The global finance markets are slipping on Friday after the UK public voted to leave the EU, but there is one currency that is reveling in the uncertainty of the Brexit result: bitcoin.

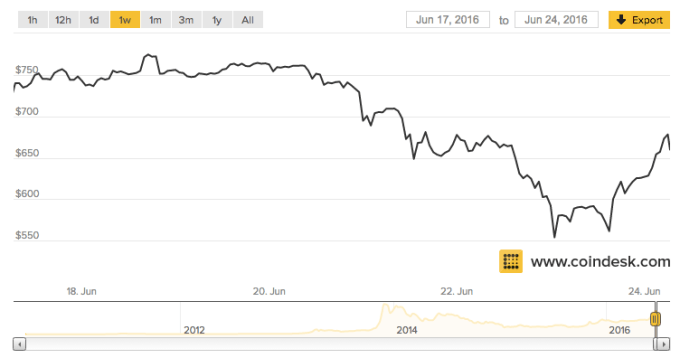

The cryptocurrency is notoriously difficult to predict. Its price against the U.S. Dollar rose as high as $1,000 in 2013 and, while it has stabilized somewhat since that landmark valuation, it hit a two-and-a-half year high of nearly $775 on June 17 before cratering nearly 25 percent over the next week.

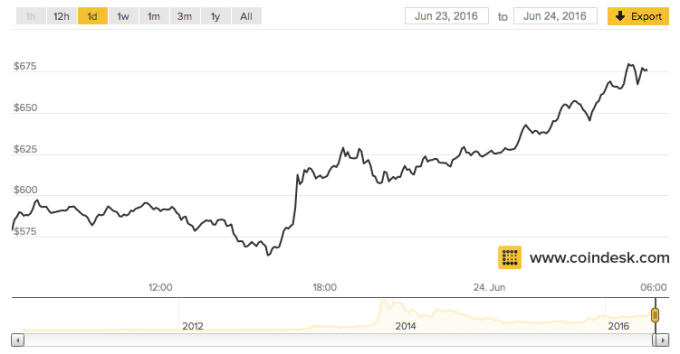

That drop was thought by some be related to the British referendum on continued EU membership, but once the result was clear — with multiple media calling it a win for the Leave campaign — bitcoin grew legs and jumped past $650 just one day after it was at $550, according to data from Coindesk.

The price of Bitcoin versus the U.S. dollar today

The price of Bitcoin versus the U.S. dollar over the past week

That’s not actually a huge surprise given the woeful day the British Pound has endured this far. The currency fell by more than 10 percent to hit a 35-year low against the Dollar, as question marks around how Britain will exit the EU — it would be the first member to do so — how it will find new trade deals, who will be in charge of the government, and more saw the Pound’s depression impact on markets across Asia and the rest of the world.

https://twitter.com/TheXclass/status/746172673877651456

Bitcoin looks like a particularly appealing vehicle for offloading the Pound given that peer-to-peer currency services like TransferWise paused working with the currency ahead of the Brexit vote due to potential market turbulence.

“With the EU Referendum in the UK on Thursday 23rd June, exchange rates are likely to be volatile. We’ve been putting plans in place so that your transfers continue to be processed as smoothly as possible,” TransferWise told customers earlier this week.

London-based TransferWise, which includes U.S.-based Andreessen Horowitz among its investors and is valued at $1.1 billion, cancelled any pending British Pound transfers that were not completed by 8pm UK time on Thursday. The company told customers it plans to resume operations today, but, at the time of writing, its service has not yet resumed support for the Pound.

Update 10AM BST: TransferWise has now restarted GBP transactions.