a result, it wasn’t really able to return the company to large financial growth. Through her overall tenure, Yahoo has seen some growth in its stock, but that growth has largely stagnated for more than two years. Mayer, like the many CEOs that came before her, simply couldn’t figure out a way to pace Yahoo with other new advertising platforms like Facebook or Snapchat despite holding a massive number of eyeballs.

[graphiq id=”9VRYql6bXOR” title=”Yahoo Inc. (YHOO) Stock Price – 2 Years” width=”600″ height=”463″ url=”https://sw.graphiq.com/w/9VRYql6bXOR” link=”http://listings.findthecompany.com/l/19200951/Yahoo-Inc-in-Sunnyvale-CA” link_text=”FindTheCompany | Graphiq” frozen=”true”]

Yahoo, today, will also not hold an earnings call to discuss the results. In a sense like that — and like LinkedIn — it really brings to a close the Yahoo leadership’s efforts to convince Wall Street that it’s a growth company that can compete with the likes of Facebook and Google. But, in the end, it simply couldn’t, and now the story of it as an independent is over.