Enormous tech M&A deals have been announced recently: EMC/Dell, WDC/SanDisk, Lam-Research/KLC-Tencor. These follow a very busy year of large tech M&A, with Avago/Broadcom, Nokia/Alcatel-Lucent and Intel/Altera.

This year is shaping up to be a record one for M&A activity across all industries. As PitchBook points out in a recent report: “Even if total value slumps in 4Q to $320 billion — compared to $437 billion in 3Q — total deal value in 2015 will still eclipse $1.7 trillion.”

However, with the large number of multi-billion dollar mergers, there is a nagging feeling that the traditional tech buyers are doing fewer acquisitions of smaller VC-backed startup companies, acquisitions that usually close for a few hundreds of millions of dollars.

With Dell/EMC/VMware busy in their own deal, the number of smaller enterprise tech acquisitions will shrink even further. CB Insights points out here that, “There have only been 45 $100M+ exits in the first three quarters of 2015, which puts it on track to be the first year with less than 70 $100M+ exits since 2010.”

So, it’s interesting to look at some recent actual data via research firms tracking this activity. Given my interest area — enterprise tech/IT/software — I took a look at the specific buyers in this space.

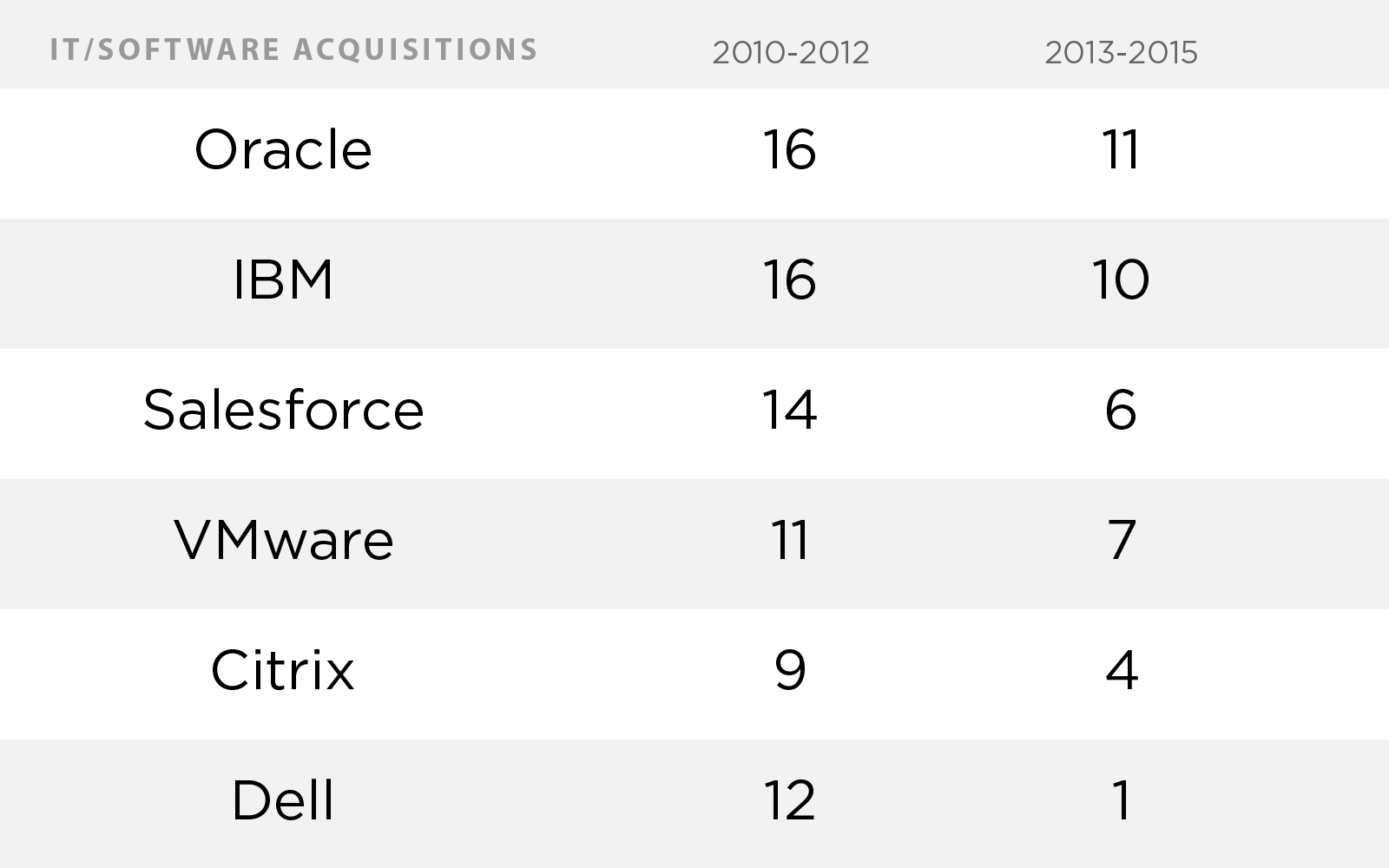

Looking at this PitchBook report from August, where they track transactions going back to 2010, and doing a comparison of the time windows of 2010-2012 and 2013-2015 (the report only goes up to the first half of 2015, so I added some recent deals announced up to the end of October 2015) reveals the following trends with IT/software buyers:

Accelerating Activity

Microsoft. Eight deals in 2010-2012 going up to 18 deals in 2013-2015, with the pace going strong over the last few months. Clearly with a new CEO and increased focus on cloud and security, Microsoft is very active in the market.

Cisco. Shows flat in the original report — eight deals in each period — but has accelerated over the last couple of months with five more deals, and recently three deals announced in three days. With a new CEO, increased focus on security and the fear of being left behind in the shifting landscape of IT, Cisco has the firepower to keep buying.

Steady Activity

EMC. EMC seems to be maintaining a steady pace of deals, and the Virtustream deal is a landmark deal for EMC in the fight to stay relevant in the cloud era. However, with the Dell merger (if it closes), it is pretty clear the deal pace for EMC and VMware will slow down.

Declining Activity

The last one obviously is not surprising, given Dell going private. HP does not show in the report, but their activity is flat and will probably decrease for a while until the new Hewlett Packard Enterprise company is back in buying mode.

So the picture becomes clear. With the exception of a few that can be aggressive and increase their activity, the rest are slowing down. Although cash balances are pretty healthy, there are many reasons for slowing down. Some companies are busy with sorting out internal activities. In many cases, expected M&A valuations have shot up considerably (a sign of the times), there has been activist involvement in some of the mature companies, etc.

With the decline of activity of the old guard, expect activity to ramp up for the new public companies of recent years: Box, New Relic, ServiceNow, Palo Alto Networks, Workday and Splunk, just to name a few. Some private companies have also become active in recent years: Dropbox, Docker and Cloudera.

Other existing players continue to be active, but on a smaller scale: Blackberry, Red Hat, SAP, Teradata, F5, Check Point, Symantec/Veritas, etc. Expect the large cloud/consumer players to do more IT/software deals: Google, Apple, Amazon and Intel.

The overall pace, however, is slowing down. Private startup companies should take the long-term view of building independent, lasting businesses.