“I want to be the global leader. I don’t want to build the non-relevant European or French player.” That’s why Emmanuel de Maistre just sold Redbird, his drone-powered analytics provider for construction and mining companies, to US drone services giant Airware.

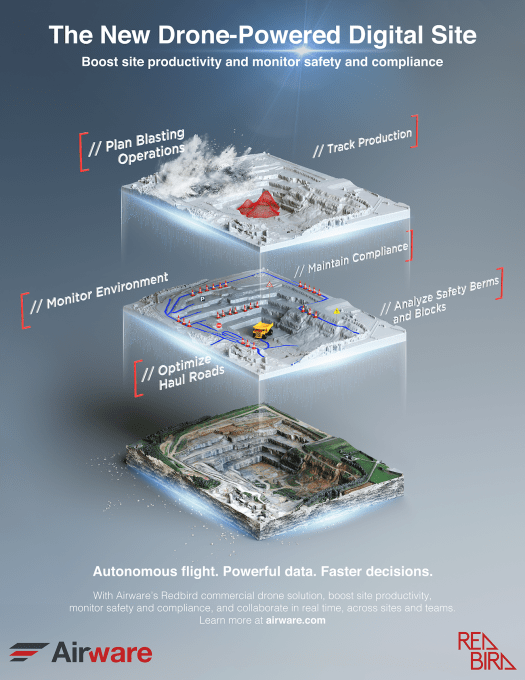

Together they can sell packages of aerial vehicle hardware, flight software, data collection, cloud management, and actionable insights to Fortune 500 companies who don’t know how to drone by themselves.

Redbird was actually the first investment from Airware’s own Commercial Drone Fund back 2015, which contributed to its $3.19 million in venture capital. Airware CEO Jonathan Downey tells me he’s vetted 115 drone investment pitches, and Redbird remained so impressive that he decided to buy it when the French startup began looking to raise more money.

Airware wouldn’t reveal the price it paid, but CEO Jonathan Downey told me “It’s a lot more than an acquihire.” Airware is buying Redbird’s 38 team members as well as their technology and business, which will continue to run under its own brand in Europe. Redbird’s Paris office will also become Airware’s European headquarters, powering the American startup’s expansion there.

Airware has raised $70 million since 2011, originally building a drone operating system for controlling aerial vehicles, carrying out data collection flights, and providing cloud management and analytics for the data to industrial clients.

Early this year, Airware began building hardware itself when necessary to offer complete end-to-end drone services. Yet now, it’s finding that high-end consumer drones equipped with its software can get the job done. That means it’s cooperating more than competing with Chinese manufacturer DJI, one of the few other drone giants.

Downey tells me “DJI started as consumers vehicles. Over time they’ve been able to address more and more of these commercial applications if you marry them with the right enterprise software.”

The acquisition allows Airware to concentrate on the insurance vertical where it helps State Farm and other customers with inspecting roofs, residential claims management, and commercial underwriting. Redbird will try to expand its lead as a provider for providing mines, quarries, and construction sites with drone-captured aerial data an analytics about their production quantities and pace, their efficiency, and their safety compliance.

Without drones, big businesses are forced to rely on expensive helicopters, limited satellite photography, or fragile human beings climbing ladders and dangling from harnesses. It’s rare that technology makes something instantly better, cheaper, and safer. Airware is betting that buying a foothold in the construction and mining drone business could turn into massive footprint as the market grows.