Sponsored by

October 15, 2019

At Brex, we are in the fortunate position of being able to make information available to help entrepreneurs make more informed decisions than the ones we made when we were first getting started. As the financial operating system for our customers, we’re uniquely positioned to understand the way startups operate based on the way they spend their capital. We can look at the aggregate, anonymized spending data to get a good sense of how startups work and the tools they use the most.

The wisdom of the crowd might not always be correct when it comes to deciding which products to use. But it’s a good thing to consider before making a decision, such as adopting a certain kind of CRM, that may have lasting consequences.

How much are startups investing in growth each month?

Successful startups invest heavily in growth. They have to hire the right people, buy equipment or software, and maybe even pay for excess server capacity to keep a product or service from crashing. Growth isn’t cheap—and that spending fuels the venture capital and startup industry.

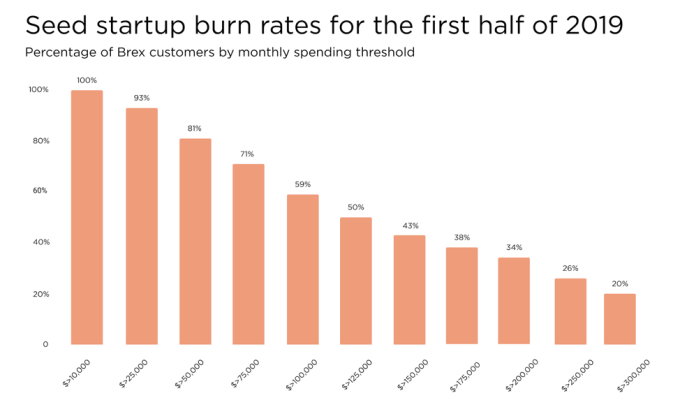

We analyzed Brex data to help provide at least one benchmark for startups to consider. Brex companies consist primarily of early- to mid-stage startups at stages we have classified by specific amounts of funding. Startup burn rates may vary considerably, and falling above or below the median isn’t necessarily bad—it’s just one of many data points startups can consider when thinking about their operations.

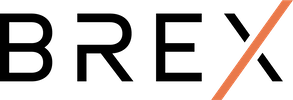

We found the median spending rate for pre-seed Brex customers remained mostly unchanged between the first and second quarters this year.

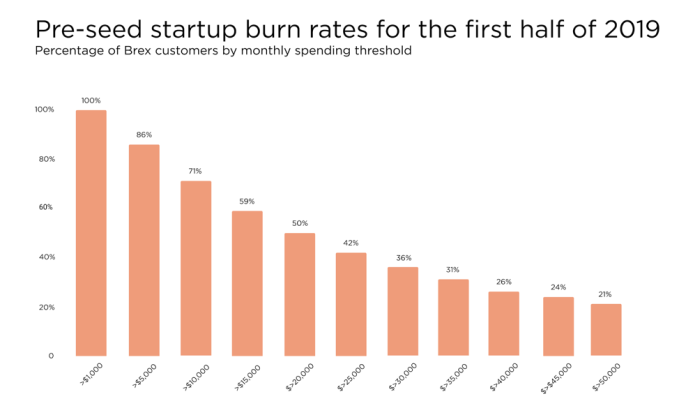

Startup growth for seed startups revolves around the customer’s schedule—and seasonality may be an even more critical factor in determining startup burn rate. We found the median monthly burn rate for seed-stage startups increased slightly between Q1 and Q2 this year.

