Flipkart, the largest e-commece site in India, has been likened to Amazon both for what it offers and its presence in the market. But it has one crucial difference: because credit cards are not that ubiquitous, and Indian consumers generally distrust the idea of paying online, Flipkart has built its business on a cash-on-delivery model; one where users order books, electronics and more online but pay after the goods are at their door. Now — flush with another $200 million in funding — Flipkart’s using its muscle to spread its e-commerce tentacles to try to change all that. To cash in on India’s growing changing spending habits it’s investing in PayZippy, which first opened for business in July as a direct merchant solution and later this year will arrive as a digital wallet that will open up to consumer purchases.

For Flipkart, which last year sold $500 million worth of merchandise and pledged to double this by 2015, managing payments is an irresistible — and must-win — opportunity.

E-payments is an ambitious idea in a market where there is only 20% credit card penetration, according to a 2012 HSBC report, with a lot of problems still existing for those who do want to use them online (more on that below). That’s not all. There are already a number of other startups also looking to move in on this emerging space who are struggling to comprehensively convince entrenched merchants, banks and consumers that this is the way forward.

The move comes as U.S. giants like Amazon and eBay move further into targeting the Indian market, and payment companies like Visa and Mastercard continue to push ahead with their own digital wallet schemes. In that regard, Flipkart’s move is as defensive as it is disruptive.

Flipkart’s payments and digital services head Mekin Maheswari said it will launch the PayZippy digital wallet as a consumer product in the next few months. Initially, this will take the form of a pre-paid wallet that customers top up and use to purchase online from Flipkart and partner websites — which would be linked to a user’s bank account or credit card.

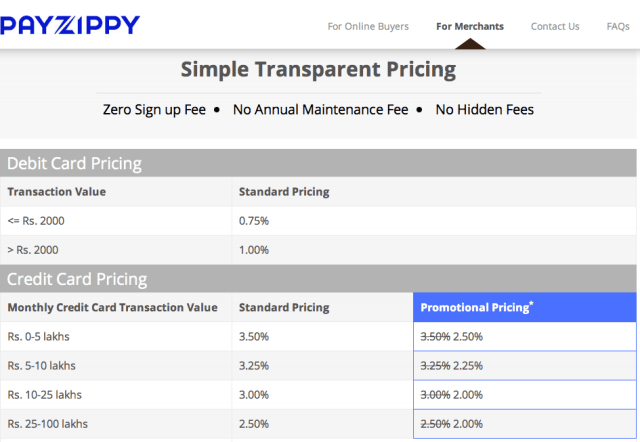

First, it’s laying some groundwork with a system for merchants that it launched on July 3, offering them card processing facilities and promising higher conversions via fewer checkout abandonments, and will soon allow them to accept payments from customers’ bank accounts. It aims to sign up 2,000 merchants by March 2014.

First, it’s laying some groundwork with a system for merchants that it launched on July 3, offering them card processing facilities and promising higher conversions via fewer checkout abandonments, and will soon allow them to accept payments from customers’ bank accounts. It aims to sign up 2,000 merchants by March 2014.

When the full wallet launches for consumers, Maheswari says the product will be able to use a single password to enable a payment — much like other digital wallet services. They’ll adhere to the Reserve Bank of India’s mandate that all online transactions be authorised by two-factor authentication, but do it better than today’s botched efforts. For example, instead of sending an authorisation code via SMS, the mobile device itself could be used as a credential.

Credit cards have been a double-edged plastic sword for India’s e-commerce industry.

Last year, Indians’ average monthly credit card spending grew to $100 a month, the first increase since 2009, and 42 percent higher than the two years ago. The banks have also been issuing more cards in recent years, including 19.6 million in the 2013 financial year. In 2008, research firm Celnet said that payments via electronic channels grew 60% in the preceding three years, and predicted they would grow to about $180 billion by 2010, when there would be about 210 million cards in circulation (40 million credit, 170 million debit).

However, the fact remains that cash-on-delivery still constitutes about two-thirds of Flipkart transactions, while only contributing 50 percent of sales, Maheswari said. Conversely, credit cards and online payments make up 30 percent of transactions but contribute 50 percent of revenue. And that’s the key: those who buy on Flipkart using credit cards are willing to spend more, while cash customers spend less. So Flipkart needs to cultivate this to achieve its lofty revenue goals, which it predicts to hit $1 billion in gross merchandise sales by 2015, and satisfy investors — who last month tipped another $200 million into the company.

