eBay has made it fairly clear that mobile is the future for e-commerce. And the numbers only reinforce this strategy- mobile payments are poised to reach $200 billion by 2012, according to Juniper Research. So, of course, eBay is wants to make its crown jewel, PayPal, the leader in the mobile payments space. In fact, PayPal’s mobile transactions have grown as smartphone usage has increased, from $25 million in 2008 to $141 million in 2009. In 2010, PayPal expects more than half a billion dollars in mobile payment volume with more than 5 million members regularly using PayPal from their mobile devices. Today, PayPal is making it easier for merchants and consumers to pay for goods on their smartphones with the launch of Mobile Express Checkout.

eBay has made it fairly clear that mobile is the future for e-commerce. And the numbers only reinforce this strategy- mobile payments are poised to reach $200 billion by 2012, according to Juniper Research. So, of course, eBay is wants to make its crown jewel, PayPal, the leader in the mobile payments space. In fact, PayPal’s mobile transactions have grown as smartphone usage has increased, from $25 million in 2008 to $141 million in 2009. In 2010, PayPal expects more than half a billion dollars in mobile payment volume with more than 5 million members regularly using PayPal from their mobile devices. Today, PayPal is making it easier for merchants and consumers to pay for goods on their smartphones with the launch of Mobile Express Checkout.

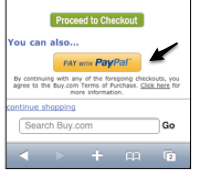

Mobile Express Checkout is the mobile version of PayPal’s Express Checkout service, which is a one-stop payment option streamlines the checkout process for consumers. A buyer will not have to reenter shipping, billing, or payment information for a PayPal payment, expediting the checkout process. All they need to do is enter their PayPal account login. It’s similar in theory to Amazon’s one click ordering option.

Merchant Express Checkout has been optimized for smartphone screens and also features strong fraud detection, says PayPal. Mobile Express Checkout is initially being rolled out on the iPhone and Android 2.0 (and higher) devices by a few retailers, including Nike and Buy.com, over the next few weeks. The technology will eventually become available to all retailers in the next few months.

PayPal sees this new mobile technology has an opportunity to allow the company’s 85 million members to easily buy goods on their phones using PayPal’s technology versus inputing a credit card. The company is sure to be on to something with this strategy-inputing your credit card, shipping and billing info on a phone is an arduous and time consuming task.

Automating this process is surely the future of mobile payments and shopping. Of course, it’s safe to assume the credit card companies, like Mastercard and Visa, will also be heading down this road soon.