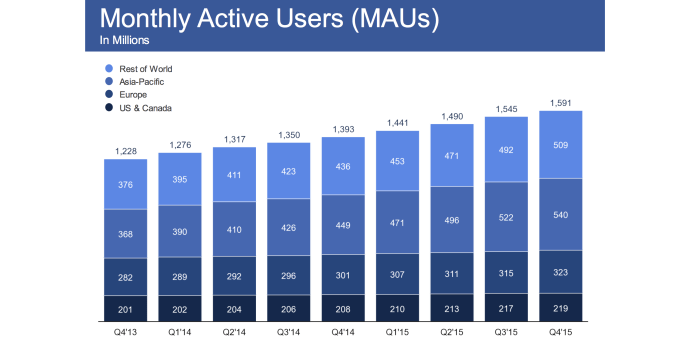

By courting users and ad dollars in the developing world, Facebook continued its growth streak. It hit 1.59 billion users today and crushed the street’s estimates in its Q4 2015 earnings with $5.841 billion in revenue and $0.79 earnings per share. That’s up from 1.55 billion users and $4.5 billion in revenue last quarter. Even with Q4 being the holidays, that 29.8% QoQ revenue growth is stunning, and it’s up 51% vs Q4 last year.

Facebook’s monthly user count grew a bit slower at 2.58% quarter over quarter from Q3’s extremely strong 4.02% growth. It shows Facebook is hitting saturation in some markets but still has room to grow in many developing countries.

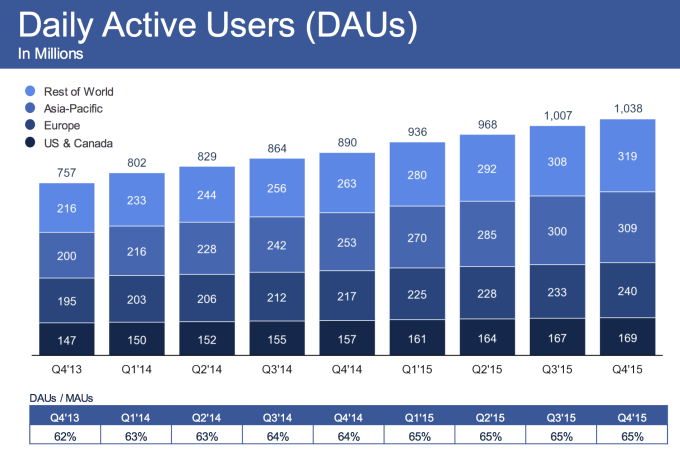

Though not as flashy as the big monthly number, daily user count is a better way to chart Facebook’s progress. Facebook’s DAU hit 1.04 billion compared to 1.01 billion in Q3, up 2.97%. Facebook’s DAU to MAU ratio, or stickyness, held firm at 65%. That means users aren’t visiting less even as the service ages.

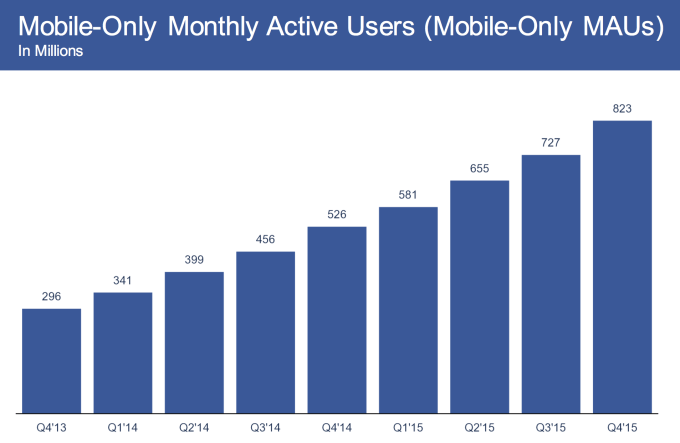

Mobile now makes up a massive 80% of Facebook’s advertising revenue, up from 78% in Q3. $5.63 billion of its total revenue came from advertising, overshadowing Facebook’s old payments business. Mobile-only users now number 827 million, up a swift 13.2% from 723 million last quarter. That’s a testament to Facebook growth in the developing world that largely skipped the full-sized computer age.

