“When will I have a robot that can do my laundry?”

This is the number one question I get from friends and family members, whose expectations are unconstrained by the software and hardware technical realities that make robots tick (washing dishes is a close second by the way).

Since most have been waiting a lifetime for this transformational milestone, I have been promising lately, with muted bravado, that it won’t be too long now.

As 2016 approaches, robotics is poised to traverse from a narrow set of industrial and military use cases to broader market applications that include commercial drones, telepresence robots, delivery robots and, of course, mobile vacuum cleaners.

But, are robots ready to be a part of our daily life?

Gill Pratt, a visionary who served as a program manager at the Defense Advanced Research Projects Agency (DARPA) and oversaw the DARPA Robotics Challenge, postulated earlier this year that robotics might soon be headed for a “Cambrian Explosion.”

The term refers to a period of time roughly half a billion years ago when the numbers and diversity of animals became critical to evolution. Pratt offered that technology developments are ushering in a similar upsurge in the diversification and applicability of robotics.

While technology breakthroughs and discoveries are a necessary precursor of mass-market success, there is typically also a set of underlying market forces and trends that create, sometimes unexpectedly, the conditions that result in widespread adoption.

In fact, there are four key market forces that now are creating a path for the emergence of those elusive home laundry robots, and that’s just the beginning.

Commodity robot hardware is at the arrival gate

The cost of robotics hardware has been declining for years. But, more recently, due to the emergence of high quality, low cost sensors, electronics, and communications for consumer electronics, a large portion of the robot bill of materials is now available at commodity pricing. Mobile robot hardware is already commoditized.

We see this in many forms with telepresence robots, a host of vacuum cleaning robots, swarms of drones/UAVs, underwater vehicles, and cars themselves evolving into human transporting mobile robots.

An expected outcome of this status is the burgeoning number of early stage companies based on mobile robot technology. There are so many drone companies looking at the agriculture space that many emerging companies are pivoting to business models based on construction and mining, and beyond. And the delivery robots are not even here yet.

As with the computer industry in the 1980’s, availability of low cost hardware is enabling a larger set of entrepreneurs to explore new applications with limited investment and risk on hardware.

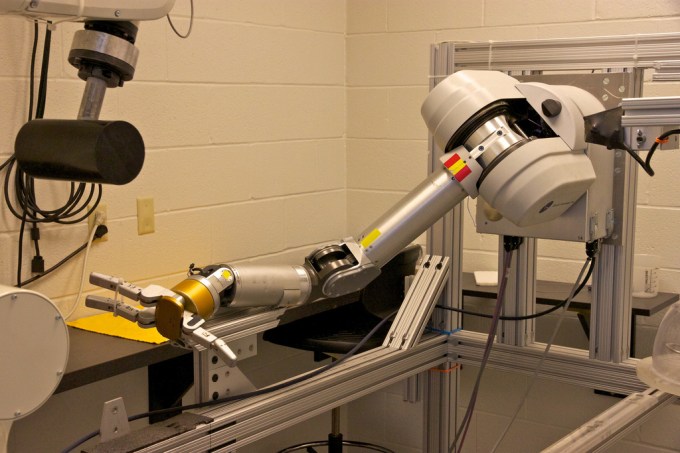

This commoditization of hardware is now extending to robot arms, where costs have dropped significantly over the last decade, as much as 50 percent or more for some applications. Earlier this year, two industrial robot arms were introduced that represent the current bar in the lower cost robot arms race: the UR3 from Universal Robotics at $23,000, and Sawyer from Rethink Robotics at $29,000.

The next level of penetration of robots for manufacturing will depend on a more significant reduction in cost and puts a new target in sight — industrial quality robot arms at $5,000 or less. For manufacturers, this is the price point that would open up a significant, broad new set of applications.

Robots will fill labor gaps, not replace workers

Although there is a seemingly universal desire among the masses for home laundry robots, technology capable of performing tasks that humans have traditionally handled also triggers apprehension – including the oft-cited fear that factory workforces will be replaced with robots. Large manufacturers today, however, are facing massive labor turnover and increased pressure to alleviate dangerous work conditions. Due to the aging of the world’s population, as well as shifting cultural views, manufacturers also face a steady decline in the number of people who want to work in factories.

A similar challenge is playing out in agriculture. Farms across the globe are grappling with high worker turnover and a reduced labor pool as improving quality of life makes grueling harvesting work less appealing. Pretty much every category of the service industry, including fast food, hotels, and elder care, are beginning to explore the opportunity for robots to offset labor challenges and create more value for customers.

We sometimes overlook the fact that manufacturing is fundamentally a service industry (people making things for people). From this perspective, manufacturing is leading the way in the next robotic trend. Whereas the first wave of manufacturing robots were put in cages and stayed there, robot solutions driven by needs in manufacturing and logistics today are forming a technology base that will support applications across broad service industries.

I am not an economist, but my belief is that the emerging labor challenges and the aging of the world’s population will be the deciding trends that finally give robotics its staying power outside of manufacturing.

Robots are now being asked to mimic human dexterity

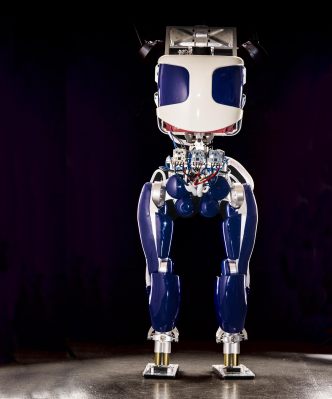

Robot use began primarily in industrial applications, where the benefits of fast, precise, repetitive manipulation were important. The ability for robots to perform manipulation that mimics or even surpasses human dexterity has been lacking outside of manufacturing and medical settings. There is no shortage of mobile robot solutions and emerging telepresence platforms – available for several thousand dollars – but they all lack manipulation.

Today, in addition to lowering the cost of robot arms, the manufacturing industry is investing in robot hardware and software solutions that increase the ability of robots to do jobs requiring dexterity, typically those that only humans can do.

The best public example of this is the Amazon Challenge, which is offering a large prize to the team that can solve robotic each-picking, the task of taking a single object out of a container of randomly arranged objects.

The first challenge was modestly successful. Expect greater leaps in performance in the next few Challenges. Once robots can each-pick for large warehouse companies to pack your orders, it is not a big leap for them to each-pick your dishes, or toys on the floor.

Robotics startups will proliferate

We know that, historically, small businesses generate the tectonic technology shifts in the market. Today, the actual inventory of early stage companies that are based on robotics is still relatively small. However, as the cost of robotic platforms – for both mobility and manipulation – continues to decrease, the number of startup companies based on robot technology will increase dramatically.

Among these startups will be the entrepreneurs who lead companies to broader uses of robotics. In the end, the success of robots will result from the insights of visionary people, more so than from any one technical innovation.

So, back to that home laundry robot. While I may be too vested in the robotics field to be impartial, the market trends highlighted in this article are real: with real people working with real hardware, and happening in the market, not in an academic research lab.

Current solution paths for critical labor challenges in manufacturing, combined with emerging consumer grade mobile and manipulation robot platforms, are aligning in time with demand across all service industries for solutions to broader labor challenges. This will ultimately expedite entrepreneurial response resulting in many new robot companies, and more than one consumer laundry robot. Or, at least I hope so — I promised.