In that regard, PayZippy has been borne out of necessity: it’s much more likely customers will spend money if they don’t have any friction to it at all, and can pay on credit.

Payments: The Final Frontier

While Amazon recently launched a fulfilment-only marketplace, and Myntra recently guaranteed deliveries in under an hour, Flipkart has set its sights on a bold new horizon.

The problem is that Indians, these days, are effectively punished for using credit cards.

Amongst Flipkart’s customers, one in every three credit card transactions fails, Maheswari said. A major reason for this stems from the implementation of the Reserve Bank of India’s (RBI) two-factor authentication mandate. Typically, banks will extend their legacy technology systems, which weren’t designed to manage online payments.

“The most popular method is Verified By Visa but it’s very painful for a customer to set up a password. Customers are redirected to five different screens and websites from different providers which, given the connectivity in India, is a major challenge,” Maheswari said. “The problem is a combination of tech on the provider’s end, connectivity at user’s, and solution itself.”

“We respect a large part of the regulations and believe the idea behind TFA is right. You would want to protect your customers and, in a country like India, that’s important but we believe that in today’s world there are ways of doing TFA intelligently.”

Flipkart and payments startups such as CitrusPay are starting to win that battle but are facing new attacks on different fronts.

Jitendra Gupta, CEO of Sequoia-backed CitrusPay, has spent the past six months convincing merchants of the value of surrendering customer data in exchange for an easier buying experience.

“We faced huge resistance but the good thing is we don’t have a conflicting business so merchants trust us,” Jitendra said, in a thinly-veiled dig at his rival.

Both parties agree the war will be won when they convince India’s rigid banks to get on board.

Here, Flipkart will deploy its goodwill.

“All banks have seen us go from near zero to the size we are today so the Flipkart brand helps quite a bit,” said Maheswari, who travels at least once a fortnight to meet potential partners in India’s business hubs of Delhi and Mumbai. “We have strong relationships with the banks and a lot of them are considerably business-hungry and want to grow. PayZippy can help them achieve that.”

The competition

Flipkart is not alone in understanding this. In fact, you could say it’s late to the party.

There’s PayU, BillDesk, and CCAvenue, just to name a few.

And CitrusPay, one of the early movers who has developed a merchant agnostic platform, generating impressive organic growth. Its online payment system CitrusCheckout is processing about 1 billion rupees ($16 million) per month, and in July crossed the one million monthly transactions milestone. About 800 merchants use the system, and it has signed up about 500,000 end consumers, who don’t have to enter their payment details when shopping at affiliated sites.

On average, 15,000 consumers use CitrusCheckout every day, spending about 1,000 rupees ($17) each time, and founder Jitendra Gupta said the biggest demand for payments is from government and utilities customers, while e-commerce didn’t even constitute 10 percent of the spend. He was sceptical that an online shopping firm could scale its product in a market where three to four players share the majority of the market share.

On average, 15,000 consumers use CitrusCheckout every day, spending about 1,000 rupees ($17) each time, and founder Jitendra Gupta said the biggest demand for payments is from government and utilities customers, while e-commerce didn’t even constitute 10 percent of the spend. He was sceptical that an online shopping firm could scale its product in a market where three to four players share the majority of the market share.

“These players are not going to use Flipkart payment services. If you’re targeting 10 percent of online payments, and out of that the top four players don’t want to use it, then where will it gain acceptance? Gupta said.

“Unlike the US or China, there is no depth in the e-commerce market here.”

Flipkart’s Maheswari said initially PayZippy will target the high-volume businesses of entertainment and travel bookings.

PayZippy, in a sense, is one of the classic examples of how tech companies that have grown far beyond the startup phase continue to try to find ways to remain innovative and disruptive anyway. All the same, this has not been a quick project. Maheswari says that the genesis for the idea came three years ago, from a hallway conversation about payments. Fast forward to about six months ago, Maheswari got selected to lead a team of 40 engineers to finally start work on the project. They moved into a building adjacent to their main offices and now essentially work as an autonomous, fully-funded start-up tasked with soon releasing a product that allows consumers to safely and conveniently transact online.

Despite all its efforts to date, it seems like the hard work has just begun.

“We do have the large advantage of Flipkart’s backing, and it helps to have such a strong anchor merchant who is willing to try things out and work with you to help in creating better payment solutions,” Maheswari said.

Image: Flickr