Just two months ago, NFT trading platform Tensor raised $3 million in a seed round. Fast forward to today, and it is close to regaining its position as the biggest Solana-based NFT marketplace based on market share.

“A lot of momentum came from the announcement,” Tensor co-founder Richard Wu said, speaking about the seed round, which TechCrunch covered exclusively in March. “When it comes to a marketplace, liquidity is key to attract users, and it had a snowball effect on itself.”

Tensor last week reached 45% of Solana’s NFT market share, surpassing Solana-centric NFT marketplace Magic Eden’s 44% share over a seven-day period, according to data collected by Tiexo. While the 1% difference may seem nominal, it’s a huge jump for a fairly new platform up against a giant with almost 200x the users.

Tensor launched a private beta in June 2022 and opened to the public the following month. In March, it had over 30,000 monthly active users, and by April, its MAU was up about 317% to over 125,000, co-founder Ilja Moisejevs said.

Compared to Magic Eden, which has 22 million unique monthly visitors, that makes its share of the market is substantial.

Magic Eden has since regained the top slot for Solana-based NFT volume over the past seven days with 44.2% share, per Tiexo data, and Tensor isn’t far behind at 40.5%. But market share is “not the top priority” for Tensor, Wu said. “For us, market share is a proxy for what we’re building, but at the end of the day, our goal is to grow Solana 10x.”

“I think a lot of people on Twitter like to dramatize things,” Moisejevs said. “They want to see a battle of marketplaces. There’s healthy competition between us [and Magic Eden], but the point we want to drive home is we’re not here to win 80% of a non-existent market. We want us to win, Solana to win, and we will be a bigger business if Solana as a chain does well.”

Solana is the third-largest blockchain for NFTs by sales volume, with over $3.96 billion in all-time sales, according to data from NFT aggregator CryptoSlam. In the past 30 days, Solana NFT sales volume decreased about 24.4% to $73.3 million, the data showed.

In general, the Solana ecosystem is getting stronger, at least compared to six months ago, Wu said. One prime example of that is the people and projects like Mad Lads, he said, adding that at one point, it was a top collection by volume ahead of some Ethereum blue chip collections. “What they’ve done and demonstrated with their launch on Solana is incredible.”

Mad Lads, a profile picture-focused collection, also helped push the platform to the top, Moisejevs said. In the past 30 days, Mad Lads was the fourth-largest NFT collection by sales volume across all chains, according to CryptoSlam data. It had over $22.2 million in sales during the same time frame.

“We try to work with creators to reward users and do interesting things to drive engagement, and that’s something that helps us stand out,” Moisejevs said. “We have an entire page just for Mad Lads; it’s styled to them and looks and feels different. It’s all about them; not about Tensor.”

Image Credits: Tensor

Tensor offers advanced functionalities for “pro NFT traders” like TradingView integration, collectionwide bids and market-making orders. Users on Tensor can buy in bulk on one screen, filter trades easily, and receive and send transactions quickly.

The platform also began growing more rapidly after it launched loyalty-like reward programs for traders, similar to what the Ethereum-based NFT marketplace Blur did. In fact, that was among the strategies that helped Blur surpass OpenSea. “Obviously, Blur is driving a lot and people draw parallels between us and them,” Moisejevs said. “We don’t encourage it, but it works in our favor.”

