As the pandemic endures, a global shift toward digital operations is underway to provide people and businesses with access to the services they need to grow and thrive. This trend is particularly crucial to fintechs that are working to ensure that the 3 billion people who are financially underserved globally can gain access to economic opportunities as the world rebuilds.

The cohort of winning startups heading up this year’s Inclusive Fintech 50 (IF50) competition — sponsored by Visa, MetLife Foundation, and Jersey Overseas Aid & Comic Relief, with support from Accion and IFC — demonstrates the critical role that innovation is playing in providing financial solutions to low-income customers and micro and small enterprises, particularly as they recover in response to the pandemic.

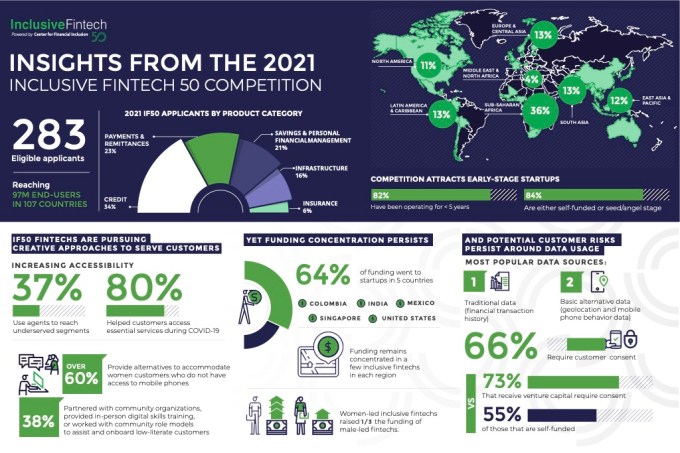

Now in its third year, IF50 recognizes 50 promising early-stage fintechs that are driving financial inclusion and resilience around the world. Managed by the Center for Financial Inclusion (CFI), the competition is an annual opportunity not only to identify outstanding inclusive fintech startups, but also to investigate opportunities, gaps, and risks in outreach, solutions, and investment. This year, IF50 received applications from nearly 300 eligible startups, together reaching over 97 million customers in 107 countries and accounting for $895 million in total funding raised.

Image Credits: Center for Financial Inclusion (opens in a new window)

CFI conducted an analysis of the information provided by these applicants and has just released an insights report, available here. The analysis found that, in light of the pandemic and the need to socially distance, inclusive fintechs grew in their numbers of active users, benefiting from a global shift toward digital operations. For example, inclusive fintechs offering payments and remittances services, which accounted for 23% of the applicant pool, grew their pool of active users by 12% a month (median compound monthly growth rate), while active users of savings and personal financial management solutions grew by 9% a month. Inclusive fintech solutions not only helped users access services remotely, but also went further in helping users during difficult times; 80% of the applicants reported that their solutions helped users access essential services like cash transfers and healthcare during the pandemic.

CEO of Accial Capital, Jared Miller, who served on the judging panel for the competition, observed, “The winners of this year’s Inclusive Fintech 50 have stepped forward during COVID 19 to responsibly serve a growing set of underserved consumers and MSMEs. Today, these tech-enabled, specialist firms foster financial wellness and resilience in a uniquely challenging operating context. They are beacons of inspiration for stakeholders and an emergent set of entrepreneurs looking to solve some of the world’s most pressing challenges.”

The IF50 applicants serve vulnerable users across a range of five product categories: payments and remittances, savings and personal financial management, insurance, credit, and infrastructure. They also serve a range of user groups, from refugees to small businesses to women. Many also provide solutions to institutional clients; analysis of the application group found that 23% of applicants leverage B2B (business-to-business) models, largely in South Asia and East Asia and the Pacific. In addition, 40% of applicants specifically serve micro and small enterprises, offering them solutions to grow sales, ease costs, and manage risks. For example, one of the IF50 winners, Tugende, provides financing, training, medical and life insurance, and other support to moto-drivers working in the ride-hailing and messenger sectors.

While the applicant pool included fintechs well-distributed across several product categories and user groups, the group exhibited concentration in age, funding stage, and region, as has been noted in previous years. Nearly 50% of the fintechs were younger than two years old, 82% younger than five years, and 84% reported they were either self-funded or at the seed/angel stage. More than 100 applicants were from Sub-Saharan Africa, while no other region had more than 36 applicants.

Funding flows also demonstrated concentration: five fintechs accounted for 83% of funding reported by applicants based in Latin America and the Caribbean and 65% in Sub-Saharan Africa. Funding flows were also concentrated in a small number of countries; 64% of funding went to startups in five countries (Colombia, India, Mexico, Singapore, and the United States), while funding per user was lowest in Sub-Saharan Africa. Funding flows are also concentrated among startups led by men, which demonstrated substantially larger deal sizes than women-led inclusive fintechs.

Among fintechs that serve end-users (B2C and B2B2C models), only 67% were able to report usage by women as distinct from that of men. Fintechs led by women were more likely to have sex-disaggregated data (77% of women-led fintechs versus 62% of men-led) and were more likely to explicitly target and serve more women customers. Among the 10 fintechs that reach the largest share of women, nine were led by women. This may be because women leaders may be more willing to invest the time and effort it takes to target women users.

The CEO of Oraan, Halima Iqbal notes, “We pay attention to where our women customers are — what they do, what their life looks like, what they need. When designing products, we looked to build with our women customers rather than around them, so that our products are culturally, religiously, and socially acceptable.” Additionally, the number of women-led IF50 winners has increased each year – this year, applications from women-led fintechs accounted for 27% of the pool, but constituted 36% of the winners.

Although the startups demonstrate creative new ways to reach users, there are a few areas that deserve greater attention in furthering the quest for financial inclusion. To start, while there is growing use of traditional and alternative data, those efforts could go farther, particularly for designing and targeting products for women, especially since fintechs report that female users often have similar or higher usage rates than men. Similarly, startups should do more to develop better protocols around customer data and consent, especially in the context of low financial and digital literacy among users. Finally, even as women-led fintechs perform at high levels, they raised one third of the funding of men-led fintechs. In addition to targeting women founders, investors should also expand their focus on markets and startups that are earlier-stage and represent opportunities for growth and impact.

The IF50 competition provides a valuable opportunity for investors to learn about new models and inclusive startups, and for startups to take inspiration from their peers.

Brad Jones, the CEO of Wave Money and a judge of the 2021 IF50 competition, says, “When funding is concentrated in fintechs operating in just a few places, we miss the opportunity to support those that are developing solutions closely aligned to the needs of the customers they aim to serve”.

In all, the competition and this year’s insight report demonstrate that fintechs can play an important role in advancing financial inclusion, particularly in difficult times like those created by the pandemic.