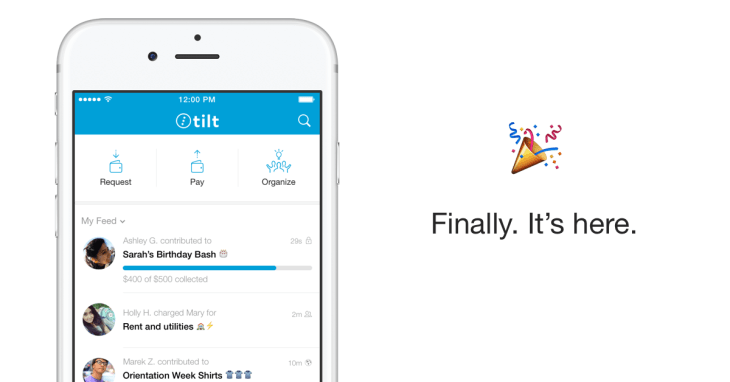

Here’s a sentence you might not have expected to read: a service built around crowdfunding is building in a one-to-one payments option in what might be one of the most increasingly crowded spaces in the U.S.

That’s what Tilt, an app geared toward crowdfunding events like parties or travel plans, is hoping will make its service even more sticky and a one-stop destination for payments between peers — and build what CEO James Beshara says is a social network around payments. Rather than gun directly for domestic markets (which still account for about half of Tilt’s activity), Tilt is trying to exploit a moment in time where PayPal and other US-based popular payments services — like Venmo — haven’t hit international markets just yet.

The idea of a one-to-one payments product existing within Tilt was kicked around for a while, but never implemented, Beshara said. But when it turned out that international users, like those in the United Kingdom, were basically bending the app in order to essentially enable one-to-one payments, it seemed like there was a potential to implement it as part of the app. Nearly a quarter of all payments activity on Tilt in the United Kingdom was one-to-one payments, despite the app not being geared toward that, Beshara said.

“In our abstinence from it, we’re much more interested in building products that unlock ideas in heads, as opposed to others, which are payments [relating to] the past,” Beshara said. “We were much more in the DNA of future-oriented types of objectives and much more social group minded activities.”

One-to-one payments isn’t the core use case of Tilt, nor is it intended to overtake Tilt’s core service as the company’s primary focus, Beshara said. Instead, the metric of success will be whether it makes the app more sticky and whether or not it leads to an increase in the number of funding campaigns that happen. In an initial test, the user base with one-to-one payments enabled increased their Tilt activity by around 34% — which is what the company is hoping will happen to the blanket user base once this is turned on, Beshara said.

Tilt has traditionally been known as being geared toward college students, and that’s largely still the case. 75% of Tilt’s users are either in college or recent graduates, Beshara said, and for that user base it made sense to create a core destination that served both one-to-one payments and group payments activity.

Tilt is closely monitoring its international activity, which accounts for more than half of its activity overall. That was part of a big push the company made starting last year in May when it raised around $30 million at a $400 million valuation. Whenever a user base starts basically inventing a new use case for a service without that being part of the original intent, it makes sense that the creator start paying close attention.

Building a powerful user experience that justifies going into the Tilt app to make a payment is not a simple task given the dead-simple approach other applications have pioneered in the U.S.. For example, Facebook has payments built on top of a communication layer, and not a service independent of a core smartphone use case. Parts of that experience involve intelligently showing who to request money from, and who to pay, right from the get-go. And speed is naturally critical.

Of course, the analogy of building a social network around payments is an extremely tall order. Basically every network is working to integrate some form of payments, looking to treat the process of exchanging money as a core element of the communications experience. Beshara says that his hope is that people think of Tilt as both a place to not only organize campaigns, but interact with and treat those campaigns as elements of content you might find in the Facebook News Feed, for example.

Building out that big base of content requires users to create that content. And getting users to create that content requires seeding a critical mass of users in order to justify their time to create that kind of content. In order to get people talking in GIFs in a Tilt feed, a lot of people have to be viewing and interacting with that Tilt to start. That’s really what the one-to-one payments tool, which intends to bring in additional users, sets out to do.

“One of the best things we’ve ever done to spur more public participatory discoverable content,” Beshara said. “That’s gonna be the most important thing for us, one-to-one payments in general is notoriously a low margin if any margin business. The only sense for us is does it actually drive the activity and the content that we really want. You come into the platform and see, man, my friends are already using this. It’s very similar to other content creation platform, something like Snapchat — if only 4 of your friends are on it, you’ll be less likely to create content than if 40 friends are on it.”