Cloud computing and advertising top startup expenses

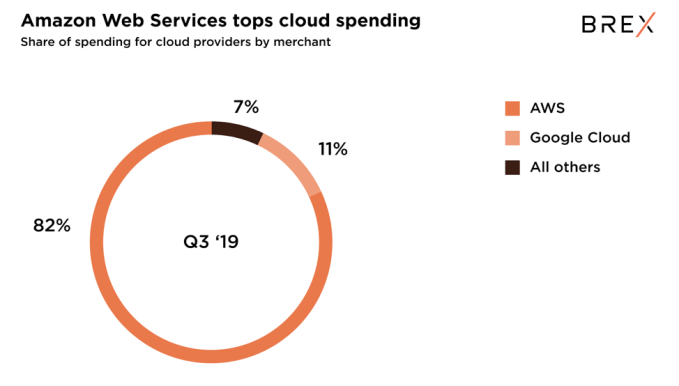

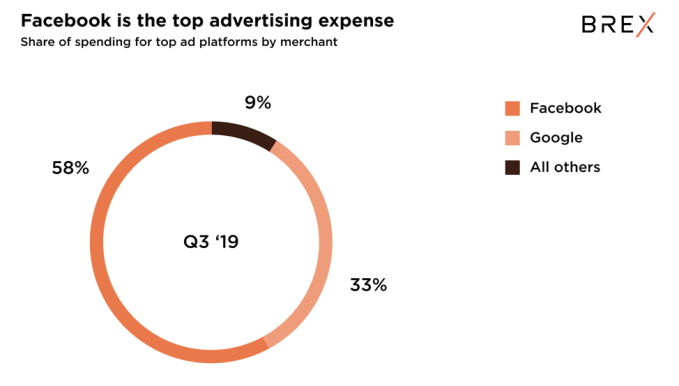

We found in the first half of 2019 that more than 10% of all Brex startup customer spent goes toward cloud services, and nearly 20% of spent goes toward advertising and marketing. And in those expenses, there are two clear winners: Amazon and Facebook.

Amazon Web Services captures the majority of startup spending on servers. After all, it effectively defined cloud computing. Long-tail server products include Heroku, Rackspace, and others.

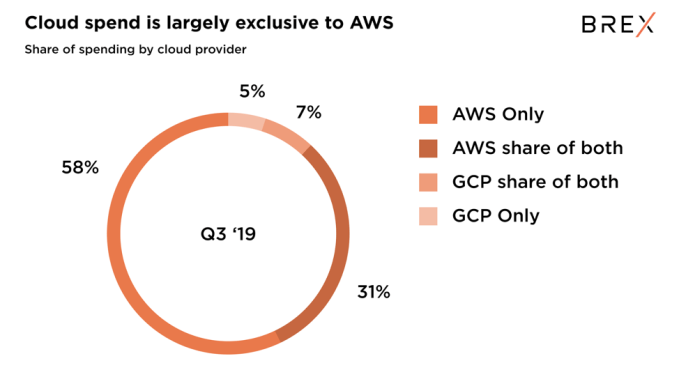

Among those top two, the majority of spending goes exclusively to Amazon Web Services. Startups are certainly giving both a try, but Google has a lot of room to grow.

Facebook and Google have the benefit of having been around for more than a decade. Advertisers generally know what to expect when they insert a dollar into Facebook or Google. That means that many of the other top social platforms like Pinterest and LinkedIn still have to work to capture that spend away from the top two.

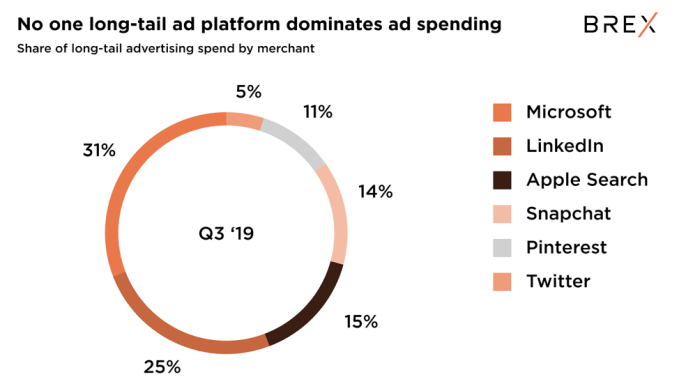

When you dig into the long tail advertising products for other major platforms and networks, you see that there isn’t any one major leader. Each platform pitches itself as an alternative that can reach a different kind of user behavior than Facebook or Google.

How startups are getting around the city

Employees need to get out of the office to do their work. Startup travel expenses, including ridesharing usage, will only start to pile up more as companies grow and expand their operations beyond their home base.

