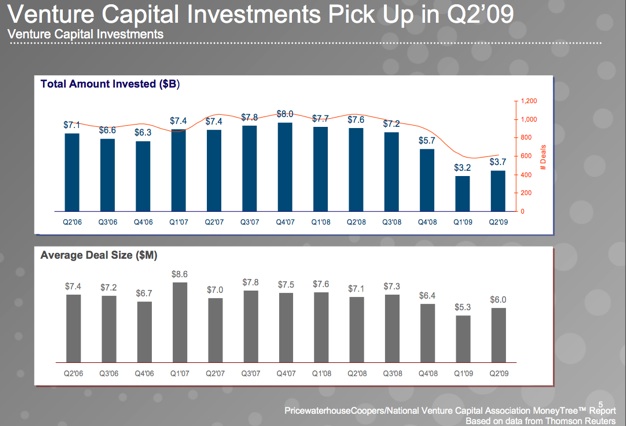

Venture capital dollars going to startups in the U.S. stabilized in the second quarter at $3.7 billion, according to the latest MoneyTree Report from PricewaterhouseCoopers and the National Venture Capital Association. The venture money invested in the quarter is still only about half of what it was a year ago (when it was $7.2 billion in the second quarter of 2008), but is 15 percent above the low point in the first quarter of 2009 (when it was $3.5 billion). All in all, VC investments are trending at mid-1990s levels, which isn’t such a bad thing.

The average deal size came up a little bit to $6 million, from $5.3 million last quarter. Seed and early stage investing picked up after venture capitalists fled to the perceived safety of later-stage investments in recent previous quarters.

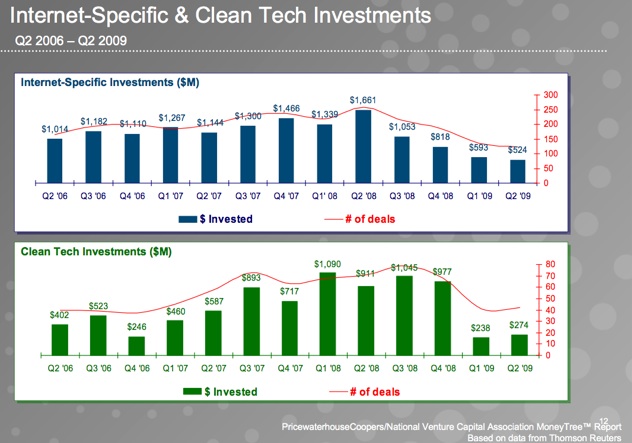

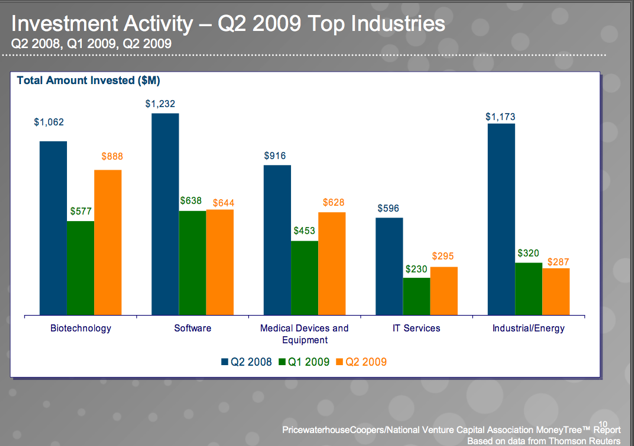

The rebound, if you want to call it that, hasn’t hit the Internet sector yet. Internet deals brought in only $524 million in the quarter, down from $593 million the quarter before and $1.7 billion a year ago. Clean tech isn’t doing so hot either, with only $274 million invested during the second quarter compared to $911 million a year ago. Most of the action came from biotech and medical devices, which saw bigger jumps in funding during the quarter to $88 million and $628 million, respectively.

Remember, this is only one source of data (most of it from Thomson Reuters). We actually measured nearly twice the dollar amount of venture deals during the quarter on CrunchBase, which we’ll share more fully soon.