Unless Specific Media hits a home run with the new streaming music service it’s raising $50 million to pivot Myspace into, its bargain basement buy of the social network for just $35 million in 2011 could be a disaster. Slides attained by Business Insider shows Myspace will lose $43 million in 2012 on revenue of just $15 million. Yet somehow it thinks the notoriously tough music biz will save it.

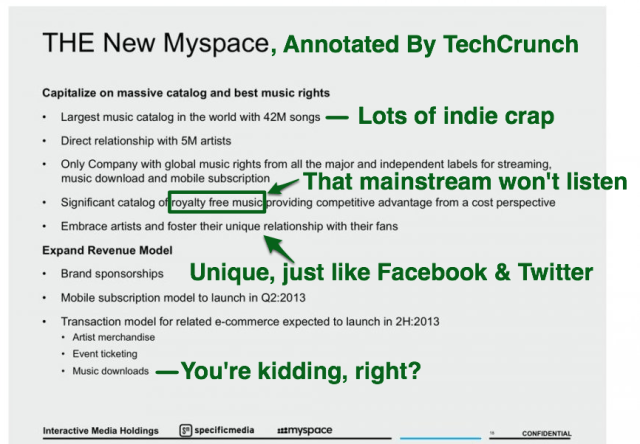

The pitch deck outlines how Specific Media, now known as Interactive Media Holding, thinks it can turn Myspace around by morphing it into a Spotify and Pandora competitor. It’s betting it can win because of the Myspace brand association with music and the fact that 50% of its streaming plays today come from unassigned artists it won’t have to pay royalties to.

It would have to win big because Myspace is hemorrhaging money. News Corp took a nasty hit buying Myspace for $580 million in 2005 when it was still growing fast. But Myspace’s core tech was rotten, and its lack of the real-world social graph let Facebook quickly usurp it. Myspace sunk like a stone, and News Corp ended up selling it to Specific Media for a lousy $35 million last summer.

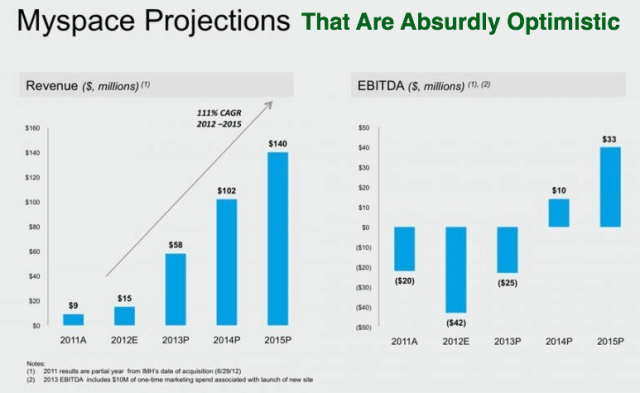

That might sound cheap but it came with a lot of baggage. Myspace now has 700 employees it has to pay, leading it to lose $20 million in 2011 on revenue of $9 million. Traffic has increased a bit since a redesign at the end of 2010. It managed 28 million monthly uniques by August 2012, up from 23 million in December 2011. But with $15 million in expected revenue and an EBITDA net loss of $43 million in 2012, the streaming music service it’s raising money for would have to rake in cash for Interactive to salvage the acquisition.

Sadly, I don’t think that will happen. If you want to bring the world affordable music, sure, go ahead and launch a streaming service. But if you’re trying to make money, you might be singing out of key. Even if it gets to escape significant royalty fees by streaming unsigned music, the jams you do have to pay the record labels for are pricey. The equation only works at massive scale with a huge ads sales team and lots of paying subscribers.

If the model wasn’t weak enough, Myspace would have to compete with the well-established Pandora and Spotify, which are becoming household names for personalized Internet radio and on-demand streaming music respectively. And they’re both losing money! Pandora had a net loss of $20 million in Q1 2012, and Spotify, despite all the label-backing, could lose $40 million in 2012. Plus there’s Apple’s iTunes and the radio service it’s rumored to launch.

And for a final piece of pessimism, there’s no way that Myspace could keep unsigned music accounting for 50% of its plays if it scales. The indie music fan base just isn’t that large. A fair amount of these too-cool-for-pop music cats are either already using Myspace, or are allegiant to blogs like Pitchfork that provide bleeding edge music discovery and curate out the crap.

This all makes the projections in Myspace’s pitch deck nearly laughable. It thinks it will lose just $25 million next year, be making $10 million by 2014, and printing $33 million on $140 million in revenue by 2015. I’m not counting Myspace out. There’s potential for it in spaces like meeting new people or customized content feeds, but streaming music? That’s pretty hazy.

Let’s face it. If you were a 23-year old Myspace-loving music discovery junkie in the site’s heyday, you’re 30 now, and probably aren’t desperately seeking the latest buzz bands like you used to.