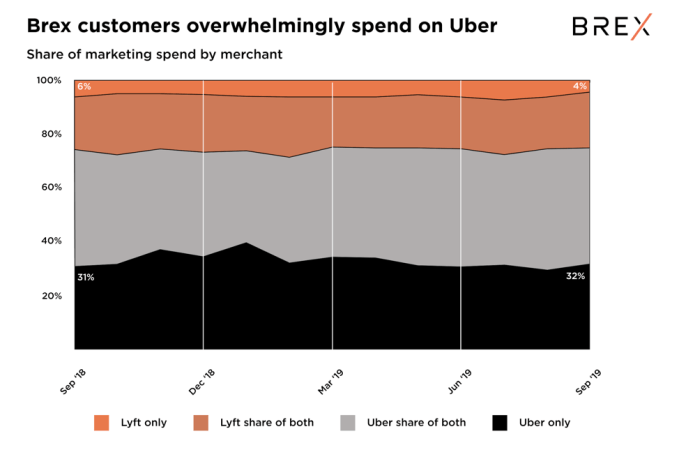

Uber is a substantially larger company than Lyft, and Brex customer spend reflects that. But Uber is also winning when it comes to “loyalty”—spending that goes exclusively to Uber.

More than 30% of Brex customer spending goes to Uber exclusively, where Lyft is out of the picture altogether. That loyalty spending has also remained mostly unchanged over the past year.

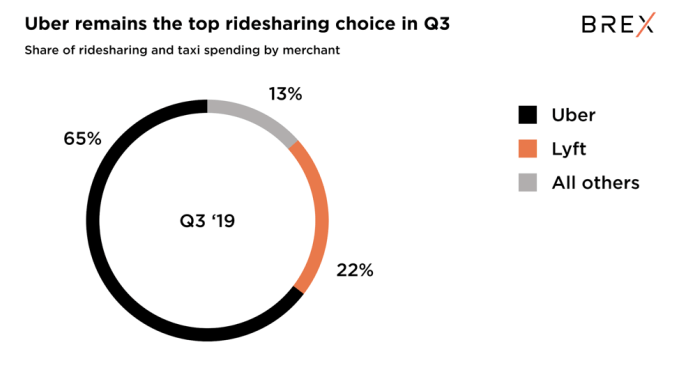

While Uber is the top choice for getting around in general, there is still a significant amount of usage in other products like taxis or micro-mobility like scooters.

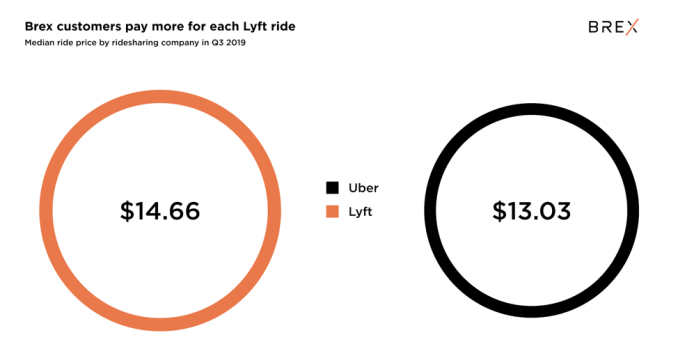

When looking at transactions at an aggregate level, we can see that a typical Lyft ride is more than $1 more expensive than an Uber ride. On paper, this might seem like a small difference—but once you start getting into the tens (or hundreds) of thousands of trips, that starts to add up.

What’s in the typical startup’s toolkit?

It’s easier than ever to get a company up and running thanks to Amazon Web Services and other cloud service providers. Startups can take advantage of the hundreds of other cloud services that make it easier to run a business. Companies like Salesforce, Atlassian, and others have created all the tools necessary to keep a company operating efficiently. And there are now even companies that can quickly provide office space for the earliest-stage companies—even if it’s just two desks.

The top tools startups use to run their business:

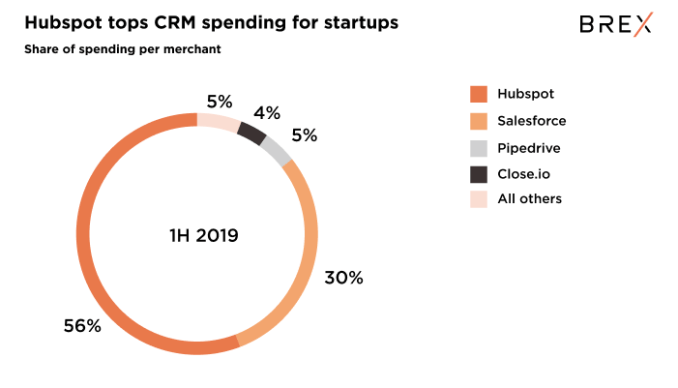

Hubspot, which builds a suite of extra tools on top of what starts as a free CRM tool, is ahead Salesforce and others in startup CRM spending.

