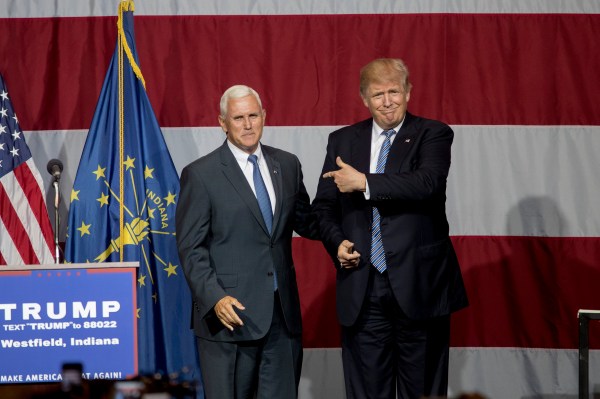

With a tweet from The Donald himself, it’s official that Governor Mike Pence of Indiana will be Donald Trump’s running mate. But Gov. Pence’s record in the tech industry has been clumsy at best.

Perhaps knowing he needed to step up his tech efforts, the Governor has been loudly parading his “new” innovation and entrepreneurship plans for the state of Indiana in the run-up to his selection. While the initiative is capturing the spotlight this week, it seems to be in direct contrast to the Governor’s lack of priorities in ensuring the safety of diverse communities. The fight got so bad that Salesforce, Angie’s List, and other tech companies had to get involved, costing Indiana millions in lost investment.

At first glance, the plans sound robust. The governor touted $100 million to support university entrepreneurship, $30 million a year for a state investment fund, $500 million from pensions to fuel early and mid-stage Indiana startups, and a plan to make venture capital investment tax credits transferable.

Unfortunately, building a successful entrepreneurial ecosystem is not only about throwing around money. The reason that building startup ecosystems is so difficult is that it is an innately human process. Creation demands a culture of inclusiveness of ideas. Capital is never enough on its own.

Gov. Pence’s VC investment tax credits only work if the state can breed strong investment opportunities to begin with. VC tax credits are designed to attract outside investment to Indiana’s startups. The majority of this capital comes from Silicon Valley, New York City, and Boston. Investors in these cities might not have to worry about the details, but entrepreneurs do. Founders need to position their companies to attract and retain top talent.

Creation demands a culture of inclusiveness of ideas. Capital is never enough on its own.

Pence wrote commentary for CNBC earlier this week. In it, he cast himself as a jobs-savvy governor with deep knowledge of the tech industry. He took credit for attracting Salesforce to invest in the state. Silicon Prairie, it’s a beautiful image, very quaint and very bullshit.

During Pence’s term as governor, Salesforce CEO Marc Benioff paid some Indiana employees as much as $50,000, who requested to relocate outside the state. He canceled all programs that required employees to travel to Indiana.

Why would a company CEO do this? Gov. Pence supported and ultimately signed the Religious Freedom Restoration Act (RFRA), which protects the rights of individuals who believe their religious liberties are being threatened at the cost of the safety and acceptance of the LGBTQ community. In the video below, re-tweeted yesterday by Salesforce’s Benioff, Gov. Pence refuses to answer any direct questions about whether the intent of the law was to discriminate against the LGBTQ community.

Salesforce, Angie’s List, and other tech companies came out strongly against the RFRA. After Salesforce threatened to halt expansion in the state, Gov. Pence signed a “fix” that prevents the law from being used as a defense to discriminate against the LGBTQ community.

What’s particularly troublesome about this is that Gov. Pence is selling himself as pro-tech and pro-Salesforce. Salesforce wasn’t wooed to pasture in Silicon Prairie by the swift progressive politics of Gov. Pence. Salesforce gobbled up Indiana based email marketing software company, ExactTarget, in 2013 because it had a great product with large economies of scale. The transaction provided the company a large representation in the state and 3,000 employees to look out for. The Government of Indiana does provide Salesforce with tax incentives as a reward for job creation, but that’s where the relationship stops.

Smaller companies have it even worse. Unlike salesforce, early-stage companies don’t have the bully-pulpit to protect their employees in the same way Salesforce does. Indiana must find a way to not just grow entrepreneurial seeds, but find a way to keep rapid-growth, high-technology companies in the state. It’s easy to attract an early-stage founder with a check for $3 million, but it grows increasingly difficult to compete with out-of-state capital for larger rounds in the 10s and 100s of millions of dollars. The dollar amounts become high, word-of-mouth travels, and uncompetitive deals become competitive.

For a Silicon Valley investor, Indiana startups can be a relative bargain. Labor, space, and the competitive market landscape reduce premiums on deals in places outside prominent startup ecosystems. For Indiana’s plan to payoff, it’s critical that startups want to stay in the state for the long-run.

Visit Indy, Indianapolis’ convention and business bureau, reported that in-total the RFRA cost Indianapolis alone over $60 million in corporate investment. Angie’s List froze a $40 million expansion to Indiana. The money quickly adds up and starts to chip away at the shimmer of the governor’s new innovation plan. The state of Indiana might have brought some amazing tech companies to its state, and that’s something to be proud of, but Governor Pence doesn’t get to claim responsibility.