The health-care industry in the U.S. is broken, and considering the industry itself represents some 18 percent of the U.S. economy, it’s a sizable problem. While other sectors have begun to adapt, health care has managed to resist change — particularly the technology-based variety. Meanwhile, 30 percent of total health-care spending in the U.S., or more than $750 billion per year, is wasted on “unnecessary services, excessive administrative costs, fraud and other problems.”

In other words, inefficiency comes with an enormous price tag.

With Obamacare on its way, a sense of urgency has grown around efforts to find (tech-based) solutions to the industry’s inefficiencies and high costs. Over the last few years, startup and investor activity has increased significantly, with investments in digital health businesses doubling from 2009 to 2011, and accelerating through 2012.

However, while startup and early-stage hacking (and investor awareness) in digital health is on the rise, it’s not all sunshine and roses. Rock Health’s report from earlier this summer showed that investments in the space have skewed towards later stages, exits are few and investors continue to dabble rather than make a handful of bets. Rock Health co-founder Halle Tecco attributes this to the prevailing perception among investors that it’s “still too early to be making major commitments.”

Furthermore, while other sectors have seen their Googles, Facebooks and PayPals — which, in turn, produced dozens of active angel investors — the “Facebook of digital health” has yet to emerge. “The emergence of a handful of key players in the market, or a few billion-dollar success stories, would go a long way” towards creating that active angel pool and inspiring the next generation of HealthTech entrepreneurs, Tecco told us at the time.

However, a recent news in the digital health space illustrates that things could be changing. After the SEC lifted its 80-year ban on “general solicitation,” allowing startups to publicly advertise their fundraising efforts, AngelList has begun experiments that could have big implications, like the recent launch of “syndicates.” Rock Health recently became one of the first accelerators to strike a partnership with AngelList, creating a special fund “through which accredited investors can now invest an equal amount of capital in each startup” from its most recent batch.

This will allow as many as 100 accredited investors to back each of its graduates at once, at a $10 million cap, in a convertible note. This could potentially give entrepreneurs greater access to early-stage capital without having to deal with the hurdles traditionally associated with raising money, in turn giving investors, which might have avoided investing in digital health startups otherwise because of the risk or unfamiliarity, access to a pre-validated portfolio of companies. Or at least that’s the idea. While there’s a long way to go, it could turn out to be a great opportunity for digital health startups to combat the dearth of early-stage capital and “nibbling investors.”

After all, amid this low angel activity, digital health startups have already begun to pursue alternative sources of capital, with an increasing number turning to crowdfunding. Rock Health reported this summer, for example, that 38 digital health campaigns raised more than $4.5 million across Indiegogo, Kickstarter, Medstartr and Fundable so far this year.

For the most recent quarter, the accelerator and its partners reported that 34 digital health campaigns closed in Q3 and raised a total of $2.1 million. However, crowdfunding remains a “hits business,” the report says, as 85 percent of crowdfunding campaigns in digital health fell short of their mark — at $20K.

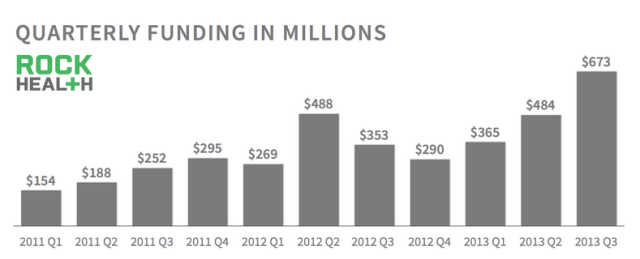

On the bright side, Rock Health’s third-quarter analysis found that venture funding is again on the rise, with $1.5 billion flowing into digital health so far this year. This means that funding is up 37 percent relative to Q3 2012 on a total of 145 deals since the first of the year. The space also saw an uptick of big investments from venture firms in Q3, with Evolent Health’s $100 million raise leading the way.