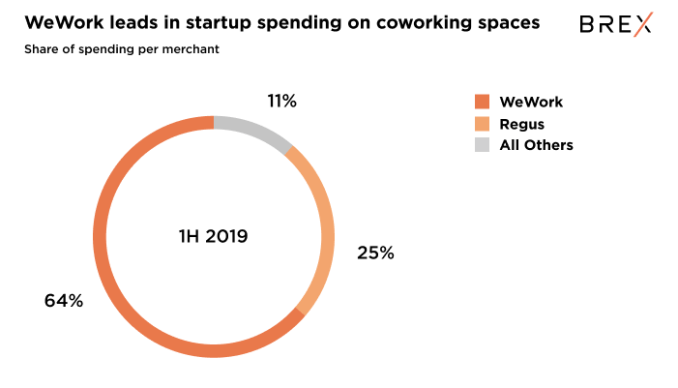

We found that WeWork has a considerable amount of competition in the form of Regus and a long tail of independent coworking spaces.

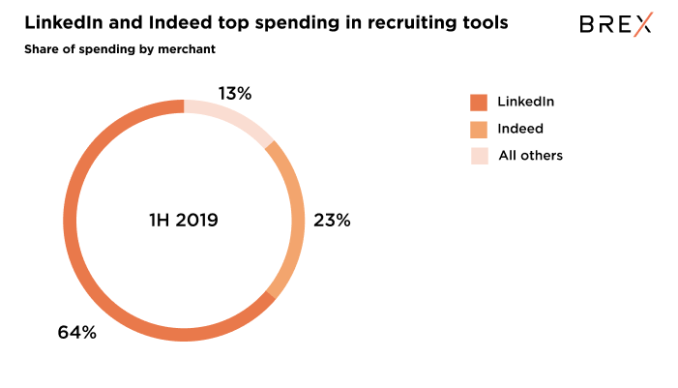

LinkedIn and Indeed, two talent acquisition platforms that have been around for more than a decade, capture the majority of startup spending in recruiting.

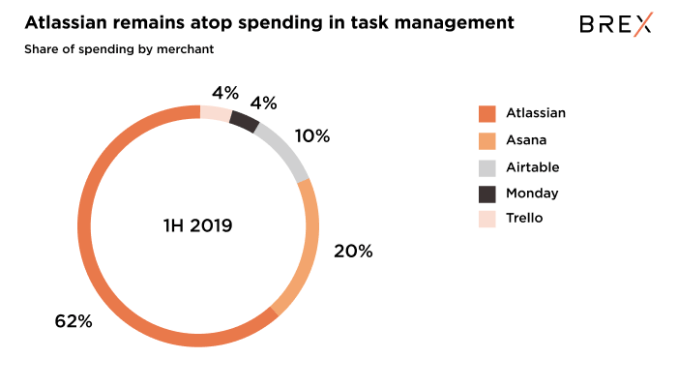

Asana is gaining momentum for spending on task management tools, which is dominated by Atlassian.

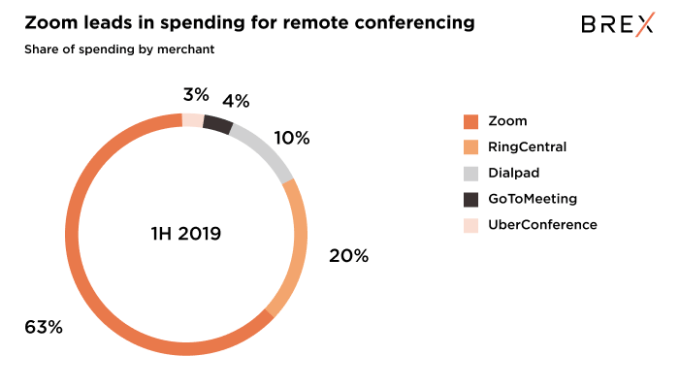

Zoom, which went public earlier this year, is the top telephony expense for all Brex customers.

