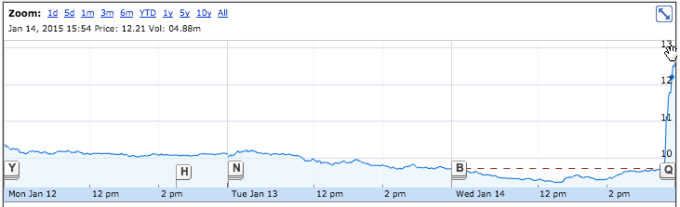

Here’s what happens to a company’s stock price when rumors hit the market that Samsung might acquire it:

This is a snapshot of BlackBerry’s public shares, which spiked nearly 30 percent at the very end of trading today after rumors spun that Samsung “recently approached” the company for a potential $7.5 billion pickup.

This is a snapshot of BlackBerry’s public shares, which spiked nearly 30 percent at the very end of trading today after rumors spun that Samsung “recently approached” the company for a potential $7.5 billion pickup.

Blackberry shot down the rumor quickly, stating with some emphasis, as TechCrunch reported, that it “has not engaged in discussions with Samsung with respect to any possible offer to purchase BlackBerry.”

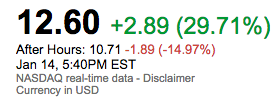

And then, the aftermath:

Expect the after-hour number to continue to grow — it’s up several points since I started to write this little post.

To put the rumored Samsung figure into perspective, even after skyrocketing by more than a fourth, BlackBerry remains worth just $5.56 billion.

Interestingly, BlackBerry did not even pick up $2 billion in market cap on the news. That highlights two things: First that investors were skeptical of the potential of the Samsung purchase as they did not send the firm’s shares very close to the rumored price. And second that BlackBerry’s base valuation is small enough, that when it pops, the raw dollar differential is somewhat muted.