Furthermore, Practice Fusion, the free, web-based EHR provider, raised $70 million, while motion-tracking sensor maker, Fitbit, closed a $43 million round, connected health device startup, Withings, raised $30 million in July and Ayasdi, which offers a Big Data solution to help uncover insight (like more targeted disease treatment) for the enterprise and big health players, raised $30 million.

Sharecare, Jeff Arnold and Dr. Mehmet Oz’s social health engagement platform, which allows consumers and employees to access assessments, content and tools designed to personalize (and increase) engagement, also recently upped its capital backing to $91 million. According to CrunchBase, the company’s last (disclosed) investment was $14 million in January 2012. And, while the amount of round was undisclosed, Heritage Group has previously stated they “make individual investments of up to $15 million in early and growth-stage healthcare businesses,” which means that either its most recent round included more capital from other investors or the company has quietly raised over $60 million during the last few years.

More significantly, The Heritage Group has been looking to re-assert itself of late and emerge as a potential strategic partner and significant source of capital for digital health startups. The organization, which represents hundreds of hospitals across the U.S., says it invests in solutions that seek to “reduce cost, improve outcomes and increase the efficiency of healthcare delivery.” Its investment in Sharecare came days after it took the role of lead investor in Simplee’s $10 million series B round. As a result, the startup, which makes a mobile app and platform to help consumers understand and manage their health-care expenses, saw its total capital increase to just under $20 million.

While Heritage Group is a familiar name in the industry, a number of big players in the tech industry not usually thought of as health-care companies have been quietly tiptoeing (or diving) into the space. From Calico, Google’s new enterprise, which shows that the tech giant is eager to begin dipping its toes into the hunt for solutions to aging and disease-related problems, to Box, which, over the last year, has leapt into the digital-health space. Both, but especially the latter, could represent big opportunities for startups as these players begin to expand their footprints.

Box, as I wrote recently, has now partnered with dozens of health-care companies, secured HIPAA compliance and has made an equity investment in drchrono, a startup building a doctor-facing EHR platform for iPads. The company is looking to “leverage its cloud collaboration platform and growing ecosystem of mobile apps to give doctors and healthcare providers” a better way to securely exchange files, health records and collaborate in the cloud. Based on what we’ve heard from Box’s new Health Boss, Missy Krasner, the company is looking to play a bigger role in encouraging innovation at the startup level in digital health, starting with a developer challenge it launched last month.

Box, as I wrote recently, has now partnered with dozens of health-care companies, secured HIPAA compliance and has made an equity investment in drchrono, a startup building a doctor-facing EHR platform for iPads. The company is looking to “leverage its cloud collaboration platform and growing ecosystem of mobile apps to give doctors and healthcare providers” a better way to securely exchange files, health records and collaborate in the cloud. Based on what we’ve heard from Box’s new Health Boss, Missy Krasner, the company is looking to play a bigger role in encouraging innovation at the startup level in digital health, starting with a developer challenge it launched last month.

Companies like Accenture and Royal Philips are also trying to stir up innovation, albeit from a hardware, wearable-tech angle, recently unveiling a “proof-of-concept video as well as plans” to develop clinical apps for Google Glass. As mHealth News pointed out, the companies aren’t the first to see the health and medical “potential of Google Glass,” as Accenture/Phillips follow Qualcomm and Palomar Health into the world of Google Glass and mHealth, which recently launched a “Glassomics” incubator at Palomar’s new, futuristic campus in California.

With a dearth of seed capital facing digital health startups, beyond crowdfunding, accelerators and incubators have begun to pop up in greater numbers to fill the gap. Of course, the Accelerator Bubble isn’t always a good thing, and could act in much the same way noisy startup verticals quickly balloon with copycats and me-too businesses, rather than creating a real ecosystem and support network around their incubations — rather than Boiler Room, pop up-style shop that’s more front than substance.

However, along with Y Combinator and a few others, TechStars has become one of the more trusted names in the Accelerator World and seems to be taking the opposite approach to Y Combinator, attaching its name to a growing list of affiliates all over the country. (Not unlike Startup Institute.) Bringing another huge mobile company into startup incubation, TechStars recently announced that it is co-creating the Sprint Mobile Health Accelerator in Kansas City in tandem with, you guessed it, Sprint.