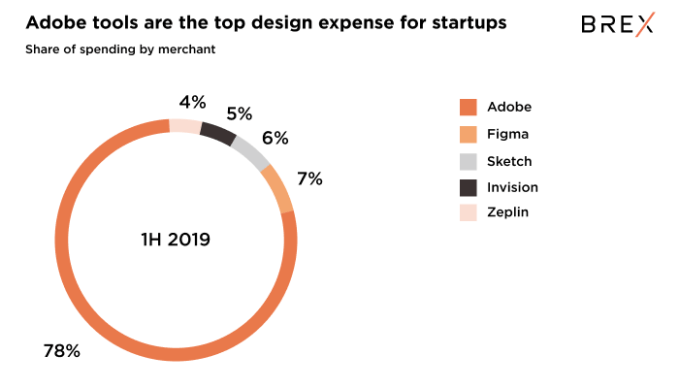

Adobe’s suite of design tools, which includes products like Photoshop and InDesign, is still the top choice for Brex customers.

The tools ecommerce companies use to their business

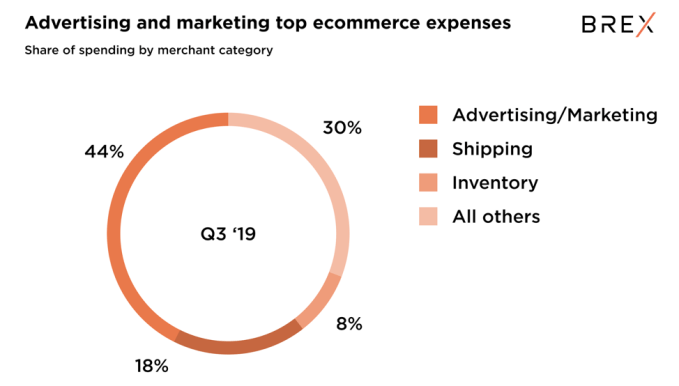

Advertising and marketing spend once again topped expenses for Brex ecommerce customers in the third quarter. In the first half of the year, around 39% of all ecommerce spend went toward advertising and marketing. That rose to 44% in the Q3 this year, while shipping and inventory costs remained the number two and number three expenses.

As usual, it’s hard to argue against a known quantity when it comes to advertising. Ecommerce companies need to get in front of their customers early if they’re going to capture a sale down the line—especially if they’re competing against multiple products. They also need to make sure their products arrive on time and meet customer expectations.

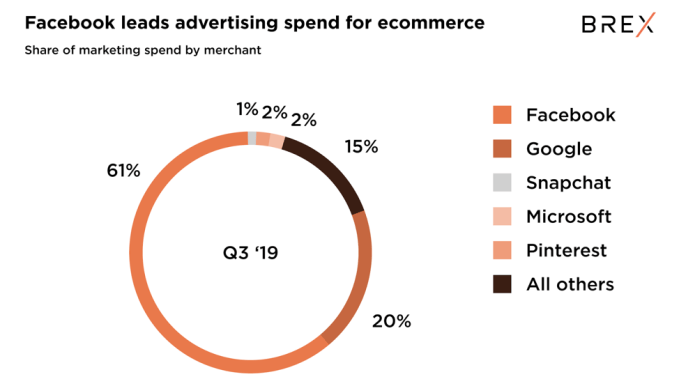

Pinterest and Snapchat once again made an appearance among the top spend for Brex ecommerce customers. They offer a different avenue to capture the interest of consumers. Pinterest, for example, tries to position itself as offering advertisers a way to attract attention in a different kind of customer life cycle. Snapchat, meanwhile, may be able to provide a highly engaged audience.

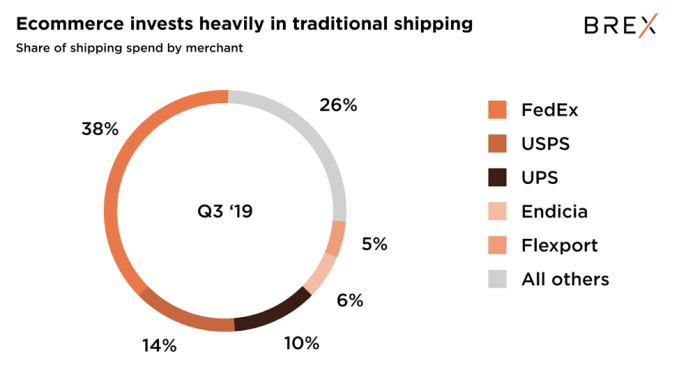

Shipping and operations expenses are also a substantial part of spending for Brex ecommerce customers. FedEx is still the largest shipping expense for Brex customers. But we also saw an uptick in usage of Flexport and Endicia in the third quarter this year.

Visit the Brex Content Hub to take a deeper dive into many of the data points covered here.

This information brought to you by Brex