Today Microsoft reported the financial performance it recorded during the first quarter of its fiscal 2016. Microsoft generated $0.67 in adjusted per-share profit off non-GAAP revenue of $21.66 billion in the three-month period.

Analysts had expected the Redmond-based software shop to earn an adjusted $0.59 per share, on revenue of $21.03 billion. Microsoft also reported GAAP revenue of $2.04 billion. By either metric, Microsoft shrunk compared to its year-ago first fiscal quarter in which it brought in $23.2 billion in total top line.

Update: I spoke with Microsoft about its non-GAAP revenue metric. In short, it’s a way for the company to demonstrate Windows revenue akin to how it did in the past, despite new accounting methods. Expect to see this as a recurring stat every quarter from here on out.

Second Update: Microsoft laid off 1,000 workers or so, quietly. News is out, however. Appears that the cuts were not constrained to a single group or location. The cuts are less than 1 percent of the company’s total staff. Still, it’s a lot of people.

Up around a point in regular trading, Microsoft is up sharply in after-hours trading following its earnings beat.

This earnings report marks a change for the company, which now disseminates its financial data under a new internal structure. The company now has 3.5 main business segments (Via a Microsoft slide deck that can be found here.):

- Productivity and Business Processes (PBP), which contains commercial Office revenue, consumer Office revenue, and Dynamics.

- Intelligent Cloud (IC), which contains service revenue and ‘Enterprise Services.’

- More Personal Computing (MPC), which contains Windows, Devices, Gaming, and Search.

- Corporate and Other, which contains everything else, and larger corporate functions.

Make sense? Let’s see how each did:

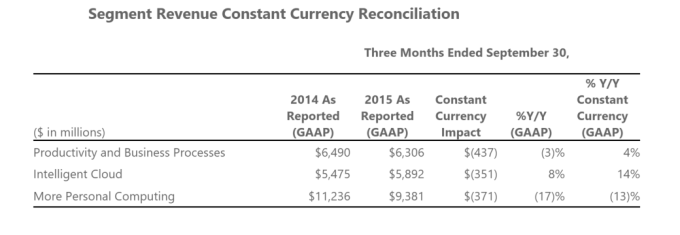

- PBP: $6.3 billion in revenue. Down 3 percent, year-over-year. Using constant currency, revenue from this group rose 4 percent comparatively.

- IC: $5.9 billion in revenue. Up 8 percent, year-over-year. Using constant currency, revenue from this group grew 14 percent.

- MPC: $9.4 billion in revenue. Down 17 percent, year-over-year. Using constant currency, revenue from this group fell 13 percent.

So, Microsoft’s growth divisions managed a mixed bag of expansion, while, as I think was expected, the Windows group took it in the shorts.

The company announced that its commercial cloud business is now on an $8.2 billion annual run rate. Office 365 consumer picked up 3 million new subscribers. Surface brought in $672 million in top line, down from its year-ago score of $908 million. Microsoft recently introduced new Surface hardware.

[findthebest id=”eFH2ziCqxr7″ title=”Microsoft Corporation (MSFT)” width=”700″ height=”484″ url=”https://w.graphiq.com/w/eFH2ziCqxr7″ link=”http://listings.findthecompany.com/l/9638071/Microsoft-Corporation-in-Redmond-WA” link_text=”Microsoft Corporation (MSFT) | FindTheCompany”]

Raw Numbers

In the quarter, Microsoft recorded GAAP operating income of $5.8 billion, and non-GAAP operating income of $7.1 billion. The company’s GAAP operating income fell 1 percent compared to the year-ago quarter.

Microsoft net income on a GAAP basis totaled $4.54 billion, inching up to $5.44 when using adjusted metrics. Compared to its year-ago quarter, Microsoft’s GAAP profit rose by 2 percent.

The company stressed the impact that shifting currency markets had on its performance, continuing a trend that we have seen from a number of companies that have multinational operations. Here’s the damage:

Forex headwinds are to business, of course, as the weather is to your local economist.

A Broader Look

There is a lot to parse in the report, which is more technical than usual due to the inclusion of various non-GAAP metrics, difficult comparative alleys, and, of course, a new structure. As such, I presume that today’s earnings call will be lively.

That said, Microsoft managed to land its numbers, and see its share price dramatically rise. Things can’t be too bad.