[Update: Mark Zuckerberg also released a slew of new stats during the Q4 Earnings call:

- 100 million hours of video watched per day

- 1 billion users on Groups

- 80 million users on Facebook Lite

- 500 million users on Events

- 123 million events created in 2015

- 50 million small and medium sized business on Pages]

Analysts estimated Facebook would see $5.37 billion in revenue and $0.68 EPS, meaning Facebook crushed estimates. eMarketer that Facebook will grab $9.86 billion in U.S. display ad revenue in 2016 — a 30.6% share of total U.S. display ad spending. Facebook was at $94.45 at the end of regular trading before earnings were released, and is now up 6.7% from market close to $100.71.

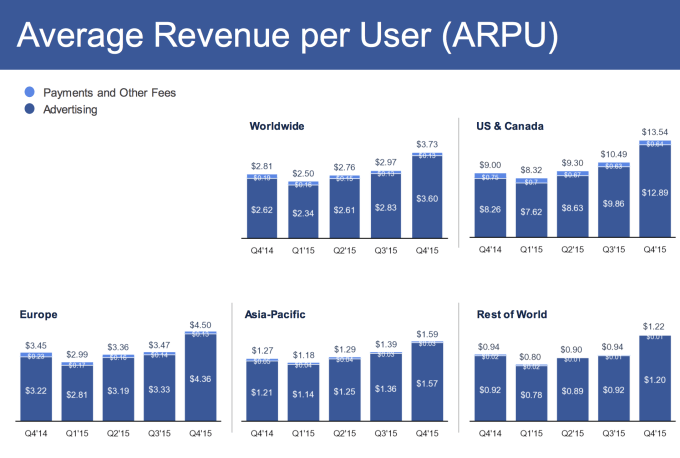

Facebook managed to steeply grow average revenue per user 25.5% from Q3’s $2.97 to $3.73. That’s also a 28.1% increase over Q4 last year. Facebook did particularly well in increasing revenue from the developing “rest of world” region to $1.22 per user, which was up 29.8% both this quarter and compared to Q4 last year.

Facebook had $692 million in capital expenditures, and $2.14 billion in free cash flow for Q4. As for the full 2015 year, Facebook reached $17.93 billion in revenue, up a remarkable 44% year-over-year, with a profit of $3.69 billion.

Why Did Facebook Do So Well?

Monetizing the developing world is a big part of it. Back in Q1 2012, Facebook was earning a measly $0.32 per user in the “rest of world” segment. It’s almost 4X that now. Despite these users being on slow connections, old smartphones or even feature phones, and not having much buying power, Facebook is convincing advertisers to pay to reach them.

On the earnings call, Facebook admitted that video is propelling engagement and time spent on its properties. Facebook sees 8 billion video views a day from 500 million users, which amounts to 100 million hours of time spent watching videos per day. This all allows Facebook to slip video ads into the News Feed and its Suggested Videos reel that appears when you finish watching another.

The Facebook Audience Network that uses its data to target ads in other apps hit a $1 billion revenue run rate. Facebook was expected to have strong sales of Instagram ads this quarter, which could be contributing to its revenue. Messenger’s continued dominance amongst western chat apps is also keeping users firmly inside the Facebook family of apps.

Instant Articles could be helping too. They effectively bar the exits from the News Feed, ensuring users don’t bounce from the app while waiting for a news article to load in the browser. And when they’re done reading, they can just go on Facebooking and seeing ads.

Looking forward, Facebook could potentially devise a new Instant Ads format that would give brands the fast-loading rich media of Instant Articles, so users aren’t discouraged from clicking. Facebook also just announced that it’s expanding its mobile ad network from apps to mobile websites, which could further boost revenue without Facebook needing to show more ads on its own properties.