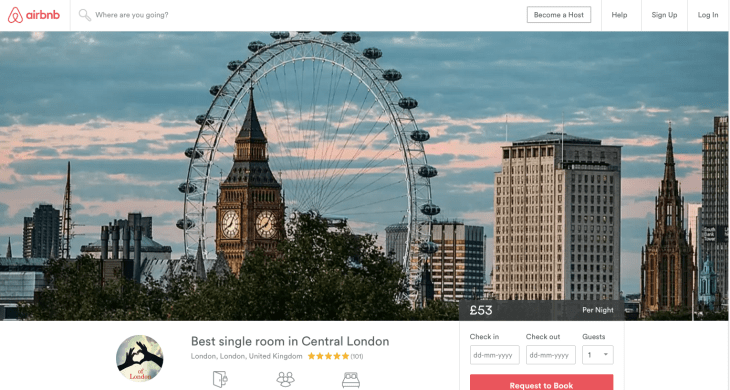

The UK government has announced a little extra tax relief aimed at encouraging what the chancellor termed ‘micro-entrepreneurs’ in yesterday’s budget — albeit the other beneficiaries here are likely to be gigantic tech platforms like Airbnb if Brits take up the invitation to rent out their spare rooms for a little tax-free extra income.

The new tax break also applies to selling goods online so tech platforms such as eBay and etsy may also see some extra uplift in the U.K. Chancellor George Osborne suggested at least half a million people will benefit from the tax cuts.

“We’re going to help the new world of micro-entrepreneurs who sell services online or rent out their homes through the internet,” he told parliament yesterday. “Our tax system should be helping these people so I’m introducing two new tax-free allowances each worth £1,000 a year, for both trading and property income. There will be no forms to fill in, no tax to pay — it’s a tax break for the digital age and at least half a million people will benefit.”

The £1,000 tax break applies twice; once for property related income and once for online trading, so Brits will be able to earn £2,000 tax free in total from the two types of ‘micro-entrepreneurial’ activity.

It’s the second such tax break for renting rooms announced by the Chancellor in recent times. Last summer he announced an existing annual tax-free threshold for taking lodgers would be raised from £4,250 to £7,500 per year. Although that ‘Rent a room scheme’ only applies when a person is renting rooms in their main residence.

The new £1,000 property income tax break for online property rental will apply even if the entire property is rented — as is often the case with Airbnb. According to Coadec, the tax break will also apply to other sharing economy style property rental services, such as workspace rent a room site Vrumi or parking space rental service JustPark.

It’s not the first time the UK government has sought to inject a little fuel into the domestic sharing economy. Back in 2014, it commissioned a policy and regulation review of the area with the stated aim of removing barriers to the further growth of sharing economy platforms.

“We back them and we want to help them make our lives easier. We are removing barriers that stop people sharing their assets, and will empower people to make more from their assets and skills,” the government wrote in its response to the review, in March last year, adding that is committed to “ensuring the UK is the best environment in the world for these entrepreneurs to flourish”.

Unsurprisingly, Airbnb has welcomed the government’s move to accelerate the domestic sharing economy, given its business is likely to be a major beneficiary of the policy — and doubtless also as a welcome contrast to other regions where city authorities have accused it of enabling the operation of illegal virtual hotels, and thus of taking housing stock out of local community use and/or inflating rents.