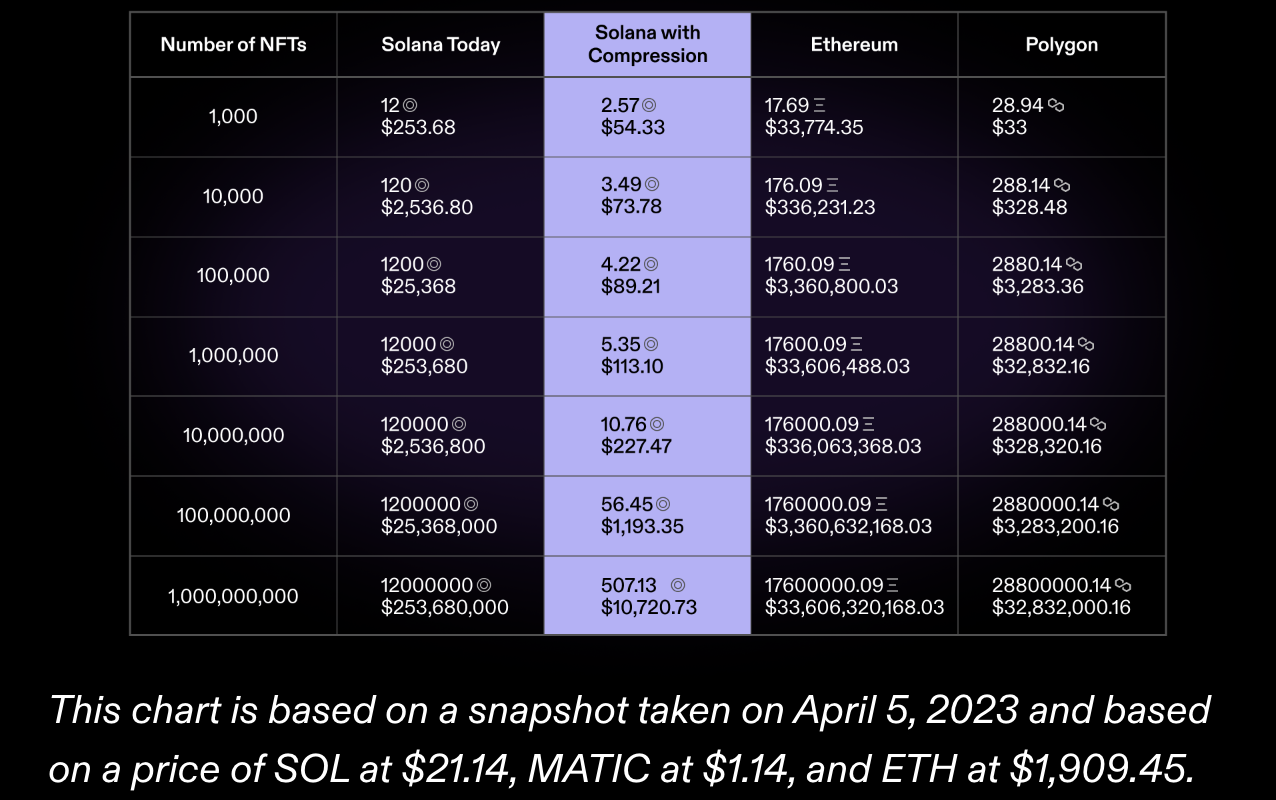

In the near term, the NFT platform plans to double down on new technology like compressed NFTs, which lets creators create a million NFTs for about $100 or a billion NFTs for $1,000, Wu said. Companies like decentralized wireless network Helium have minted or created almost 1 million compressed NFTs on Solana, with each one representing a hotspot owned by users.

Image Credits: Solana

Compressed NFTs are a new Solana-centric feature launched in early April that allows creators to mint massive numbers of NFTs for a relatively low cost compared to other blockchains like Ethereum or even the classic Solana NFT minting procedure.

“If you think about what a lot of companies and platforms want to do, it’s experimenting with NFTs but at a low cost,” Wu noted. “This will attract a ton of people outside of Solana because this low cost [from compressed NFTs] is only possible on Solana right now.”

While the platform started out with a focus on “pro traders,” its main focus going forward is to grow beyond that definition and build an experience where all Solana-based products could work together on its platform, Moisejevs said.

About 80% of users on Tensor use light mode, which is similar to traditional marketplaces, while 20% use its pro mode, which is for the more serious NFT traders, Wu said. “The market for pro traders is eventually going to taper off and plateau, so we’re really digging into not just the pro trader value proposition but the faster UX and clean UX that people are used to.”

Instead of copying and pasting what’s happening on Ethereum, Tensor wants to focus on what’s only possible on Solana, “which is compressed NFTs and being cheap and fast on Solana — we’re pushing toward those value props,” Wu said.

Moisejevs also envisions Tensor expanding beyond Solana to other chains. “If we get to the point where we’ve done everything we think is worth doing on Solana, I don’t see why we wouldn’t expand to another chain.”

In the next five years, Moisejevs predicts Solana will have more use cases where NFTs will have to change and adapt. “NFTs on Solana will become a LEGO-like thing in the future, and we’re thinking about how we can cater to that.”

“Our vision, broadly speaking, is that we want to enable all sorts of applications built on top of NFTs and digital assets,” Wu said.