Credit card penetration is one of those problems that isn’t really a ‘problem’ in the West. In the U.S. alone, 232 million adults are said to own at least one credit card, with 18 percent of consumers in the country owning two or three cards.

That high level of credit adoption is one factor that has helped online commerce take off in the West. Or, to put it another way, the lack of credit cards in emerging markets like is one of the major hurdles that online commerce companies are facing. And it is a huge problem. Lazada, for example, is the most funded e-commerce firm in Southeast Asia, but it ran out of money before Alibaba pumped $1 billion into its business. The fact that countries like Indonesia have sub-10 percent credit card ownership is an important factor, as was pointed out in a recent Google report.

So far, the solutions have been bank transfers, which are time-consuming and painful, and cash-on-delivery, the idea that you literally pay for a product with cash when it is delivered to your door. That overcomes the issue that most of Southeast Asia’s cumulative 600 million-plus population does not own a credit card, but it presents new problems: an increase in return rates and higher potential for fraud or cash lost in transit.

A number of companies believe technology can bridge the gap, using processes like virtual credit cards or over-the-counter payments. FinAccel is a new company that’s proposing a different approach: enabling a credit line for online purchases.

The company is based in Jakarta, Indonesia, and it essentially acts as a layer between its credit card and lending company partners and consumers buying online. Started last year by Akshay Garg, who founded ad tech firm Komli, ex-McKinsey consultant Umang Rustagi, and Alie Tan, formerly of a number of startups, the company has raised an undisclosed seed round, which TechCrunch understands to be more than $1 million, led by Jungle Ventures to get started.

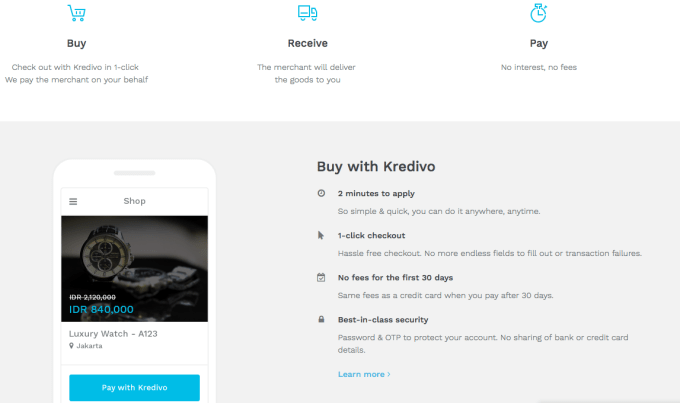

Garg told TechCrunch in an interview that the idea is to disrupt the credit industry by enabling consumers to reap the benefits with a model that befits today’s digital era. FinAccel’s product — Kredivo — is designed to sit at the point of sale like Visa, but enable customers to pay with one click and make repayments to FinAccel directly.

Initially live in Indonesia only, customers have 30 days to repay the amount at no added cost, but the startup is planning to introduce credit card-style payback plans soon. That would be priced at 41.75 percent APR over a period upwards of six months, which Garg said is anything up to one-third cheaper than “nearly every consumer finance company in the market” and on-par with credit card holders.

“You might say that’s high, but the cost of capital here is high,” he added. “We are basically putting a virtual credit in hands of five to 10 million people in next five years.”

“We want to go hard against the consumer finance companies,” Garg said. “There’s a crazy amount of bullshit marketing in the industry today.”

The goal, he explained, is more than just beating existing finance companies, though, since FinAccel wants to unlock new consumer spending opportunities, particularly in the e-commerce space.

Like Alibaba’s micro-loan services in China, Kredivon is billed as making near real-time decisions on credit applications. The service uses over 1,800 data points to assess the credit worthiness of the applicant inside two minutes. Beyond expected information such as salary and job information, Garg said other variables considered including social media information from sources such as Facebook, Twitter, and Instagram among others.

Garg explained that interactions on posts on Facebook can speak to how integrated a person is in their communities and society in general. But it is far from the only deciding factor.

“Most people who are more integrated into society tend to be trustworthy, that’s not the sole determining one of 1,500-1,800 variables but one illustratable point. Also, for example, if you are tweeting about a car, that says a lot about you — if you’re buying a car in Jakarta, you’re definitely earning more than $1,000/$2,000 a month,” he said.

Other less expected indicators including the kind of apps an applicant has on their phone — the Financial Times and Economist can be indicators of high social status, Garg suggested — while call logs (those who call more in emerging markets tend to be more affluent and not on pre-paid accounts), environmental data and device and app history on Android devices are all also factors.

FinAccel is starting out in Indonesia, but it has plans to be present across Southeast Asia’s six main countries with an expansion that will likely kick off next year starting with Thailand, Garg said.

“We’re launching in Indonesia because this is our core market, because it is hard to have a big business in Southeast Asia if you’re not present in Indonesia, plus the problems are the gnarliest here.

Our view is that we are solving the toughest problem in the market right now, once we get a foothold here the plan is to launch in other markets.”