The typical investment in a U.S. seed-stage company rose in the first half of 2016, with many startups and their backers looking to shore up a longer runway before seeking Series A funding, according to CrunchBase data.

Overall, the average seed round size in the first half of this year was $1.14 million, up from $947,000 in the same period last year.

Median dollars for a seed raise in the first half of 2016 was $625,000, up from $425,000 dollars in 2015. As average and median seed fundings keep rising, seed is increasingly looking like the new Series A.

“Startups are raising more seed tranches and closing larger Series A rounds when they do,” said CrunchBase CEO Jager McConnell. “That puts pressure on seed stage investors to put more capital to work, particularly as the expectations of a tougher funding environment means founders will need to stretch their dollars further.”

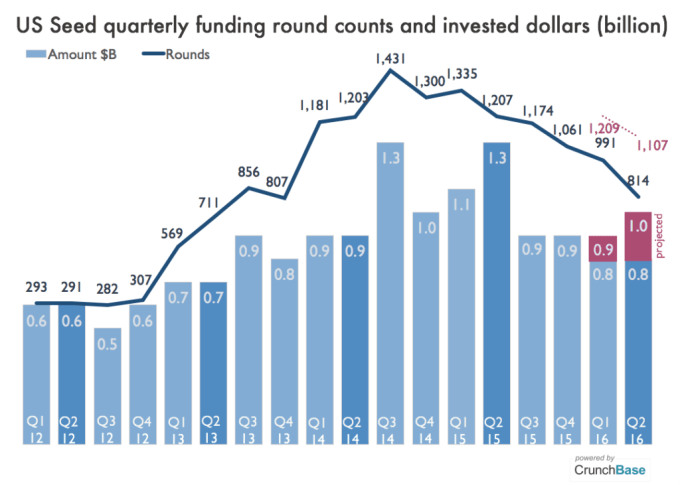

Projected seed investment for the second quarter and first half is $967 million and $1.9 billion. This compares with $1.3 billion and $2.4 billion reported for the same period last year. Even though averages and medians are up, based on these projections, the overall dollar amounts invested in seed are down from its peak by around $400 to 500 million for the first half of this year.

Reported seed investments totaled $780 million for the second quarter and $1.6 billion for the first half of the year. The higher projected numbers are based on the historical pattern of over 40 percent of funding amounts at that stage being reported after end-of-quarter.

The number of projected rounds for the first half of the year is 2,316. This compares with 2,542 reported rounds for the first half of 2015, down by just over 200 rounds. The number of reported rounds for this year, meanwhile, totaled 814 for the second quarter and 1,805 for the first half of the year.

California accounted for by far the highest portion of seed-funded companies, with 817 reporting rounds closing in the first half of the year. New York had 337 companies, Texas had 97, and Massachusetts had 95.

Popular sectors for seed funding included data and analytics, hardware, healthcare, commerce and financial services. Data and analytics, in particular, saw a measurable increase in seed funding activity from year-ago levels.

Seed stage funding counts have increased more than threefold since 2012. Many new investors have moved into seed stage funding, due in part to the lower setup costs for an early stage startup. Since 2012 we have seen a growth in active angels, accelerators and micro VC firms, as well as expanding interest from traditional venture firms for this stage of investing, as seed rounds have grown in importance to early stage companies.

Much of the rise in seed fundings is due to the rise of highly active investors in the space. The most active investor in the first half of 2016 was 500 Startups, with 46 deals, followed by Y Combinator with 24 and SOSV with 23.