TechStars co-founder David Cohen said in a recent announcement that the accelerator will offer a three-month-long program, which is set to begin in March 2014. Startups selected to participate will receive up to $120K in funding — $20K of which will come from TechStars, up front, with Sprint offering an additional $100K in the form of convertible debt to those that graduate. TechStars will be running the program, while Sprint will provide “expertise and resources,” like mentorship, access to its carrier technology, APIs and testing labs, along with support from development teams and “a network of engineers at its corporate campus,” according to Xconomy.

TechStars co-founder David Cohen said in a recent announcement that the accelerator will offer a three-month-long program, which is set to begin in March 2014. Startups selected to participate will receive up to $120K in funding — $20K of which will come from TechStars, up front, with Sprint offering an additional $100K in the form of convertible debt to those that graduate. TechStars will be running the program, while Sprint will provide “expertise and resources,” like mentorship, access to its carrier technology, APIs and testing labs, along with support from development teams and “a network of engineers at its corporate campus,” according to Xconomy.

Techstars is running the program, while Sprint is providing its expertise and the resources available to a company with 53 million customers. That includes mentorship, access to its carrier technology and application programming interfaces, support from its development teams, and access to testing labs and network engineers at its corporate campus.

While it may appear to be another run-of-the-mill accelerator of late — in Missouri, no less — the city plays home to a handful of big technology and life sciences companies, like Garmin, Sprint and Cerner, as well as The Stowers Institute for Medical Research. It also happens to be the first market that Google chose for Fiber, its high-speed Internet infrastructure project, and is on its way to becoming a viable hub for tech startups.

To that point, Sprint’s involvement should represent another positive sign for digital (and mobile) health entrepreneurs, as the company recently hired a “chief healthcare executive” and has been making an effort to accelerate its existing remote monitoring and secure mobile network tools for health care. More importantly, both Verizon and AT&T have recognized the opportunity in the mobile health market and are launching their own remote monitoring and mobile solutions for health care.

The competition, by itself, is a good thing, but it also represents opportunity for entrepreneurs as big, enterprise players pour more capital and resources into digital health. For those building quality products, this could mean exit opportunities, or at the very least potential partners, for distribution and otherwise. What’s more, it probably won’t be long before these other big mobile players find a way to get into the startup incubation game themselves.

The list of HealthTech accelerators with the same kind of traction, brand recognition and network one associates with Y Combinator, for example, is small. Granted, most health accelerators are (at least) a few years younger, and Rock Health, Blueprint Health, Startup Health, DreamIt, NY Digital Health Accelerator and a few others have started to make some headway (particularly the first two). TechStars entering the fray makes sense, and is likely a sign of things to come.

The digital health space will be looking to Box, Google, Sprint and other established tech companies to act as resources, partners and perhaps even exit ramps to complement the traditional list of institutional investors. The industry is still in search of a few big exits or IPOs to coax more angels into the ring, and with close to (or more than) $100 million in capital in their tanks, companies like Practice Fusion, Audax Health, Sharecare, Castlight, Care.com, 23andme and Zocdoc need to step up to the plate.

In the meantime, support from alternative sources of capital, like crowdfunding, AngelList and accelerators may very well provide the bridge to keep innovation alive in the industry. Plus, the backdrop and context surrounding the industry should be looking more and more appealing for founders looking to start building. The government-backed health exchanges are now live (and a total mess), Obamacare will be going into full effect in a couple of months, bringing a laundry list of digital imperatives — and changes as a result — to the industry. This is confusing for startups, and some are already trying to find a solution.

Two other significant pieces of news to consider: Amazon Web Services is now available to U.S.-based health care entrepreneurs, who were previously legally unable to use these key development tools and the FDA has finally put out its final guidance on what type of mobile health apps. MobiHealthNews has a great rundown, which is a must read for digital and mobile health entrepreneurs — a lot of it isn’t necessarily surprising, but a number of questions as to what kind of cases/apps the FDA won’t be regulating are now much more.