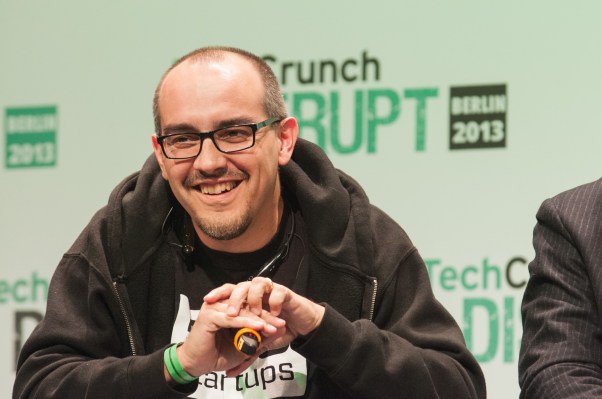

Like startups, most venture capital firms fail- at least in terms of returns. In our latest interview with Dave McClure, Founder @ 500 Startups, he argues that poor venture returns are the fault of ‘focused’ investment strategies. Instead, McClure argues that a high-volume, diversified investment strategy delivers consistently stronger cash on cash returns than a more concentrated thesis. So why should the VC industry consider a less concentrated, potential even ‘spray and pray’ approach to investing?

1.) Winners Are Rare

If we surmise that unicorns happen 1-2% of the time, it is logical to adopt a portfolio size that includes at least 100 companies. The larger portfolio size will greatly increase the chance of investing in a mystical ‘unicorn’. McClure backed up this thesis by breaking down the return profile of 500’s portfolio. In this breakdown, McClure stated 60-80% of investments do not reach any exit or return less than 1X invested. 15-20% of companies invested in do succeed and return a small exit, in the region of 3-5x. A further 5-10% achieve valuations of $100m+. However, the fund is returned by the 1-2% that achieve ‘unicorn status’, returning 50x or more of investment.

2.) Signalling Is Over-played

Many investors will cite negative signaling as a reason for not having a more diversified approach. They argue that seed investors who do not follow on in their companies, present negative signals to the wider fund environment. However, McClure cites that ‘if founders and VCs are worried about me investing, then there is a problem with the company.’ McClure goes further stating that ‘negative signaling is largely overplayed’ and used to force investors to follow on.

3.) Earn The Right

With a multi party seed round, investors are forced to earn the right to participate in the next round due to the increased competition. This could result in VC funds delivering greater value and serving the entrepreneur to a higher quality.

Ultimately, diversified, high volume portfolios cannot prevail throughout funding rounds. As dollars invested increases, volume must decrease. Yet the approach cited by McClure; ‘spray and pray’ at seed, gather insight and optionality on early stage opportunities and then double down on the winners, has the potential to destabilise the common worship of concentrated portfolio strategy as industry best practice.